PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740995

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740995

Cellular Vehicle-to-Everything (C-V2X) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

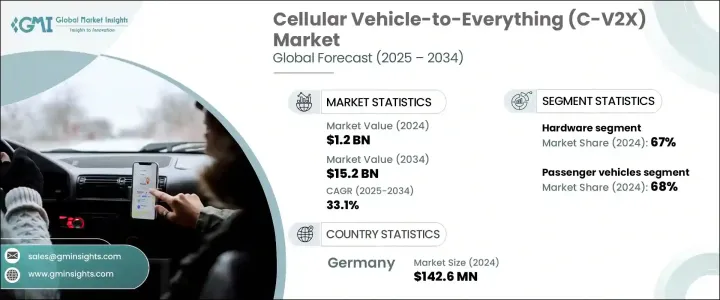

The Global Cellular Vehicle-To-Everything Market was valued at USD 1.2 billion in 2024 and is projected to grow at a CAGR of 33.1% to reach USD 15.2 billion by 2034. This rapid expansion is primarily driven by the increasing demand for advanced road safety technologies and the growing need for efficient, intelligent traffic management systems. With road accidents remaining a significant concern worldwide, the adoption of C-V2X technology has surged. This innovation facilitates real-time communication between vehicles, infrastructure, and pedestrians, helping to reduce collision risks and streamline traffic flow. As urban centers shift toward smarter, safer transportation solutions, C-V2X is becoming integral in enabling a connected transport ecosystem that enhances both safety and convenience. It also plays a critical role in the evolution of autonomous vehicles, ensuring they operate safely and efficiently within increasingly complex environments.

C-V2X is foundational for both autonomous and connected vehicles. By allowing vehicles to exchange real-time data regarding their position, speed, and intent, it supports safer and more coordinated driving experiences. This continuous data transmission is vital for the safe operation of autonomous vehicles, helping them respond to road conditions, hazards, and surrounding traffic far beyond the line of sight. Traditional sensors like radar and cameras alone can not achieve this level of environmental awareness. C-V2X facilitates smoother lane changes, safer intersection navigation, and optimized routing. It can even reduce congestion, particularly in complex urban or highway settings. The market's rapid growth reflects the broader automotive industry's push toward increased automation and the evolving need for enhanced vehicle safety.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.2 Billion |

| Forecast Value | $15.2 Billion |

| CAGR | 33.1% |

In terms of components, the C-V2X market is divided into hardware and software, with hardware holding a dominant 67% market share in 2024. This segment's prominence is due to the essential role that hardware plays in enabling V2X functionality. Devices such as on-board units, sensors, antennas, and roadside infrastructure are integral for real-time data exchange. Automotive manufacturers are increasingly incorporating these technologies into vehicles to improve automation, navigation, and safety. The continued investment in connected infrastructure by both public and private sectors is fueling the growth of the hardware segment.

Passenger vehicles led the market with a 68% share in 2024 and are expected to grow at a CAGR of 33.5%. The widespread adoption of advanced driver-assistance systems (ADAS) in passenger cars has been a key factor driving demand for C-V2X technology. These systems leverage the additional data provided by C-V2X to enhance hazard detection, improve situational awareness, and strengthen overall vehicle safety.

In Germany, the C-V2X market generated USD 142.6 million, holding a 27% share in 2024. The country's leadership in the market can be attributed to its advanced automotive ecosystem, widespread 5G deployment, and robust government initiatives promoting intelligent transportation systems. These policies, alongside collaborative innovation across the automotive and telecommunications sectors, make Germany a prime location for large-scale C-V2X testing in Europe.

Key players in the market include Intel, Robert Bosch, Qualcomm, ATandT, Huawei Technologies, Keysight Technologies, Infineon Technologies, Continental, ZTE, and Denso. To stay competitive, these companies focus on strategic partnerships with automakers, telecom providers, and infrastructure firms. Their investments in 5G integration, smart city pilot projects, and participation in standardization initiatives are key to accelerating the commercialization of C-V2X systems. Additionally, significant RandD efforts are being made to enhance latency, coverage, and interoperability while companies continue to expand their product offerings to cater to both passenger and commercial vehicle platforms.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 C-V2X hardware suppliers

- 3.2.2 C-V2X software suppliers

- 3.2.3 Automotive OEMs

- 3.2.4 Telecom service providers

- 3.2.5 End use

- 3.3 Profit margin analysis

- 3.4 Trump administration tariffs

- 3.4.1 Impact on trade

- 3.4.1.1 Trade volume disruptions

- 3.4.1.2 Retaliatory measures by other countries

- 3.4.2 Impact on the industry

- 3.4.2.1 Price Volatility in key materials

- 3.4.2.2 Supply chain restructuring

- 3.4.2.3 Production cost implications

- 3.4.3 Key companies impacted

- 3.4.3.1 Automotive OEM

- 3.4.3.2 Telecom equipment providers

- 3.4.3.3 Semiconductor and module suppliers

- 3.4.4 Strategic industry responses

- 3.4.4.1 Supply chain reconfiguration

- 3.4.4.2 Pricing and product strategies

- 3.4.5 Outlook and future considerations

- 3.4.1 Impact on trade

- 3.5 Technology & innovation landscape

- 3.6 Patent analysis

- 3.7 Key news & initiatives

- 3.8 Regulatory landscape

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Rising number road accidents across the globe

- 3.9.1.2 Growing adoption of autonomous vehicles

- 3.9.1.3 Rising demand for safer road travel

- 3.9.1.4 Growing popularity of vehicle telematics

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 Network security and privacy issues

- 3.9.2.2 Lack of cellular coverage

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Communication, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Vehicle-to-Person (V2P)

- 5.3 Vehicle-to-Infrastructure (V2I)

- 5.4 Vehicle-to-Network (V2N)

- 5.5 Vehicle-to-Vehicle (V2V)

Chapter 6 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Hardware

- 6.2.1 On-Board Units (OBUs)

- 6.2.2 Roadside Units (RSUs)

- 6.2.3 Antennas

- 6.2.4 Communication modules

- 6.3 Software

- 6.3.1 Traffic management software

- 6.3.2 Fleet management systems

Chapter 7 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Passenger vehicles

- 7.2.1 Hatchback

- 7.2.2 Sedan

- 7.2.3 SUV

- 7.3 Commercial vehicles

- 7.3.1 Light Commercial Vehicles (LCV)

- 7.3.2 Medium Commercial Vehicles (MCV)

- 7.3.3 Heavy Commercial Vehicles (HCV)

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 Fleet management

- 8.3 Autonomous driving

- 8.4 Collision avoidance

- 8.5 Intelligent traffic systems

- 8.6 Parking management systems

- 8.7 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 Saudi Arabia

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 AT&T

- 10.2 Autotalks

- 10.3 Cohda Wireless

- 10.4 Commsignia

- 10.5 Continental

- 10.6 Denso

- 10.7 Ficosa International

- 10.8 Huawei Technologies

- 10.9 Infineon Technologies

- 10.10 Intel

- 10.11 Keysight Technologies

- 10.12 Nokia

- 10.13 NTT DOCOMO

- 10.14 Qualcomm

- 10.15 Quectel Wireless Solutions

- 10.16 Robert Bosch

- 10.17 Rohde & Schwarz

- 10.18 Savari

- 10.19 Shenzhen Genvict Technologies

- 10.20 ZTE Corporation