PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740959

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740959

Deployable Military Shelters Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

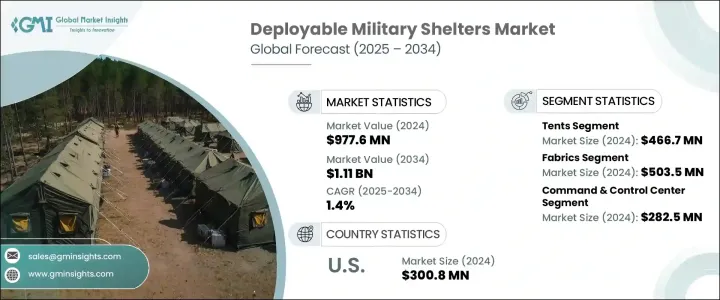

The Global Deployable Military Shelters Market was valued at USD 977.6 million in 2024 and is estimated to grow at a CAGR of 1.4% to reach USD 1.11 billion by 2034. This steady growth is fueled by rising global defense budgets and an increasing need for mobile infrastructure during emergency and humanitarian operations. Defense forces across the globe are continually investing in versatile and robust shelter systems to meet evolving battlefield and logistical requirements. These shelters are no longer used solely for military needs; they now support civil applications during disaster response and recovery missions. As militaries and governments prioritize rapid mobility and real-time operational capabilities, the demand for compact, durable, and easily deployable shelters is witnessing an upward trend. This includes mobile field hospitals, operational command centers, and emergency housing units. Moreover, the market is gaining momentum as nations aim to enhance readiness for unpredictable threats across multiple operational domains-land, air, sea, cyber, and space. In response, manufacturers are innovating rapidly to design systems that can withstand harsh climates, offer efficient energy solutions, and be swiftly deployed in both combat and crisis situations.

Trade policy changes in recent years have had a noticeable impact on the cost structure of deployable shelters. The introduction of tariffs under Section 232 and Section 301 significantly increased the costs of vital raw materials, including steel, aluminum, and advanced technical fabrics. These tariffs disrupted established international supply chains that relied on imported components, causing delays in procurement and driving up overall prices. As a result, manufacturers were compelled to shift sourcing strategies, favoring suppliers from North America or regions unaffected by the tariffs. Although the policies aimed to boost domestic manufacturing, they created short-term instability and exposed vulnerabilities in the production and delivery networks of deployable shelters.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $977.6 Million |

| Forecast Value | $1.11 Billion |

| CAGR | 1.4% |

In terms of product segmentation, shelters are categorized into tents, container-based units, and other structures. Among these, tents represented the largest market segment in 2024, valued at USD 466.7 million. Their versatility and rapid setup capability make them ideal for tactical use and short-term deployments. Modern tents have evolved with enhanced materials that offer advanced protection features, such as resistance to fire, UV rays, and infrared detection. These innovations support stealth and safety in operational zones, improving the reliability and security of shelter deployments in diverse conditions.

Material selection plays a crucial role in shelter performance, especially under operational stress. The fabric segment led the market in 2024, with a value of USD 503.5 million. Lightweight and flexible, these materials meet the growing need for efficient, mobile logistics. Technological advancements in textiles-like flame-retardant coatings, UV blocking capabilities, and infrared camouflage-have made fabrics a preferred choice for tactical environments. The focus on maximizing durability while minimizing weight makes these fabrics suitable for fast-moving, high-volume deployment needs.

By application, the market is segmented into command and control centers, medical facilities, maintenance units, humanitarian deployments, and living quarters. The command and control center segment dominated the market with a valuation of USD 282.5 million in 2024. As global defense forces shift toward integrated multi-domain operations, the need for shelter systems that can support secure communications, satellite links, and real-time decision-making tools continues to grow. These shelters are being developed with built-in electromagnetic interference shielding and hardened communication modules to ensure they remain operational in contested environments.

The United States led the global market with a valuation of USD 300.8 million in 2024. This leadership is driven by its expansive military presence, increasing demand for mobile infrastructure, and a proactive approach to defense modernization. The country's rapid deployment forces and emergency management agencies are key adopters of deployable shelters, using them in a variety of domestic and international missions. Budget allocations and investments in advanced shelter technologies have further strengthened its market position.

Manufacturers are focusing on next-generation innovations such as modular designs, integrated solar capabilities, and shelters with embedded communication infrastructure. These features align with the need for sustainability, quick deployment, and adaptability in extreme environments. The industry is moving toward scalable solutions that offer flexibility and resilience for a wide range of operational demands, from battlefield coordination to disaster response. As the requirement for climate-resistant, energy-efficient, and easily transportable structures continues to rise, the deployable military shelters market is expected to evolve rapidly to meet new and complex challenges.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact

- 3.2.2.1.1 Price volatility in key components

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Increasing global military expenditure

- 3.3.1.2 Modernization of armed forces

- 3.3.1.3 Increased use in humanitarian & disaster relief operations

- 3.3.1.4 Focus on troop safety and operational efficiency

- 3.3.1.5 Environmental and climate considerations

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 High initial investment and lifecycle cost

- 3.3.2.2 Climate and terrain adaptability issues

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Shelter Type, 2021 – 2034 (USD Million & Thousand Units)

- 5.1 Key trends

- 5.2 Tents

- 5.3 Container-based shelters

- 5.4 Others

Chapter 6 Market Estimates and Forecast, By Material, 2021 – 2034 (USD Million & Thousand Units)

- 6.1 Key trends

- 6.2 Fabric

- 6.3 Metal

- 6.4 Composite materials

Chapter 7 Market Estimates and Forecast, By Application, 2021 – 2034 (USD Million & Thousand Units)

- 7.1 Key trends

- 7.2 Command & control centers

- 7.3 Medical facilities

- 7.4 Maintenance facilities

- 7.5 Humanitarian

- 7.6 Living quarters

- 7.7 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Million & Thousand Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 AAR

- 9.2 Alaska Structures

- 9.3 Blu-Med

- 9.4 CAMSS Shelters

- 9.5 Camel Manufacturing

- 9.6 General Dynamics

- 9.7 HDT Global

- 9.8 Litefighter Systems

- 9.9 Losberger

- 9.10 Marshall Aerospace and Defense Group

- 9.11 Outdoor Venture

- 9.12 Rapid Deployable Systems

- 9.13 RDD USA

- 9.14 Rubb Buildings

- 9.15 Saab

- 9.16 Sprung Structures

- 9.17 UTS Systems

- 9.18 Weatherhaven Global Resources

- 9.19 Western Shelter Systems