PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740963

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740963

HVAC Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

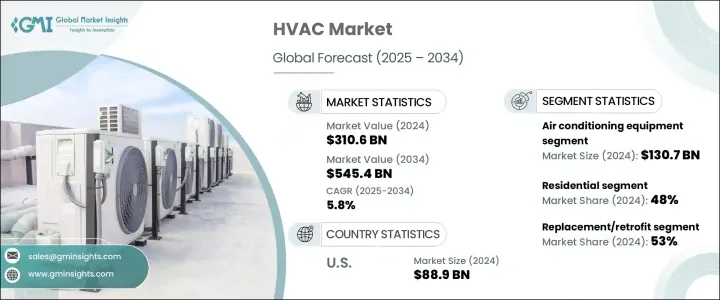

The Global HVAC Market was valued at USD 310.6 billion in 2024 and is estimated to grow at a CAGR of 5.8% to reach USD 545.4 billion by 2034. One of the major factors supporting this growth is the rising demand for energy-efficient and eco-friendly cooling technologies across both developed and developing countries. As global focus intensifies on sustainability and environmental protection, manufacturers are being encouraged to innovate and develop advanced HVAC systems that consume less energy and produce fewer emissions. Regulatory bodies are implementing various energy efficiency programs that promote the use of such systems, which is prompting both businesses and consumers to opt for energy-conscious HVAC solutions. This shift in preference is accelerating the adoption of smart and variable-speed air conditioning systems, which offer better performance and lower operational costs. The growing need to reduce power consumption, particularly in climate control systems, has made energy-efficient HVAC technologies increasingly attractive across residential, commercial, and industrial applications. Additionally, climate change and rising global temperatures are pushing more regions toward consistent use of cooling systems, further amplifying the need for high-performance HVAC units.

Rapid urbanization in emerging markets, combined with increased construction of residential complexes, commercial spaces, and industrial infrastructure, is also fueling the market. Modern buildings are being designed with smart systems and integrated HVAC technologies that comply with the latest energy standards. Governments around the world are enforcing building codes that mandate the use of energy-efficient climate control solutions in new developments. The push for smarter, more connected buildings has significantly contributed to the demand for HVAC systems equipped with features like automated temperature control, smart sensors, and IoT connectivity. In addition, retrofit installations are gaining traction, especially in older buildings that require upgrades to meet updated regulatory standards and sustainability goals. The retrofit/replacement segment accounted for 53% of the total HVAC market in 2024, showing strong momentum in markets where legacy systems are still in use.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $310.6 Billion |

| Forecast Value | $545.4 Billion |

| CAGR | 5.8% |

When broken down by product type, the HVAC market includes air conditioning equipment, heating equipment, ventilation systems, chillers, and cooling towers. In 2024, air conditioning equipment was the dominant category, generating revenue of USD 130.7 billion. Its continued growth is largely driven by increased awareness of energy-efficient cooling solutions, particularly in urban areas where air quality and rising temperatures are a growing concern. On the other hand, the heating equipment segment is poised to grow at a CAGR of approximately 5.7% from 2025 to 2034, supported by growing demand for cost-effective and low-emission heating systems.

End-use segmentation of the market includes residential, commercial, and industrial sectors. The residential segment comprised 48% of the market in 2024, backed by rapid urban expansion and a growing middle-class population that is increasingly investing in air conditioning and climate control systems for personal comfort. Commercial spaces, such as office buildings, retail outlets, and hospitality venues, are also witnessing heightened demand for advanced HVAC systems. These facilities prioritize air quality, comfort, and operational efficiency, driving the installation of smart and connected HVAC technologies. The commercial segment is further benefitting from infrastructure upgrades and compliance with stricter environmental standards, which are pushing building owners to retrofit older systems with modern, energy-efficient solutions.

Geographically, the United States remained a leading contributor to the HVAC market, accounting for approximately 79% of the North American share and generating revenue of USD 88.9 billion in 2024. The market growth in the US is being fueled by federal mandates and incentives that promote energy efficiency in heating and cooling systems. Programs offering tax credits for replacing older HVAC units with modern, energy-efficient alternatives are supporting the acceleration of system upgrades in both residential and commercial buildings. As a result, there has been a strong uptick in demand for HVAC systems that feature advanced connectivity, improved energy management, and reduced environmental impact.

Several prominent companies are actively shaping the HVAC landscape through product innovation and strategic partnerships. Key industry players include Carrier, Bosch, Daikin Industries, GREE Electric Appliances, Danfoss, Haier, Johnson Controls, Hisense HVAC Equipment, Lennox International, Midea, LG Electronics, Mitsubishi Electric, Rheem Manufacturing Company, Panasonic, and Trane Technologies. These companies are continually investing in R&D to meet evolving consumer expectations and regulatory requirements, helping to drive the market toward smarter, greener, and more efficient HVAC solutions.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufactures

- 3.1.6 Distributors

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Supplier landscape

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing infrastructure development

- 3.6.1.2 Growing uses in various industries

- 3.6.1.3 Technological advancements

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High costs of investments

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Heating equipment

- 5.2.1 Furnaces

- 5.2.2 Boiler

- 5.2.3 Heat pumps

- 5.3 Ventilation equipment

- 5.3.1 Air handlers

- 5.3.2 Ductwork

- 5.3.3 Fans

- 5.4 Air conditioning equipment

- 5.5 Chillers

- 5.6 Cooling towers

Chapter 6 Market Estimates & Forecast, By End Use, 2021-2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Residential

- 6.3 Commercial

- 6.4 Industrials

Chapter 7 Market Estimates & Forecast, By Installation, 2021-2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 New construction

- 7.3 Replacement/Retrofit

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Direct sales

- 8.3 Indirect sales

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 Saudi Arabia

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 Bosch

- 10.2 Carrier

- 10.3 Daikin Industries

- 10.4 Danfoss

- 10.5 GREE Electric Appliances

- 10.6 Haier

- 10.7 Hisense HVAC equipment

- 10.8 Johnson Controls

- 10.9 Lennox International

- 10.10 LG Electronics

- 10.11 Midea

- 10.12 Mitsubishi Electric

- 10.13 Panasonic

- 10.14 Rheem Manufacturing Company

- 10.15 Trane Technologies