PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1741002

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1741002

Servo Motors and Drives Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

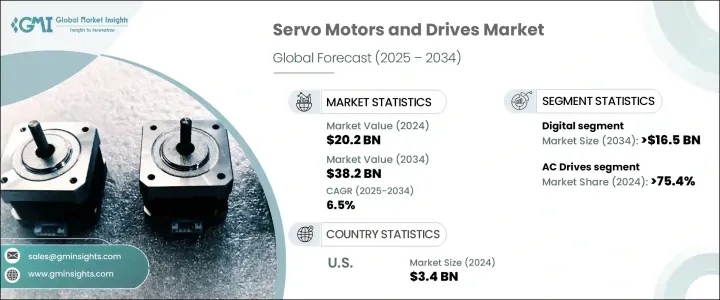

The Global Servo Motors and Drives Market was valued at USD 20.2 billion in 2024 and is estimated to grow at a CAGR of 6.5% to reach USD 38.2 billion by 2034, fueled by the rising integration of automation, robotics, and energy-efficient technologies in industrial settings. The adoption of advanced motion control systems that offer high precision in speed and positional accuracy is becoming more critical as industries strive to enhance productivity while cutting operational costs. Increasing investment in research and development, especially in industrial automation and smart manufacturing, is playing a major role in driving this growth. Businesses are prioritizing technologies that reduce energy consumption and minimize environmental impact, a trend further supported by stringent efficiency mandates and emission control regulations introduced globally. These changes are creating a strong foundation for long-term market expansion.

As demand grows, there is a noticeable shift toward smarter, cost-effective alternatives to traditional equipment. Innovations in servo motors and drives are meeting the needs of modern manufacturing and logistics systems that require exceptional accuracy and consistent performance under variable conditions. Additionally, rising industrial digitization and the proliferation of smart factory initiatives are accelerating the deployment of servo technologies across multiple sectors. Companies are looking for systems that can adapt to dynamic workloads, offer remote monitoring, and integrate seamlessly with other intelligent subsystems. These developments are shaping a competitive environment where manufacturers are compelled to improve product efficiency, precision, and flexibility to stay relevant.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $20.2 Billion |

| Forecast Value | $38.2 Billion |

| CAGR | 6.5% |

The market is segmented based on category into digital and analog types. Digital servo motors and drives are gaining traction and are anticipated to surpass USD 16.5 billion by 2034. Their increasing popularity is attributed to enhanced functionality, better holding power, and the ability to provide advanced feedback and control features. These systems are well-suited for applications that demand real-time monitoring and rapid adjustments, making them an ideal fit for evolving automation needs. The digital segment benefits from increased investment in automated production facilities and a growing emphasis on reducing downtime and maintenance costs.

From the drive perspective, the market is divided into AC and DC drives. AC drives are expected to dominate with a significant share, accounting for over 75.4% of the total market in 2024, and are projected to grow steadily through 2034. The demand for AC servo drives has risen sharply, driven by widespread automation across industries and the growing adoption of Industry 4.0 technologies. These drives are favored due to their superior energy efficiency, compatibility with advanced industrial protocols, and flexibility in various operational conditions. Continued technological upgrades, including real-time data analytics and predictive maintenance capabilities, are further supporting the expansion of AC drive solutions.

In the United States, the servo motors and drives market has shown consistent year-on-year growth. Valued at USD 3 billion in 2022, it climbed to USD 3.2 billion in 2023 and reached USD 3.4 billion in 2024. The country's growth trajectory is underpinned by the increasing adoption of industrial IoT, smart manufacturing technologies, and the rising presence of fully automated production lines. Federal and private initiatives focused on R&D, alongside support for AI integration in industrial environments, are creating fertile ground for the sector's development.

Market concentration remains moderate, with the top five manufacturers holding a combined share of approximately 25%. These leading firms are not only investing in product innovation but are also broadening their scope to include complete industrial automation ecosystems. By forming strategic partnerships and enhancing compatibility with complementary technologies, they are positioning themselves to deliver comprehensive solutions that go beyond traditional drive systems. Key areas of focus include the integration of artificial intelligence, machine learning algorithms, and IoT-enabled features into servo systems, which helps develop smart, adaptive systems capable of self-regulation and real-time optimization.

With technological advancements continuously reshaping the manufacturing landscape, industry players are channeling resources into developing servo motors and drives that support real-time responsiveness, higher efficiency levels, and broader connectivity. These advancements reflect a larger shift toward intelligent automation and support the rising need for systems that offer flexibility, longevity, and scalability across diverse industrial applications.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.2 Retaliatory measures

- 3.2.3 Impact on the industry

- 3.2.3.1 Supply-side impact (raw materials)

- 3.2.3.1.1 Price volatility in key materials

- 3.2.3.1.2 Supply chain restructuring

- 3.2.3.1.3 Production cost implications

- 3.2.3.2 Demand-side impact (selling price)

- 3.2.3.2.1 Price transmission to end markets

- 3.2.3.2.2 Market share dynamics

- 3.2.3.2.3 Consumer response patterns

- 3.2.3.1 Supply-side impact (raw materials)

- 3.2.4 Key companies impacted

- 3.2.5 Strategic industry responses

- 3.2.5.1 Supply chain reconfiguration

- 3.2.5.2 Pricing and product strategies

- 3.2.5.3 Policy engagement

- 3.2.6 Outlook and future considerations

- 3.2.7 Regulatory landscape

- 3.2.1 Impact on trade

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's Analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL Analysis

Chapter 4 Market Size and Forecast, By Category, 2021 - 2034, ('000 Units & USD Million)

- 4.1 Key trends

- 4.2 Digital

- 4.3 Analog

Chapter 5 Market Size and Forecast, By Drive, 2021 - 2034, ('000 Units & USD Million)

- 5.1 Key trends

- 5.2 AC drive

- 5.3 DC drive

Chapter 6 Market Size and Forecast, By Application, 2021 - 2034, ('000 Units & USD Million)

- 6.1 Key trends

- 6.2 Oil and gas

- 6.3 Metal cutting & forming

- 6.4 Material handling equipment

- 6.5 Packaging and labeling machinery

- 6.6 Robotics

- 6.7 Medical robotics

- 6.8 Rubber & plastics machinery

- 6.9 Warehousing

- 6.10 Automation

- 6.11 Extreme environment applications

- 6.12 Semiconductor machinery

- 6.13 AGV

- 6.14 Electronics

- 6.15 Others

Chapter 7 Market Size and Forecast, By Region, 2021 - 2034, ('000 Units & USD Million)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.2.3 Mexico

- 7.3 Europe

- 7.3.1 UK

- 7.3.2 Germany

- 7.3.3 France

- 7.3.4 Italy

- 7.3.5 Spain

- 7.3.6 Norway

- 7.3.7 Sweden

- 7.3.8 Denmark

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Japan

- 7.4.3 India

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.4.6 Thailand

- 7.4.7 Malaysia

- 7.4.8 Philippines

- 7.4.9 Indonesia

- 7.5 Middle East & Africa

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 Qatar

- 7.5.4 South Africa

- 7.5.5 Nigeria

- 7.5.6 Egypt

- 7.5.7 Algeria

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Argentina

- 7.6.3 Chile

Chapter 8 Company Profiles

- 8.1 ABB

- 8.2 Advanced Motion Controls

- 8.3 Allied Motion

- 8.4 Baumueller

- 8.5 Bosch Rexroth

- 8.6 Danfoss

- 8.7 Delta Electronics

- 8.8 Fuji Electric

- 8.9 Hitachi

- 8.10 Ingenia Cat

- 8.11 KEB Automation

- 8.12 Kollmorgen

- 8.13 Mitsubishi Electric

- 8.14 Nidec

- 8.15 Panasonic

- 8.16 Rockwell Automation

- 8.17 Schneider Electric

- 8.18 Siemens

- 8.19 Yaskawa Electric