PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750269

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750269

Truck Mounted Knuckle Boom Cranes Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

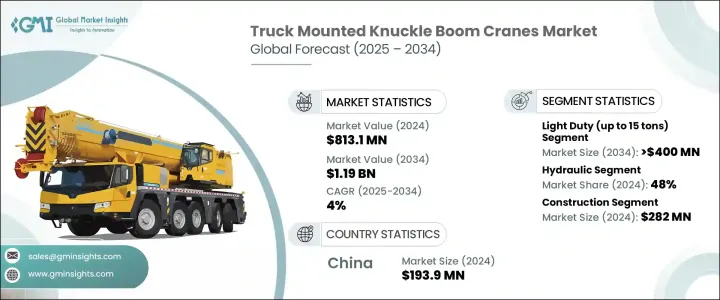

The Global Truck Mounted Knuckle Boom Cranes Market was valued at USD 813.1 million in 2024 and is estimated to grow at a CAGR of 4% to reach USD 1.19 billion by 2034, driven by rising demand for compact and efficient lifting equipment across multiple sectors such as utilities, logistics, and construction. These cranes are mounted on trucks, enabling high mobility and functionality in urban and remote project locations. Their articulated arm design allows for better maneuverability in space-constrained areas, making them indispensable in modern infrastructure and utility operations.

As industries continue to automate and streamline their processes, technologically enhanced crane systems are becoming the standard. Features like remote-control functionality, improved load management, and integrated safety systems are optimizing job site performance. These tools help reduce manual workload while increasing productivity and job accuracy. Businesses are increasingly investing in multifunctional machines that can perform multiple tasks and reduce labor dependency, aligning well with the capabilities of knuckle boom cranes. Additionally, market interest is rising for equipment that supports precision handling, real-time monitoring, and energy-efficient performance.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $813.1 Million |

| Forecast Value | $1.19 Billion |

| CAGR | 4% |

In 2024, the light-duty crane segment held a notable 40% share and is forecasted to reach USD 400 million by 2034. Light-duty truck-mounted knuckle boom cranes, typically with a lifting capacity under 15 tons, are the preferred choice for urban development projects, telecom upgrades, and municipal work. Their compact build, simple setup, and lower operational costs make them attractive to small contractors and local authorities. These cranes are particularly favored in densely populated or restricted-access areas where larger equipment is impractical. In emerging markets, increased investment in telecom infrastructure and electrification programs boosts their adoption.

Hydraulic-powered systems segment held a 48% share in 2024 as these systems are widely recognized for their strength, precision, and adaptability. Their compatibility with modern sensors and load-control technologies enables better performance in demanding tasks like heavy lifting, accurate positioning, and repetitive operations. Users benefit from smooth operation, improved energy usage, and reduced mechanical strain, making hydraulic cranes suitable across several applications.

China Truck Mounted Knuckle Boom Cranes Market generated USD 193.9 million in 2024, driven by rapid urban expansion and significant infrastructure investment. National incentives and domestic manufacturing capacity continue to support the strong growth of this sector in the region. The country's aggressive push for industrialization and smart infrastructure initiatives has spurred demand for advanced lifting solutions such as truck-mounted knuckle boom cranes. Government-backed subsidies and projects aimed at enhancing logistics and construction capabilities have bolstered the sector, making China a leader in both production and consumption of these cranes.

To boost market share and brand presence, leading companies like Palfinger, Hiab, HMF Group, and Manitex International are investing in advanced crane technologies with smart safety systems and telematics integration. Amco Veba and CPS Group are expanding through global partnerships and localized manufacturing strategies to enhance accessibility and reduce costs. Action Construction Equipment and Mikron Hidrolik focus on diversifying product lines to meet evolving client needs. ATLAS Group and SANY emphasize R&D to develop high-efficiency, lightweight cranes, further reinforcing their competitive positions in the global market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 Spare parts providers

- 3.1.1.2 Manufacturers

- 3.1.1.3 Vehicle chassis suppliers

- 3.1.1.4 Component and Technology Suppliers

- 3.1.1.5 Distributors

- 3.1.1.6 End use

- 3.1.2 Profit margin analysis

- 3.1.1 Supplier landscape

- 3.2 Impact of Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Strategic industry responses

- 3.2.3.1 Supply chain reconfiguration

- 3.2.1 Impact on trade

- 3.3 Pricing and product strategies

- 3.4 Technology & innovation landscape

- 3.4.1 Current Technological Trends

- 3.4.1.1 Telematics and fleet management integration

- 3.4.1.2 Hydraulic efficiency enhancements

- 3.4.1.3 Remote crane operation and control

- 3.4.1.4 Load monitoring and anti-tipping systems

- 3.4.2 Emerging Technologies

- 3.4.2.1 Electrification and hybrid propulsion systems

- 3.4.2.2 Autonomous crane operation

- 3.4.2.3 Augmented Reality (AR) for maintenance and training

- 3.4.2.4 Advanced materials and lightweight design

- 3.4.1 Current Technological Trends

- 3.5 Patent analysis

- 3.6 Regulatory landscape

- 3.7 Use cases

- 3.8 Key news & initiatives

- 3.9 Price trend

- 3.9.1 Drive

- 3.9.2 Region

- 3.10 Cost breakdown analysis

- 3.11 Regulatory landscape

- 3.12 Impact on forces

- 3.12.1 Growth drivers

- 3.12.1.1 Integration of advanced automation and remote-control systems

- 3.12.1.2 Availability of compact and lightweight design innovations

- 3.12.1.3 Development of multi-functional hydraulic systems

- 3.12.1.4 Improved load monitoring and safety features

- 3.12.2 Industry pitfalls & challenges

- 3.12.2.1 High initial investment and maintenance costs

- 3.12.2.2 Complexity in system integration and operator training

- 3.12.1 Growth drivers

- 3.13 Growth potential analysis

- 3.14 Porter's analysis

- 3.15 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Lifting Capacity, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 Light duty (up to 15 tons)

- 5.3 Medium duty (15-100 tons)

- 5.4 Heavy duty (above 50 tons)

Chapter 6 Market Estimates & Forecast, By Drive, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 Hydraulic

- 6.3 Electric

- 6.4 Diesel

Chapter 7 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 Construction

- 7.3 Logistics and transportation

- 7.4 Utilities

- 7.5 Mining

- 7.6 Forestry

- 7.7 Others

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 Direct sales

- 8.3 Distributors

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 9.1 North America

- 9.1.1 U.S.

- 9.1.2 Canada

- 9.2 Europe

- 9.2.1 UK

- 9.2.2 Germany

- 9.2.3 France

- 9.2.4 Italy

- 9.2.5 Spain

- 9.2.6 Russia

- 9.3 Asia Pacific

- 9.3.1 China

- 9.3.2 India

- 9.3.3 Japan

- 9.3.4 Australia

- 9.3.5 South Korea

- 9.3.6 Southeast Asia

- 9.4 Latin America

- 9.4.1 Brazil

- 9.4.2 Mexico

- 9.4.3 Argentina

- 9.5 MEA

- 9.5.1 South Africa

- 9.5.2 Saudi Arabia

- 9.5.3 UAE

Chapter 10 Company Profiles

- 10.1 Action Construction Equipment

- 10.2 Amco Veba

- 10.3 ATLAS Group

- 10.4 Century Cranes

- 10.5 Cormach

- 10.6 CPS Group

- 10.7 Fassi Gru

- 10.8 FURUKAWA UNIC

- 10.9 Heila Cranes

- 10.10 Hiab

- 10.11 Hidrokon

- 10.12 HMF Group

- 10.13 Iowa Mold Tooling

- 10.14 JomacLTD

- 10.15 Manitex International

- 10.16 Mikron Hidrolik

- 10.17 Nandan GSE

- 10.18 Palfinger

- 10.19 SANY

- 10.20 Xuzhou BOB-LIFT Construction Machinery