PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740985

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740985

Vehicle-to-Grid (V2G) Technology Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

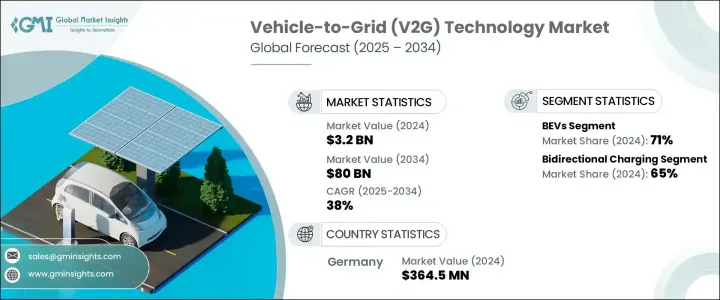

The Global Vehicle-To-Grid Technology Market was valued at USD 3.2 billion in 2024 and is estimated to grow at a CAGR of 38% to reach USD 80 billion by 2034, driven by the accelerating adoption of electric vehicles, rising investment in smart grid systems, and global climate goals pushing for low-carbon infrastructure. As the world moves toward cleaner energy solutions, V2G technologies are becoming a key pillar of the future energy landscape. With electric vehicles becoming mainstream and renewable energy integration gaining urgency, V2G platforms are positioned as critical enablers of energy flexibility.

Companies across the automotive and energy sectors are working aggressively to commercialize V2G systems that can support peak load management, stabilize power supplies, and minimize dependence on fossil fuels. Growing urbanization, government incentives, technological innovations, and the increasing need for energy storage solutions are creating a fertile environment for the expansion of V2G networks. The trend toward decentralized energy systems is further amplifying the role of V2G in modern energy ecosystems, creating new revenue streams for EV owners, utilities, and technology providers alike. As countries intensify efforts to cut transportation emissions, V2G is seen as a key strategy for aligning national energy agendas with global climate targets.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.2 Billion |

| Forecast Value | $80 Billion |

| CAGR | 38% |

Governments are aligning national strategies with international climate goals by supporting bidirectional charging networks, allowing EVs to interact with the grid as both energy consumers and energy providers. Utilities leverage EVs as grid assets to manage renewable energy variability and ease peak demand pressures. V2G-enabled EV fleets are increasingly used in cities and industrial areas to replace conventional power sources during high-demand periods. These vehicles contribute to grid resilience by discharging stored electricity, which minimizes reliance on fossil-fueled generation. Technology providers are building platforms with advanced features like predictive energy usage, real-time grid communication, and energy trading capabilities to boost value creation. In several regions, government funding, incentives, and infrastructure upgrades are accelerating the conversion of standard EV charging systems into V2G-capable ones.

Battery electric vehicles (BEVs) dominated the market by vehicle type in 2024, capturing about 71% share, and are forecasted to maintain their lead with a CAGR of 38.3%. Their ability to support bidirectional energy flows and zero-emission operation makes them highly compatible with V2G systems. BEVs are widely integrated into commercial fleets and urban mobility programs, including public transportation and last-mile delivery. Their expanding availability, coupled with supportive policies, is boosting their presence in the V2G ecosystem.

The bidirectional charging segment in the vehicle-to-grid (V2G) technology market held a 65% share in 2024 and is expected to grow at a CAGR of 37.7% through 2034. These chargers allow energy to move in both directions, enabling EVs to not only charge from the grid but also return power when needed. Utilities and fleet operators prioritize these systems for their ability to store surplus renewable energy and release it during demand peaks, optimizing grid efficiency and reducing energy costs.

The Germany Vehicle-To-Grid (V2G) Technology Market held a 39% share in 2024, generating USD 364.5 million. The country's leadership stems from its deep-rooted expertise in automotive manufacturing, extensive EV deployment programs, and a well-developed electric grid capable of supporting bidirectional energy flow. Germany's federal initiatives supporting energy transition and electrification, combined with significant investments in grid modernization, are accelerating the scale-up of V2G infrastructure.

Major automakers and energy companies worldwide are actively testing and implementing V2G platforms in urban centers, industrial zones, and fleet hubs. Key players in the Global Vehicle-To-Grid (V2G) Technology Market include ABB, Mitsubishi Motors, NRG Energy, Denso, Hitachi, AC Propulsion, Nissan Motor, Nuvve, Honda Motor, and OVO Energy. To strengthen their footprint, major V2G players are investing heavily in RandD to develop more efficient and scalable bidirectional charging technologies. They are forming partnerships with automotive manufacturers and utility companies to accelerate pilot projects and large-scale deployments. Many firms focus on software advancements, including grid optimization, AI-driven load management, and energy market integration to maximize returns.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 360-degree synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Charging infrastructure providers

- 3.2.2 Grid operators

- 3.2.3 V2G service providers

- 3.2.4 Technology providers

- 3.2.5 End use

- 3.3 Impact of Trump administration tariffs

- 3.3.1 Trade impact

- 3.3.1.1 Trade volume disruptions

- 3.3.1.2 Retaliatory measures

- 3.3.2 Impact on industry

- 3.3.2.1 Supply-side impact (raw materials)

- 3.3.2.1.1 Price volatility in key materials

- 3.3.2.1.2 Supply chain restructuring

- 3.3.2.1.3 Production cost implications

- 3.3.2.2 Demand-side impact (Cost to customers)

- 3.3.2.2.1 Price transmission to end markets

- 3.3.2.2.2 Market share dynamics

- 3.3.2.2.3 Consumer response patterns

- 3.3.2.1 Supply-side impact (raw materials)

- 3.3.3 Key companies impacted

- 3.3.4 Strategic industry responses

- 3.3.4.1 Supply chain reconfiguration

- 3.3.4.2 Pricing and product strategies

- 3.3.4.3 Policy engagement

- 3.3.5 Outlook & future considerations

- 3.3.1 Trade impact

- 3.4 Profit margin analysis

- 3.5 Technology & innovation landscape

- 3.6 Patent analysis

- 3.7 Key news & initiatives

- 3.8 Regulatory landscape

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Supportive government regulations and financial incentives for V2G deployment

- 3.9.1.2 Growing adoption of electric vehicles across the globe

- 3.9.1.3 Rising urbanization and industrialization

- 3.9.1.4 Ongoing technological advancements in V2G technology

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 High cost associated with upgrading existing charging infrastructure

- 3.9.2.2 Lack of standardized charging infrastructure

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 BEVs

- 5.3 PHEVs

- 5.4 FCVs

Chapter 6 Market Estimates & Forecast, By Charging, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Unidirectional charging

- 6.3 Bidirectional charging

Chapter 7 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Smart meters

- 7.3 Electric vehicle supply equipment (EVSE)

- 7.4 Home energy management

- 7.5 Software solutions

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 Domestic

- 8.3 Commercial

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 Saudi Arabia

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 ABB

- 10.2 AC Propulsion

- 10.3 Boulder Electric Vehicle

- 10.4 Denso Corporation

- 10.5 Edison International

- 10.6 EnerDel

- 10.7 Engie Group

- 10.8 Fermata Energy

- 10.9 Groupe Renault

- 10.10 Hitachi

- 10.11 Honda Motor

- 10.12 Indra

- 10.13 Mitsubishi Motors Corporation

- 10.14 Nissan Motor Corporation

- 10.15 NRG Energy

- 10.16 Nuvve Corporation

- 10.17 OVO Energy

- 10.18 PG&E Corporation

- 10.19 Toyota Shokki

- 10.20 Wallbox