PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750270

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750270

Semiconductor Rectifiers Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

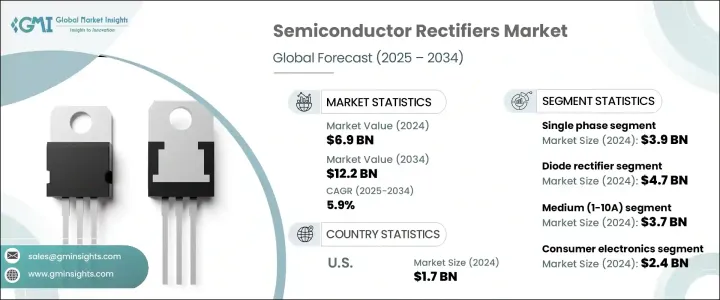

The Global Semiconductor Rectifiers Market was valued at USD 6.9 billion in 2024 and is estimated to grow at a CAGR of 5.9% to reach USD 12.2 billion by 2034, fueled by increasing global consumption of consumer electronics and a surge in renewable energy deployment. Devices generating direct current in clean energy systems require conversion to alternating current-an area where rectifiers play a crucial role in power inverters and converters.

However, trade policies- notably the tariffs imposed on semiconductor components imported from China during the Trump administration-introduced substantial turbulence into the global supply chain. These tariffs not only increased import costs but also caused ripple effects across the industry, including inconsistent pricing, prolonged product deployment cycles, and squeezed profit margins. As a response, many manufacturers began diversifying their supplier networks and exploring nearshoring strategies to minimize risk. While the intent was to stimulate domestic production and reduce reliance on imports, the short-term consequence was a period of volatility that slowed market momentum and complicated production planning.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.9 Billion |

| Forecast Value | $12.2 Billion |

| CAGR | 5.9% |

Based on product segmentation, single-phase rectifiers segment generated USD 3.9 billion in 2024. Their extensive use in consumer electronics and residential setups stems from their efficiency in handling low-power conversions, compact footprint, and ease of integration into standardized circuit designs. Their affordability and flexibility make them an ideal fit for mass-market applications that prioritize cost and simplicity without sacrificing performance.

Meanwhile, diode rectifiers led by type with a valuation of USD 4.7 billion in 2024. These components remain integral to a broad range of low-to-mid power systems due to their minimalistic design and high energy efficiency. Their growing use in renewable energy infrastructure, including solar power inverters and electric vehicle chargers, underscores their role in scaling next-generation power solutions that demand reliability and space efficiency.

United States Semiconductor Rectifiers Market generated USD 1.7 billion in 2024, attributed to a mature industrial base that supports sectors like aerospace, defense, and telecommunications-industries that depend on high-performance and long-lasting electronic components. Further boosting this leadership are federal incentives promoting domestic semiconductor fabrication, which aim to enhance self-reliance in critical technology areas and mitigate geopolitical supply disruptions.

Key players in the Global Semiconductor Rectifiers Market, including Texas Instruments, ON Semiconductor, STMicroelectronics, Infineon Technologies, Renesas Electronics, and Toshiba, are adopting multi-pronged strategies to reinforce their market position. These companies invest in R&D to enhance efficiency and reduce form factor in rectifier technologies. Expansion of manufacturing capacities in regions with favorable trade conditions is also underway. Firms like ABB and NXP Semiconductor are entering strategic collaborations to broaden their application portfolios, while Microchip Technology and IXYS are exploring AI-integrated power solutions. Additionally, players like Rohm Semiconductor and Mitsubishi Electric focus on vertical integration and geographic diversification to mitigate supply chain risks and ensure stable delivery in high-demand sectors.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact

- 3.2.2.1.1 Price volatility in key components

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Rising demand for consumer electronics

- 3.3.1.2 Growing electrification of automobiles

- 3.3.1.3 Expansion of renewable energy infrastructure

- 3.3.1.4 5G and next-gen communication networks

- 3.3.1.5 Surge in data centres and cloud computing

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 High initial cost of advanced rectifiers

- 3.3.2.2 Thermal management and reliability issues

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 (USD Billion & Billion Units)

- 5.1 Key trends

- 5.2 Single phase

- 5.3 Three phase

Chapter 6 Market Estimates and Forecast, By Type, 2021 - 2034 (USD Billion & Billion Units)

- 6.1 Key trends

- 6.2 Diode rectifiers

- 6.3 Thyristor rectifiers

Chapter 7 Market Estimates and Forecast, By Power Rating, 2021 - 2034 (USD Billion & Billion Units)

- 7.1 Key trends

- 7.2 Low (less than 1 A)

- 7.3 Medium (1-10 A)

- 7.4 High (over 10 A)

Chapter 8 Market Estimates and Forecast, By End Use Industry, 2021 - 2034 (USD Billion & Billion Units)

- 8.1 Key trends

- 8.2 Automotive

- 8.3 Consumer electronics

- 8.4 Power and utility

- 8.5 It and telecom

- 8.6 Others

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion & Billion Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 ABB

- 10.2 ASI semiconductor

- 10.3 Infineon technologies

- 10.4 IXYS

- 10.5 Microchip technology

- 10.6 Mitsubishi electric

- 10.7 NXP semiconductor

- 10.8 ON semiconductor

- 10.9 Renesas electronics

- 10.10 Rohm semiconductor

- 10.11 STMicroelectronics

- 10.12 Taiwan semiconductor

- 10.13 Texas instruments

- 10.14 Toshiba