PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1741027

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1741027

Cerebral Oximetry Monitoring Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

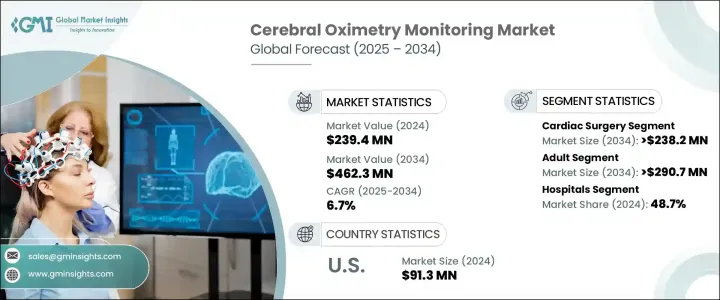

The Global Cerebral Oximetry Monitoring Market was valued at USD 239.4 million in 2024 and is estimated to grow at a CAGR of 6.7% to reach USD 462.3 million by 2034. This growth trajectory is driven by a rising number of surgical procedures worldwide and an increasing prevalence of neurological conditions. With the global population aging and age-related medical conditions becoming more common, there is a growing demand for advanced non-invasive monitoring solutions that help ensure patient safety, especially in high-risk clinical settings. As more healthcare providers place an emphasis on avoiding cerebral desaturation and improving surgical outcomes, cerebral oximetry monitoring systems have become an essential component of modern operating rooms and intensive care units. Technological innovations and the introduction of sophisticated monitoring devices are further fueling adoption, while greater awareness of patient care standards continues to enhance market potential. Hospitals are now prioritizing the integration of brain oxygen monitoring technologies to prevent neurological damage during complex surgeries, and patients are increasingly seeking out institutions that offer these advanced care solutions.

The increasing frequency of cardiovascular and neurological disorders among the aging population is one of the most significant growth drivers in this market. As life expectancy rises, so does the need for surgical interventions, particularly those requiring brain function monitoring. Cerebral oximeters provide real-time feedback during procedures, allowing medical professionals to respond quickly to changes in brain oxygenation levels. In addition, the surge in global surgeries-especially those involving the heart and vascular system-creates an ongoing demand for these monitoring systems. Changes in surgical protocols and growing support for patient monitoring technologies among healthcare professionals are also adding momentum to this market's expansion.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $239.4 Million |

| Forecast Value | $462.3 Million |

| CAGR | 6.7% |

From an application standpoint, cerebral oximetry monitoring is primarily used in cardiac and vascular surgeries, among other uses. The cardiac surgery segment alone is forecast to grow at a CAGR of 6.6%, reaching over USD 238.2 million by 2034. The need for brain oxygen monitoring is particularly critical during heart operations due to the potential risk of reduced brain perfusion when a heart-lung machine is used. As surgical approaches become more advanced, ensuring uninterrupted brain oxygenation during these procedures becomes more essential, which directly boosts the demand for cerebral oximeters.

When analyzed by age group, the market is divided into adult and pediatric segments. The adult segment is anticipated to experience a CAGR of 6.4%, with a market value expected to surpass USD 290.7 million by the end of 2034. The increasing incidence of adult-specific conditions, including stroke, cardiac complications, and neurodegenerative diseases, is encouraging the use of cerebral monitoring during medical procedures. Additionally, the regulatory clearance and availability of new oximetry devices for adult brain monitoring further contribute to segment growth.

In terms of end users, hospitals hold the largest share of the cerebral oximetry monitoring market, accounting for 48.7% of total revenue in 2024. Their dominance stems from the availability of specialized care and the use of high-end monitoring systems during surgeries and critical care. Hospitals are increasingly adopting cerebral oximetry tools to meet the demands of complex procedures and elevate patient safety standards. These facilities not only have the necessary infrastructure but also attract patients who are seeking the highest levels of care and technological support during medical treatment. The increase in hospital and clinic visits for conditions requiring intensive monitoring continues to propel the segment forward.

Regionally, the United States remains a dominant player in this space. The cerebral oximetry monitoring market in the US was valued at USD 85.5 million in 2023 and rose to USD 91.3 million in 2024. Between 2025 and 2034, the market in the US is expected to grow at a CAGR of 5.9%. Factors contributing to this robust growth include a large aging population, advanced healthcare infrastructure, and the presence of leading medical device companies. The US also benefits from a high volume of surgical procedures, a strong focus on patient safety, and favorable healthcare policies supporting the adoption of innovative technologies.

The cerebral oximetry monitoring industry is moderately consolidated, with the top five players controlling roughly 55% to 60% of the market. With only a limited number of participants, the market shows characteristics of controlled competition, where dominant companies tend to specialize in specific technological niches. Many major players are investing in new product development, while others are expanding their reach through acquisitions and partnerships. Companies are positioning themselves by offering differentiated features in their devices and by targeting emerging markets where adoption rates are still growing.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of neurological disorders

- 3.2.1.2 Technological advancements in cerebral oximeters

- 3.2.1.3 Growing awareness regarding patient safety and cerebral desaturation

- 3.2.1.4 Rising demand for non-invasive brain monitoring systems

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Fluctuation and lack of accuracy in measurement

- 3.2.2.2 High cost of devices

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Trump administration tariffs

- 3.5.1 Impact on trade

- 3.5.1.1 Trade volume disruptions

- 3.5.1.2 Retaliatory measures

- 3.5.2 Impact on the Industry

- 3.5.2.1 Supply-side impact (raw materials)

- 3.5.2.1.1 Price volatility in key materials

- 3.5.2.1.2 Supply chain restructuring

- 3.5.2.1.3 Production cost implications

- 3.5.2.2 Demand-side impact (selling price)

- 3.5.2.2.1 Price transmission to end markets

- 3.5.2.2.2 Market share dynamics

- 3.5.2.2.3 Consumer response patterns

- 3.5.2.1 Supply-side impact (raw materials)

- 3.5.3 Key companies impacted

- 3.5.4 Strategic industry responses

- 3.5.4.1 Supply chain reconfiguration

- 3.5.4.2 Pricing and product strategies

- 3.5.4.3 Policy engagement

- 3.5.5 Outlook and future considerations

- 3.5.1 Impact on trade

- 3.6 Technology landscape

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

- 3.10 Value chain analysis

- 3.11 Outlook on monitoring cerebral ischemia using cerebral oximetry

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Cardiac surgery

- 5.3 Vascular surgery

- 5.4 Other applications

Chapter 6 Market Estimates and Forecast, By Age Group, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Adult

- 6.3 Pediatric

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Ambulatory surgical centers

- 7.4 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 CASMED

- 9.2 Edwards

- 9.3 GE HealthCare

- 9.4 HAMAMATSU

- 9.5 Honeywell

- 9.6 Masimo

- 9.7 Medtronic

- 9.8 Mespere LIFE SCIENCES

- 9.9 mindray

- 9.10 NIHON KOHDEN

- 9.11 NONIN

- 9.12 sentec

- 9.13 TERUMO