PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1741020

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1741020

Lemongrass Oil Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

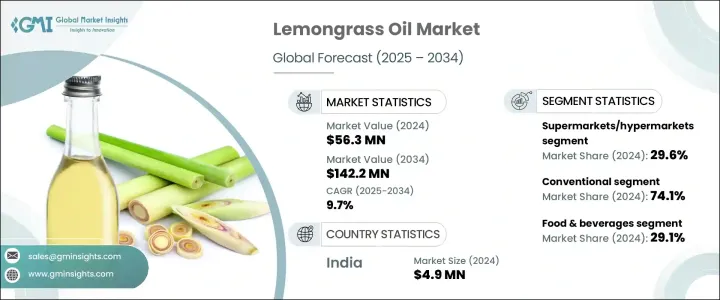

The Global Lemongrass Oil Market was valued at USD 56.3 million in 2024 and is estimated to grow at a CAGR of 9.7% to reach USD 142.2 million by 2034, driven by the growing popularity of lemongrass oil in cosmetics and personal care products, where it is valued for its antibacterial, antifungal, and anti-inflammatory properties. With increasing consumer demand for organic and plant-based ingredients, lemongrass oil has become a sought-after component in skincare, body care, and hair care products. The rise of the clean beauty movement and the trend toward chemical-free alternatives have fueled this demand, encouraging large cosmetics companies to integrate lemongrass oil into their product lines.

The use of lemongrass oil in beauty products such as cleansers, toners, and moisturizers is expanding. Oil is known for its ability to control excess oil production, reduce acne, and rejuvenate the skin. Its antioxidant properties are also utilized in anti-aging products to protect the skin from free radicals. In hair care, lemongrass oil is popular in shampoos and conditioners for its ability to nourish the scalp, fight dandruff, and strengthen hair. Additionally, its refreshing citrus scent has made it a popular ingredient in body washes and deodorants. This increasing consumer preference for plant-based beauty products drives the market's growth.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $56.3 Million |

| Forecast Value | $142.2 Million |

| CAGR | 9.7% |

The market is divided into conventional and organic types, with the conventional segment holding 74.1% share in 2024. Conventional lemongrass oil is more widely available and is produced through traditional farming methods. It serves various industries, including cosmetics, food, pharmaceuticals, and aromatherapy. Countries like India, China, and Indonesia lead in production, and their robust supply chains ensure the availability of lemongrass oil globally. Its high citral content makes it a favored ingredient in fragrances, insect repellents, and food flavorings, contributing to its widespread use.

The food and beverage industry remains the largest consumer of lemongrass oil, capturing a share of 29.1%, followed closely by the rapidly expanding pharmaceutical sector. Lemongrass oil is prized for its antibacterial properties, which make it an ideal addition to various food products such as herbal teas, soups, sauces, and confectioneries. Beyond its citrusy flavor, the oil offers digestive and antioxidant benefits, contributing to its growing popularity in food and beverage formulations. As more consumers seek natural and health-promoting ingredients, lemongrass oil's versatility in both culinary and wellness applications continues to drive demand within the sector.

India Lemongrass Oil Market generated USD 4.9 million in 2024, with India being a key oil producer. The United States and various European countries are the largest importers of lemongrass oil, accounting for a significant share of global demand. These regions rely heavily on the tropical countries where lemongrass is grown for essential oil extraction. The global demand for lemongrass oil continues to grow as international markets recognize the benefits of this versatile oil in both culinary and wellness products. As the market expands, India and other producing countries are poised to meet the increasing global demand, further solidifying their positions in the global lemongrass oil supply chain.

Leading companies in the lemongrass oil industry include Young Living Essential Oils, Edens Garden, Mountain Rose Herbs, NOW Foods, and Aura Cacia. These companies are focusing on product innovation, expanding their global presence, and increasing consumer education about the benefits of lemongrass oil. They are also exploring sustainable farming practices, building strategic partnerships with suppliers, and enhancing their product offerings to meet growing consumer demand for organic and eco-friendly products.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Trump Administration Tariffs

- 3.4.1 Impact on Trade

- 3.4.1.1 Trade Volume Disruptions

- 3.4.1.2 Retaliatory Measures

- 3.4.2 Impact on the Industry

- 3.4.2.1 Supply-Side Impact (Raw Materials)

- 3.4.2.1.1 Price Volatility in Key Materials

- 3.4.2.1.2 Supply Chain Restructuring

- 3.4.2.1.3 Production Cost Implications

- 3.4.2.1 Supply-Side Impact (Raw Materials)

- 3.4.3 Demand-Side Impact (Selling Price)

- 3.4.3.1 Price Transmission to End Markets

- 3.4.3.2 Market Share Dynamics

- 3.4.3.3 Consumer Response Patterns

- 3.4.4 Key Companies Impacted

- 3.4.5 Strategic Industry Responses

- 3.4.5.1 Supply Chain Reconfiguration

- 3.4.5.2 Pricing and Product Strategies

- 3.4.5.3 Policy Engagement

- 3.4.6 Outlook and Future Considerations

- 3.4.1 Impact on Trade

- 3.5 Trade statistics (HS Code)

- 3.5.1 Major Exporting Countries, 2021-2024 (Kilo Tons)

- 3.5.2 Major Importing Countries, 2021-2024 (Kilo Tons)

Note: the above trade statistics will be provided for key countries only.

- 3.6 Regulatory landscape

- 3.6.1 North America

- 3.6.2 Europe

- 3.6.3 Asia Pacific

- 3.6.4 Other Regions

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Growing demand for natural essential oils

- 3.7.1.2 Expanding applications in cosmetics & personal care

- 3.7.1.3 Growth in food & beverage industry

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 Intense competition from synthetic alternatives

- 3.7.2.2 Limited availability of raw materials

- 3.7.1 Growth drivers

- 3.8 Extraction and Processing Technologies

- 3.8.1 Traditional Methods

- 3.8.2 Modern Extraction Technologies

- 3.9 Supply Chain Structure and Dynamics

- 3.9.1 Raw Material Sourcing

- 3.9.2 Production and Processing

- 3.9.3 Distribution Channels

- 3.10 Cost Structure Analysis

- 3.10.1 Production Costs

- 3.10.2 Processing Costs

- 3.10.3 Distribution and Marketing Costs

- 3.11 Consumer Behavior

- 3.11.1 Consumer Demographics and Preferences

- 3.11.2 Purchase Decision Factors

- 3.11.2.1 Quality and Purity Considerations

- 3.11.2.2 Price Sensitivity

- 3.12 Environmental Impact Assessment

- 3.13 Growth potential analysis

- 3.14 Porter's analysis

- 3.15 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

- 4.5 Strategic Recommendations for Market Stakeholders

- 4.5.1 Recommendations for Manufacturers and Suppliers

- 4.5.2 Recommendations for Distributors and Retailers

- 4.5.3 Recommendations for End Use Industries

- 4.6 Strategic Initiatives and Recent Developments

- 4.6.1 Mergers and Acquisitions

- 4.6.2 Partnerships and Collaborations

- 4.6.3 Product Launches and Innovations

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Conventional

- 5.3 Organic

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Food & beverages

- 6.3 Personal care & cosmetics

- 6.4 Pharmaceuticals

- 6.5 Aromatherapy

- 6.6 Household cleaning products

Chapter 7 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Online retail

- 7.3 Supermarkets/hypermarkets

- 7.4 Specialty stores

- 7.5 Direct sales

- 7.6 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 AG Organica

- 9.2 Aura Cacia

- 9.3 doTERRA

- 9.4 Edens Garden

- 9.5 Mountain Rose Herbs

- 9.6 NOW Foods

- 9.7 Phoenix Aromas & Essential Oils, LLC

- 9.8 Plant Therapy Essential Oils

- 9.9 The Lebermuth Company

- 9.10 Young Living Essential Oils