PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750265

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750265

Two-Wheeler Suspension System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

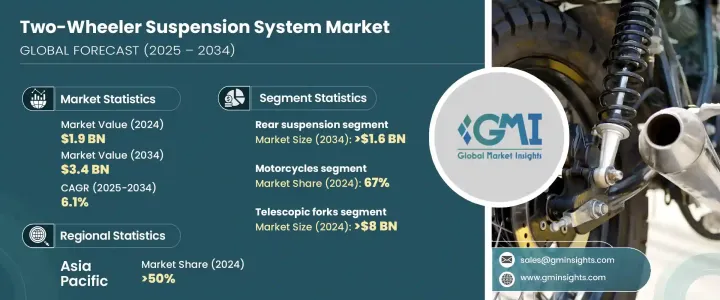

The Global Two-Wheeler Suspension System Market was valued at USD 1.9 billion in 2024 and is estimated to grow at a CAGR of 6.1% to reach USD 3.4 billion by 2034, driven by rising two-wheeler usage across developing nations, where increasing urban density, limited public transit options, and a growing middle-income population have created a strong preference for affordable and fuel-efficient mobility solutions. As personal transportation gains momentum in urban and semi-urban areas, the demand for durable and high-performance suspension systems is climbing. Riders want smoother handling, enhanced comfort, and improved safety, leading manufacturers to prioritize suspension innovations that meet regulatory standards and evolving user expectations.

The evolution of rear and front suspension technologies-especially the shift toward advanced mono-shock setups, lightweight materials, and electronically controlled systems-helps shape the market. Consumers are becoming more selective, demanding systems that offer better ride dynamics, particularly on poorly maintained roads. As demand grows for mid-range and commuter two-wheelers with refined suspension components, companies are shifting their focus to provide more adaptable solutions. Intelligent suspensions that adjust automatically to terrain or speed are emerging as performance-enhancing features that appeal to safety-conscious users.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.9 Billion |

| Forecast Value | $3.4 Billion |

| CAGR | 6.1% |

Front and rear suspension systems continue to play a crucial role in enhancing the overall riding experience, with rear suspension units taking a significant lead in the market. In 2024, the rear suspension segment generated USD 1 billion, with projections indicating that this value will reach USD 1.6 billion by 2034. This growth is attributed to the vital function these units serve in absorbing road shocks, ensuring rider comfort, and improving vehicle stability, especially in regions with underdeveloped infrastructure. In less-developed urban and semi-urban areas, where roads often face wear and tear, rear suspension systems are essential for reducing the impact of rough surfaces on the overall ride quality.

The Motorcycles segment in the two-wheeler suspension system market held 67% share in 2024. This segment is expected to maintain its leadership, thanks to manufacturers increasingly integrating mono-shock rear suspension into mid-segment models. These systems, once reserved for high-performance bikes, are now featured in daily-use motorcycles to improve handling, cornering, and road comfort. The emphasis on performance, fuel efficiency, and affordability has pushed OEMs to recalibrate shock absorber systems for everyday commuters navigating rugged terrains.

Asia Pacific Two-Wheeler Suspension System Market held 50% share in 2024, with China leading the way. The large population of two-wheeler users in China, paired with heavy urban congestion, has driven the demand for high-performance suspension systems. As urban traffic increases, two-wheelers have become an essential mode of personal transportation due to their affordability and maneuverability. The growing middle class, which is seeking cost-effective mobility solutions, has further contributed to the increased demand for reliable suspension systems. In this context, suspension systems are critical not just for safety but also for offering a comfortable and stable ride, making them a key feature in two-wheeler design and manufacturing.

Leading market players like KYB, Endurance Technologies, Showa, Gabriel India, WP Suspension, Mando, Tenneco, Fox Factory, BITUBO, and Chongqing Chuandong Shock Absorber are advancing their market positions through focused R&D investments, strategic collaborations, and new product rollouts. These companies refine their product lines to offer enhanced suspension performance for various motorcycle classes. Many are prioritizing lightweight, durable materials and electronically adaptive solutions. Partnerships with OEMs and aftermarket suppliers allow firms to strengthen their distribution channels, while global expansion strategies and technological differentiation help them remain competitive in an evolving mobility landscape.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Raw material suppliers

- 3.2.2 Component manufacturers

- 3.2.3 OEM (Original Equipment Manufacturers)

- 3.2.4 Technology providers

- 3.2.5 Aftermarket suppliers and distributors

- 3.3 Impact of Trump administration tariffs

- 3.3.1 Impact on trade

- 3.3.1.1 Trade volume disruptions

- 3.3.1.2 Retaliatory measures

- 3.3.2 Impact on the Industry

- 3.3.2.1 Price volatility in key materials

- 3.3.2.2 Supply chain restructuring

- 3.3.2.3 Price transmission to end markets

- 3.3.3 Strategic industry responses

- 3.3.3.1 Supply chain reconfiguration

- 3.3.3.2 Pricing and product strategies

- 3.3.1 Impact on trade

- 3.4 Profit margin analysis

- 3.5 Technology & innovation landscape

- 3.6 Key news & initiatives

- 3.7 Cost breakdown analysis

- 3.8 Pricing analysis

- 3.8.1 Product

- 3.8.2 Region

- 3.9 Patent analysis

- 3.10 Regulatory landscape

- 3.11 Impact forces

- 3.11.1 Growth drivers

- 3.11.1.1 Growing demand for two-wheelers in emerging economies

- 3.11.1.2 Technological advancements in suspension systems

- 3.11.1.3 Increasing focus on rider safety and comfort

- 3.11.1.4 Increasing preference for road-based travel over short-haul flights

- 3.11.2 Industry pitfalls & challenges

- 3.11.2.1 Price sensitivity in emerging markets

- 3.11.2.2 Limited standardization across models

- 3.11.1 Growth drivers

- 3.12 Growth potential analysis

- 3.13 Porter's analysis

- 3.14 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Suspension, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 Front suspension

- 5.3 Rear suspension

Chapter 6 Market Estimates & Forecast, By Product, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 Telescopic forks

- 6.3 Mono shock

- 6.4 Twin shock absorbers

- 6.5 Spring and damper units

Chapter 7 Market Estimates & Forecast, By Vehicles, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 Motorcycles

- 7.3 Scooters

- 7.4 Electric two-wheelers

Chapter 8 Market Estimates & Forecast, By Sales Channels, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 OEM (Original Equipment Manufacturers)

- 8.3 Aftermarket

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 Saudi Arabia

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 BITUBO

- 10.2 Chongqing Chuandong Shock Absorber

- 10.3 Duro Shox

- 10.4 Endurance Technologies

- 10.5 Fox Factory

- 10.6 Fras-le

- 10.7 Gabriel

- 10.8 Hagon Shocks

- 10.9 JRi Shocks

- 10.10 K-Tech Suspension

- 10.11 KYB

- 10.12 Mando

- 10.13 Matris Dampers

- 10.14 Norton Motorcycle

- 10.15 Penske Racing Shocks

- 10.16 Showa

- 10.17 Tenneco

- 10.18 Touratech

- 10.19 WP Suspension

- 10.20 ZF Friedrichshafen