PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1741042

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1741042

Biohazard Bags Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

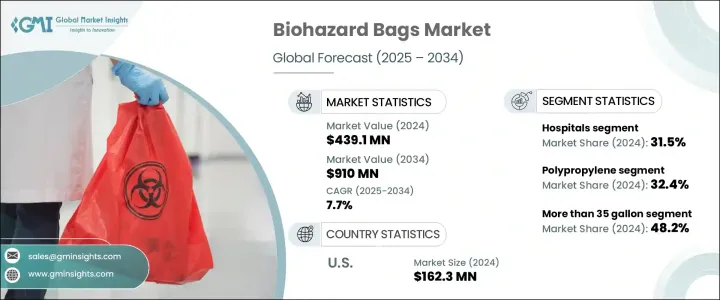

The Global Biohazard Bags Market was valued at USD 439.1 million in 2024 and is estimated to grow at a CAGR of 7.7% to reach USD 910 million by 2034. This growth is being fueled by a rising demand for secure waste disposal solutions and the implementation of strict global waste management protocols. Healthcare systems worldwide are becoming more reliant on biohazard bags as medical and laboratory waste production increases. From routine medical procedures to complex diagnostic testing, biohazardous waste is being generated in substantial quantities, driving the consistent need for reliable containment solutions. Regulations around the safe disposal of infectious and hazardous waste have tightened in many regions, compelling facilities to adopt standardized, compliant waste-handling practices. These rules directly support the market's expansion by enforcing mandatory usage of certified bags to contain biological and chemical contaminants safely. The healthcare sector alone contributes significantly to this demand, generating massive volumes of contaminated items daily that must be securely managed. As facilities modernize and expand, the need for biohazard bags that can withstand rough handling and chemical exposure continues to rise.

In 2024, the segment for biohazard bags with a capacity of more than 35 gallons held the largest share, accounting for 48.2% of the total market. These large-capacity bags are preferred by facilities with high waste output, as they allow for more efficient collection and transportation. Reducing the number of smaller bags used not only cuts material costs but also simplifies logistical processes. Their ability to handle bulk waste makes them especially useful in large-scale operations where operational efficiency is critical. Facilities producing significant volumes of contaminated material such as surgical tools used PPE, and laboratory waste rely heavily on bags of this size to maintain compliance with hygiene and safety standards. The widespread preference for larger-capacity bags is also influenced by their role in streamlining waste handling and minimizing the frequency of waste collection.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $439.1 Million |

| Forecast Value | $910 Million |

| CAGR | 7.7% |

When categorized by material, the market is dominated by polypropylene-based bags, which accounted for a 32.4% share in 2024. This material is favored for its high durability, chemical resistance, and exceptional strength under pressure. Polypropylene bags are especially useful in situations requiring sterilization, as they can withstand high temperatures commonly used in autoclaving. Their chemical resistance makes them ideal for containing biohazards without compromising structural integrity. In addition to being highly effective, these bags are cost-efficient to produce, allowing widespread use in environments where large quantities are consumed daily. Their ability to resist punctures and exposure to biological substances also makes them a go-to option for healthcare and research settings. As demands grow for reliable and compliant disposal methods, polypropylene continues to meet industry standards while supporting budget-conscious purchasing decisions.

From an end-use perspective, hospitals emerged as the leading consumers in 2024, representing 31.5% of the market. These facilities handle a constant influx of patients, generating various types of infectious waste that must be disposed of according to stringent regulations. Items such as used syringes, contaminated gloves, bandages, and other medical supplies are collected daily, making it essential for hospitals to rely on high-performance biohazard bags. In these settings, waste must be clearly segregated and managed to avoid health risks and environmental hazards. The demand from hospitals remains high due to the continuous generation of diverse waste streams, each requiring specialized containment solutions in compliance with safety guidelines. With their need for consistent, secure waste management, hospitals are the primary drivers of volume in the biohazard bags market.

In terms of regional performance, the United States led the North American market in 2024, with a revenue contribution of approximately USD 162.3 million. The country's comprehensive healthcare infrastructure and strict enforcement of medical waste disposal laws are key contributors to this dominance. Domestic guidelines ensure that all biohazardous materials are disposed of in approved containers, pushing demand across hospitals, clinics, and labs. As the number of healthcare establishments continues to grow, so does the need for dependable disposal methods. The high frequency of medical interventions across the nation further fuels the requirement for secure and compliant waste management systems, making biohazard bags a staple across facilities.

Market competition remains strong, with a mix of international and domestic brands offering tailored solutions to meet evolving waste disposal needs. Industry leaders currently hold a combined market share of about 40%, competing on product quality, regulatory compliance, and price efficiency. Local manufacturers in emerging economies are pushing global players to provide affordable yet reliable products to retain market relevance. Customization, material innovation, and competitive pricing will continue to shape the strategic direction of key players in this sector.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing demand for biohazard bags globally

- 3.2.1.2 Favorable regulatory guidelines for effective waste management

- 3.2.1.3 Growing healthcare industry especially in developing countries

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Lack of awareness regarding health hazards associated with medical waste

- 3.2.2.2 Lack of training for proper disposal of medical waste

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Trump administration tariffs

- 3.4.1 Impact on trade

- 3.4.1.1 Trade volume disruptions

- 3.4.1.2 Retaliatory measures

- 3.4.2 Impact on the Industry

- 3.4.2.1 Supply-side impact (raw materials)

- 3.4.2.1.1 Price volatility in key materials

- 3.4.2.1.2 Supply chain restructuring

- 3.4.2.1.3 Production cost implications

- 3.4.2.2 Demand-side impact (selling price)

- 3.4.2.2.1 Price transmission to end markets

- 3.4.2.2.2 Market share dynamics

- 3.4.2.2.3 Consumer response patterns

- 3.4.2.1 Supply-side impact (raw materials)

- 3.4.3 Key companies impacted

- 3.4.4 Strategic industry responses

- 3.4.4.1 Supply chain reconfiguration

- 3.4.4.2 Pricing and product strategies

- 3.4.4.3 Policy engagement

- 3.4.5 Outlook and future considerations

- 3.4.1 Impact on trade

- 3.5 Industry value chain analysis

- 3.6 Raw material analysis

- 3.7 Regulatory landscape

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Competitive dashboard

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategic outlook matrix

Chapter 5 Market Estimates and Forecast, By Capacity Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Less than 15 gallon

- 5.3 15 to 35 gallon

- 5.4 More than 35 gallon

Chapter 6 Market Estimates and Forecast, By Material Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Polypropylene

- 6.3 Polyethylene

- 6.4 Plastic

- 6.5 HDPE (high-density polyethylene)

- 6.6 Other material types

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Laboratories and research centers

- 7.4 Pharmaceutical and biotech companies

- 7.5 Clinics and diagnostic centers

- 7.6 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Poland

- 8.3.7 Switzerland

- 8.3.8 Sweden

- 8.3.9 Netherlands

- 8.4 Asia Pacific

- 8.4.1 Japan

- 8.4.2 China

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Indonesia

- 8.4.7 Thailand

- 8.4.8 Vietnam

- 8.5 Latin America

- 8.5.1 Mexico

- 8.5.2 Brazil

- 8.5.3 Mexico

- 8.5.4 Argentina

- 8.5.5 Chile

- 8.5.6 Colombia

- 8.5.7 Peru

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

- 8.6.4 Iran

- 8.6.5 Iraq

- 8.6.6 Israel

Chapter 9 Company Profiles

- 9.1 Abdos Labtech

- 9.2 Action Health

- 9.3 Bel-Art Products

- 9.4 Cole-Parmer Instrument Company

- 9.5 Desco Medical

- 9.6 Heathrow Scientific

- 9.7 Lithey

- 9.8 Medegen Medical Products

- 9.9 Sharps Compliance

- 9.10 Stericycle

- 9.11 ThermoFisher Scientific

- 9.12 Tilak Polypack

- 9.13 Transcendia

- 9.14 TUFPAK

- 9.15 VWR International