PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740955

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740955

Self-Storage Software Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

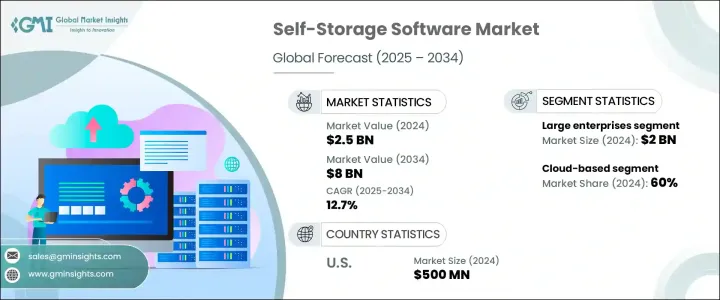

The Global Self-Storage Software Market was valued at USD 2.5 billion in 2024 and is estimated to grow at a CAGR of 12.7% to reach USD 8 billion by 2034, driven by the surging demand for digital solutions across the real estate sector, rapid urban migration, and the rising need for efficient space management in both residential and commercial environments. As real estate dynamics continue to evolve, self-storage businesses are increasingly turning to digital platforms to streamline operations, elevate tenant experiences, and strengthen facility security. The growing emphasis on convenience, automation, and data-driven decision-making is driving the adoption of cutting-edge software systems. Operators are seeking scalable, cloud-based tools that enable real-time monitoring, improve occupancy management, and enhance operational efficiency without the limitations of traditional infrastructure.

In today's tech-forward landscape, self-storage software plays a critical role in modernizing facility operations. With features like contactless rentals, automated billing, online payments, and real-time availability tracking, these solutions help operators stay ahead in a competitive market. Integrating customer relationship management (CRM) tools, digital access control systems and advanced analytics further allows businesses to boost visibility and improve the overall user experience. As digital security becomes more important, platforms now incorporate encryption, mobile alerts, and detailed access logs to enhance transparency and build tenant trust. The integration of emerging technologies such as predictive analytics, blockchain for secure contract management, and augmented reality (AR) for immersive virtual tours is reshaping how businesses interact with both data and customers, ultimately driving greater agility and profitability.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.5 Billion |

| Forecast Value | $8 Billion |

| CAGR | 12.7% |

Cloud-based self-storage software dominates the market and accounted for nearly 60% of the global revenue in 2024. This segment's popularity stems from its flexibility, affordability, and ability to seamlessly support operations across multiple locations. Cloud platforms are easier to scale and manage, making them ideal for self-storage operators expanding their footprint. These systems allow for the implementation of artificial intelligence (AI)-driven tools, predictive maintenance schedules, and dynamic pricing models-features that are often difficult to deploy with on-premises infrastructure. Businesses benefit from centralized access, real-time updates, and minimal IT overhead, which significantly enhances performance and decision-making capabilities.

Subscription-based models have emerged as the preferred pricing structure across the self-storage software industry. These models offer unmatched affordability and integration flexibility, especially for small and mid-sized operators looking to avoid the financial burden of upfront capital investments. Through a recurring payment structure, businesses gain continuous access to the latest software features, real-time updates, technical support, and robust cybersecurity enhancements. This setup ensures operational consistency while helping operators remain compliant with changing industry standards. The subscription model also enables providers to offer more frequent product improvements, keeping businesses agile in a fast-moving digital ecosystem.

The U.S. Self-Storage Software Market reached USD 500 million in 2024 and is projected to grow at a CAGR of around 12.9%. With a well-established self-storage sector and rising consumer expectations for digital convenience, the U.S. is witnessing a significant shift toward cloud-based management platforms. Strategic investments by key software providers and government initiatives to upgrade digital infrastructure and enhance data security are further accelerating software adoption. Businesses across the country are recognizing the value of scalable, AI-enabled solutions in optimizing space utilization, improving service delivery, and ensuring regulatory compliance.

Leading players in the global self-storage software market include OpenTech Alliance, storEDGE, QuikStor, Yardi Systems, Cascade Self-Storage, and Space Management. These companies are focused on expanding their portfolios with advanced, cloud-native solutions that elevate user experience and streamline back-end processes. By leveraging AI, IoT, and blockchain technologies, they are offering smarter, more secure, and highly efficient platforms. Many are also engaging in strategic partnerships, acquisitions, and collaborative ventures to strengthen their market presence, broaden their reach, and drive innovation in the self-storage software space.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 Raw material providers

- 3.1.1.2 Component providers

- 3.1.1.3 Manufacturers

- 3.1.1.4 Technology providers

- 3.1.1.5 Distribution channel analysis

- 3.1.1.6 End use

- 3.1.2 Profit margin analysis

- 3.1.1 Supplier landscape

- 3.2 Impact of Trump administration tariffs

- 3.2.1 Trade impact

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Strategic industry responses

- 3.2.3.1 Supply chain reconfiguration

- 3.2.3.2 Pricing and product strategies

- 3.2.1 Trade impact

- 3.3 Technology & innovation landscape

- 3.4 Patent analysis

- 3.5 Regulatory landscape

- 3.6 Cost breakdown analysis

- 3.7 Key news & initiatives

- 3.8 Impact forces

- 3.8.1 Growth drivers

- 3.8.1.1 Digital transformation of facility management

- 3.8.1.2 Rising urbanization & space constraints

- 3.8.1.3 Demand for contactless & remote access

- 3.8.1.4 Integration with smart technologies

- 3.8.2 Industry pitfalls & challenges

- 3.8.2.1 High initial implementation costs

- 3.8.2.2 Data privacy & cybersecurity risks

- 3.8.1 Growth drivers

- 3.9 Growth potential analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Deployment, 2021 - 2034 ($Mn)

- 5.1 Key trends

- 5.2 Cloud-based

- 5.3 On-premises

Chapter 6 Market Estimates & Forecast, By Organization Size, 2021 - 2034 ($Mn)

- 6.1 Key trends

- 6.2 Large enterprises

- 6.3 Medium-Sized Enterprises (SME)

- 6.4 Small enterprises

Chapter 7 Market Estimates & Forecast, By Business Model, 2021 - 2034 ($Mn)

- 7.1 Key trends

- 7.2 Subscription-based

- 7.3 Perpetual License-based

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Mn)

- 8.1 Key trends

- 8.2 Residential

- 8.3 Commercial

- 8.4 Industrial

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 France

- 9.3.3 UK

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Apex

- 10.2 Beloit

- 10.3 Cascade

- 10.4 Easy Storage

- 10.5 iStorage

- 10.6 MyStorage

- 10.7 OpenTech Alliance

- 10.8 QuikStor

- 10.9 Rentec Direct

- 10.10 Secure Self Storage

- 10.11 Self Storage Manager

- 10.12 Shedul

- 10.13 SiteLink

- 10.14 Space Management

- 10.15 Storage Commander

- 10.16 Storage Pro Software

- 10.17 storEDGE

- 10.18 STORIS

- 10.19 StorTrack

- 10.20 Yardi Systems