PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740996

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740996

Molded Pulp Packaging Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

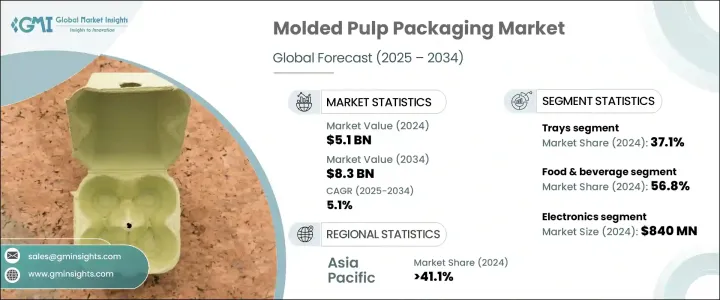

The Global Molded Pulp Packaging Market was valued at USD 5.1 billion in 2024 and is projected to grow at a CAGR of 5.1% to reach USD 8.3 billion by 2034. This growth is being driven by the increasing shift toward sustainable packaging solutions alongside a global effort to reduce environmental waste. As stricter regulations on single-use plastics take hold and consumers become more environmentally conscious, the demand for biodegradable and recyclable alternatives continues to rise. Molded pulp packaging, made from renewable fiber-based materials, is gaining traction across various industries, offering a sustainable alternative to traditional plastic packaging. This material's compostability and recyclability make it the preferred choice for brands aiming to meet their environmental goals and bolster their eco-friendly image.

The molded pulp packaging market is also experiencing substantial momentum due to growing restrictions on plastic use, particularly in the e-commerce and retail sectors. These restrictions are pushing companies toward eco-friendly packaging solutions. National and international policies favoring green alternatives are further accelerating the market's adoption, with trade policies, like import tariffs in the U.S., helping to strengthen local supply chains by encouraging domestic sourcing of pulp. This trend could reduce reliance on foreign suppliers, benefiting regional pulp producers, especially if import costs continue to rise.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.1 Billion |

| Forecast Value | $8.3 Billion |

| CAGR | 5.1% |

Among product types, molded pulp trays have become a dominant segment, generating USD 1.9 billion in 2024. This segment is expected to grow at a CAGR of 5.2%, driven by the trays' protective properties and eco-conscious appeal. As industries move toward more sustainable operations, demand for molded pulp trays is expected to increase, fueling segment growth.

The food and beverage industry, valued at USD 2.9 billion in 2024, is also a major driver of market expansion. Projected to grow at a CAGR of 4.9% through 2034, the sector is increasingly adopting molded pulp packaging to comply with regulatory mandates and cater to environmentally aware consumers. As companies prioritize sustainability, they enhance consumer loyalty and encourage the continued adoption of molded pulp packaging in food-related applications.

The Asia Pacific region, which held a 41.1% share of the market in 2024, is forecasted to grow at a CAGR of 5.6%. Rapid industrialization, a booming e-commerce sector, and heightened awareness of sustainable packaging in key markets such as China, India, Japan, and Southeast Asia are driving demand for molded pulp alternatives to plastic. The region's competitive edge is further strengthened by the availability of raw materials, lower production costs, and large-scale manufacturing capabilities.

Leading market players such as Huhtamaki, Eco Pulp Packaging, Dart Container Corporation, Henry Molded Products Inc., Pactiv Evergreen Inc., and UFP Technologies, Inc. are focusing on expanding their product lines and investing in automation to meet growing demand. Strategic partnerships with retailers and FMCG brands are enhancing their distribution networks, while investments in sustainable innovations and biodegradable materials are helping them solidify their market position. Additionally, these companies are entering new regional markets and aligning with circular economy initiatives to foster long-term brand value.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates & calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Vendor matrix

- 3.4 Profit margin analysis

- 3.5 Technology & innovation landscape

- 3.6 Patent analysis

- 3.7 Key news and initiatives

- 3.8 Industry impact forces

- 3.8.1 Growth drivers

- 3.8.1.1 Growing adoption of sustainable packaging in e-commerce

- 3.8.1.2 Increased adoption by healthcare packaging sectors

- 3.8.1.3 Rising regulations promoting eco-friendly packaging

- 3.8.1.4 Rising consumer awareness of environmental impacts

- 3.8.1.5 Emergence of sustainable practices in emerging markets

- 3.8.2 Industry pitfalls & challenges

- 3.8.2.1 Lengthy production cycles

- 3.8.2.2 Competition from bioplastics

- 3.8.1 Growth drivers

- 3.9 Growth potential analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

- 3.12 Future market trends

- 3.13 Regulatory landscape

Chapter 4 Market Estimates and Forecast, By Product Type, 2021 - 2034 (USD Bn & Kilo Tons)

- 4.1 Key trends

- 4.2 Trays

- 4.3 Clamshells

- 4.4 Cups and bowls

- 4.5 Plates

- 4.6 Others

Chapter 5 Market Estimates and Forecast, By Molding Technology, 2021 - 2034 (USD Bn & Kilo Tons)

- 5.1 Key trends

- 5.2 Thick-Wall molding

- 5.3 Transfer molding

- 5.4 Thermoformed pulp

- 5.5 Processed pulp

Chapter 6 Market Estimates and Forecast, By End Use Industry, 2021 - 2034 (USD Bn & Kilo Tons)

- 6.1 Key trends

- 6.2 Food & beverage

- 6.3 Electronics

- 6.4 Healthcare

- 6.5 Automotive

- 6.6 Cosmetics & personal care

- 6.7 Others

Chapter 7 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Bn & Kilo Tons)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Rest of Europe

- 7.4 Asia Pacific

- 7.4.1 Japan

- 7.4.2 China

- 7.4.3 India

- 7.4.4 South Korea

- 7.4.5 ANZ

- 7.4.6 Rest of Asia Pacific

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Rest of Latin America

- 7.6 Middle East and Africa

- 7.6.1 South Africa

- 7.6.2 UAE

- 7.6.3 Saudi Arabia

- 7.6.4 Rest of Middle East and Africa

Chapter 8 Company Profiles

- 8.1 Best Plus Pulp Factory

- 8.2 buhl-paperform GmbH

- 8.3 CKF Inc.

- 8.4 Dart Container Corporation

- 8.5 Eco Pulp Packaging

- 8.6 EnviroPAK

- 8.7 Green Pack.

- 8.8 Hartmann Packaging

- 8.9 Henry Molded Products Inc.

- 8.10 Huhtamaki

- 8.11 HZ Green Pulp Sdn Bhd

- 8.12 Keiding, Inc.

- 8.13 Pacific Pulp Molding, Inc

- 8.14 Pactiv Evergreen Inc.

- 8.15 Primapack

- 8.16 Sabert Corporation

- 8.17 UFP Technologies, Inc.

- 8.18 Western Pulp Products Company