PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750266

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750266

Prescription Lens Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

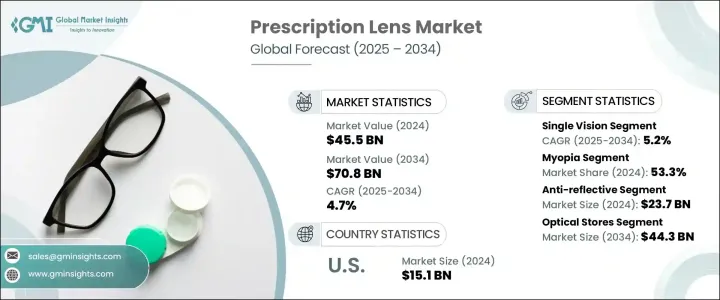

The Global Prescription Lens Market was valued at USD 45.5 billion in 2024 and is estimated to grow at a CAGR of 4.7% to reach USD 70.8 billion by 2034, driven by several factors, including an increasing global incidence of refractive errors such as myopia, hyperopia, astigmatism, and presbyopia. The rising screen time among individuals of all ages, especially younger generations, is contributing to worsened vision problems, leading to greater demand for corrective solutions. Additionally, advancements in lens materials and coatings, such as anti-glare, blue light blocking, and scratch resistance, are attracting more consumers seeking comfort and protection.

Increasing disposable income in emerging markets also helps make high-quality, customized lenses more accessible, while fashion trends are pushing consumers to choose stylish, functional eyewear. The expansion of online retailers has significantly reshaped the prescription lens market, making it more accessible and convenient for consumers, particularly younger generations who are more tech-savvy. With just a few clicks, individuals can now customize and order prescription lenses, often with the added benefit of home delivery. This ease of access has especially resonated with younger buyers who prioritize convenience and the ability to shop from the comfort of their homes.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $45.5 Billion |

| Forecast Value | $70.8 Billion |

| CAGR | 4.7% |

The market is divided into various types of prescription lenses, including single vision, bifocal, progressive, trifocal, and workspace progressives, with the single vision segment expected to grow significantly generating USD 33.2 billion by 2034, due to its simplicity and versatility in addressing common refractive errors like myopia and hyperopia, particularly among younger users. Single vision lenses are affordable, easily accessible, and can be customized with different coatings, making them widely popular. This segment is also witnessing increased demand from children and students due to the rising use of digital devices.

The prescription lens market is further segmented by applications, including myopia, hyperopia, astigmatism, and presbyopia. The myopia segment is the largest, accounting for a 53% share in 2024. The surge in myopia cases, especially among younger populations due to excessive screen use and limited outdoor activity, is driving the demand for corrective lenses. Advancements like anti-reflective coatings and blue light filters are increasing the comfort and protection offered by these lenses, making them even more appealing. Addressing myopia is important to prevent long-term vision complications such as retinal detachment and glaucoma.

United States Prescription Lens Market was valued at USD 15.1 billion in 2024 and is expected to continue growing due to the increasing need for eye care. As the population ages, there is a rising demand for lenses that correct presbyopia, while younger consumers are fueling the market for myopia and astigmatism lenses. The competitive landscape is evolving with companies offering high-quality products, thus addressing various visual needs. Additionally, the growing dependence on digital devices is driving the demand for lenses designed to combat digital eye strain and blue light exposure.

Prominent companies operating in the Global Prescription Lens Market include CooperVision, Hoya, Essilor, Bausch + Lomb, Ray-Ban, and Johnson & Johnson. These players are enhancing their market positions by focusing on innovations such as advanced lens coatings, sustainable manufacturing practices, and expanding their digital sales platforms to meet the growing demand for personalized, high-performance lenses. Companies are also prioritizing research and development to create more comfortable, durable, and aesthetically appealing lenses for a broader range of consumers. Furthermore, many of these companies are forming strategic partnerships with eyewear retailers and optometrists to strengthen their distribution channels.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of vision impairments

- 3.2.1.2 Growing geriatric population

- 3.2.1.3 Increased screen time of individuals on electronic gadgets

- 3.2.1.4 Technological advancements

- 3.2.1.5 Rise in awareness towards eye health

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of advanced lenses

- 3.2.2.2 Availability of non-prescription alternatives

- 3.2.2.3 Regulatory challenges

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Trump administration tariffs

- 3.5.1 Impact on trade

- 3.5.1.1 Trade volume disruptions

- 3.5.1.2 Country-wise response

- 3.5.2 Impact on the industry

- 3.5.2.1 Supply-side impact (Cost of manufacturing)

- 3.5.2.1.1 Price volatility in key materials

- 3.5.2.1.2 Supply chain restructuring

- 3.5.2.1.3 Production cost implications

- 3.5.2.2 Demand-side impact (Cost to consumers)

- 3.5.2.2.1 Price transmission to end markets

- 3.5.2.2.2 Market share dynamics

- 3.5.2.2.3 Consumer response patterns

- 3.5.2.1 Supply-side impact (Cost of manufacturing)

- 3.5.3 Key companies impacted

- 3.5.4 Strategic industry responses

- 3.5.4.1 Supply chain reconfiguration

- 3.5.4.2 Pricing and product strategies

- 3.5.4.3 Policy engagement

- 3.5.5 Outlook and future considerations

- 3.5.1 Impact on trade

- 3.6 Technology landscape

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

- 3.10 Value chain analysis

- 3.11 Future market trends

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Single Vision

- 5.2.1 Convex

- 5.2.2 Concave

- 5.2.3 Cylindrical

- 5.3 Bifocal

- 5.4 Progressive

- 5.5 Trifocal

- 5.6 Workspace progressives

- 5.7 Other types

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Myopia

- 6.3 Hyperopia/hypermetropia

- 6.4 Astigmatism

- 6.5 Presbyopia

Chapter 7 Market Estimates and Forecast, By Coating, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Anti-reflective

- 7.3 Scratch resistant coating

- 7.4 Anti-fog coating

- 7.5 Ultraviolet treatment

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Optical stores

- 8.3 Hospital and clinics

- 8.4 E-commerce platforms

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Alcon

- 10.2 Bausch + Lomb

- 10.3 CooperVision

- 10.4 Essilor

- 10.5 Hoya

- 10.6 Johnson & Johnson

- 10.7 Prive Revaux

- 10.8 Ray-Ban

- 10.9 Rodenstock

- 10.10 Seiko

- 10.11 Shamir Optical

- 10.12 Silhouette

- 10.13 VISION EASE

- 10.14 Vision Rx Lab

- 10.15 Zeiss