PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750279

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750279

Infectious Disease Therapeutics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

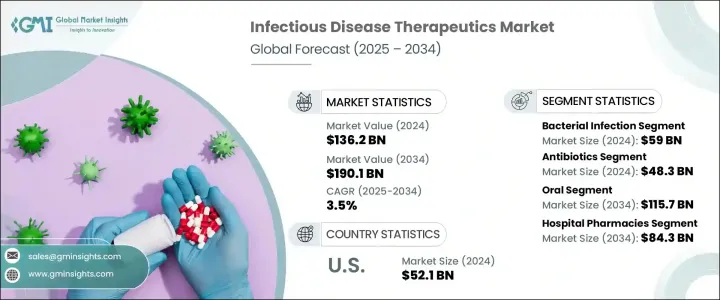

The Global Infectious Disease Therapeutics Market was valued at USD 136.2 billion in 2024 and is estimated to grow at a CAGR of 3.5% to reach USD 190.1 billion by 2034, driven by the increasing occurrence of infectious diseases globally. Treatments targeting infectious conditions from bacterial and viral infections to fungal and parasitic diseases are seeing wider adoption, particularly as populations grow and healthcare access expands. These therapies include antimicrobial drugs and vaccines that treat or prevent illnesses by targeting the root cause or strengthening immunity.

Additionally, zoonotic infections transmitted from animals to humans are becoming increasingly common, driving a surge in treatment requirements across global healthcare systems. Factors such as urbanization, deforestation, and intensified livestock farming contribute to the rising incidence of these infections. Notably, the persistent global burden of retroviral diseases like HIV continues to create a strong demand for advanced antiviral therapies, reinforcing the market's upward trajectory. As awareness campaigns grow more effective and diagnostic technologies improve, early detection rates are climbing. This trend, coupled with the expansion of healthcare infrastructure and insurance coverage in both mature and developing economies, is accelerating access to treatment and fueling steady market growth.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $136.2 Billion |

| Forecast Value | $190.1 Billion |

| CAGR | 3.5% |

In 2024, the bacterial infections segment generated USD 59 billion. The increased vulnerability to bacterial illnesses is largely tied to compromised immune systems resulting from poor nutrition, sedentary lifestyles, aging populations, and the prevalence of chronic diseases such as diabetes and cancer. In many parts of the world, particularly in low- and middle-income countries, inadequate sanitation facilities, contaminated water sources, and insufficient food hygiene standards continue to amplify the spread of bacterial pathogens. These conditions create persistent healthcare challenges, spurring consistent demand for effective antibiotics, combination therapies, and next-generation treatment solutions.

The antibiotics segment generated USD 48.3 billion in 2024. These medications remain the cornerstone in managing common and serious bacterial conditions. However, the increasing resistance to traditional antibiotics has triggered a push for novel therapeutic solutions and next-generation antibiotic development. Drug-resistant strains are becoming more difficult to treat, which places greater urgency on pharmaceutical innovation and broader antimicrobial pipelines.

United States Infectious Disease Therapeutics Market generated USD 52.1 billion in 2024. Several factors have reinforced this leadership, including a growing elderly population, the spread of antimicrobial-resistant pathogens, and robust innovation ecosystems. The healthcare sector's continued investment in the development of advanced biologics and pathogen-targeted immunotherapies further enhances the country's market standing. Scientific breakthroughs in treatment platforms, especially in vaccine development and delivery, shape disease prevention and treatment strategies.

Key companies in the Global Infectious Disease Therapeutics Market are prioritizing R&D innovation, strategic partnerships, and regulatory approvals to expand their product offerings and global reach. Pfizer and Gilead Sciences are advancing mRNA and antiviral therapies, while Merck and GlaxoSmithKline are enhancing vaccine research. F. Hoffmann-La Roche and Johnson & Johnson continue to invest in targeted biologics and next-gen antivirals. Sanofi and AstraZeneca are collaborating with research institutions to accelerate drug development. Novartis and Bayer are focusing on portfolio diversification through acquisitions and licensing agreements. Meanwhile, Sandoz International and Boehringer Ingelheim leverage biosimilar pathways to strengthen their competitive edge.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising incidences of infectious diseases

- 3.2.1.2 Increasing development of innovative therapeutics

- 3.2.1.3 Advancement in diagnostic technologies

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High treatment costs due to antimicrobial resistance

- 3.2.2.2 Stringent regulatory approvals

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Trump administration tariffs

- 3.5.1 Impact on trade

- 3.5.1.1 Trade volume disruptions

- 3.5.1.2 Retaliatory measures

- 3.5.2 Impact on the Industry

- 3.5.2.1 Supply-side impact (raw materials)

- 3.5.2.1.1 Price volatility in key materials

- 3.5.2.1.2 Supply chain restructuring

- 3.5.2.1.3 Production cost implications

- 3.5.2.2 Demand-side impact (selling price)

- 3.5.2.2.1 Price transmission to end markets

- 3.5.2.2.2 Market share dynamics

- 3.5.2.2.3 Consumer response patterns

- 3.5.2.1 Supply-side impact (raw materials)

- 3.5.3 Key companies impacted

- 3.5.4 Strategic industry responses

- 3.5.4.1 Supply chain reconfiguration

- 3.5.4.2 Pricing and product strategies

- 3.5.4.3 Policy engagement

- 3.5.5 Outlook and future considerations

- 3.5.1 Impact on trade

- 3.6 Pipeline analysis

- 3.7 Future market trends

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Infection Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Bacterial infection

- 5.3 Viral infection

- 5.3.1 Retroviral infection(HIV/AIDS)

- 5.3.2 Influenza

- 5.3.3 Hepatitis

- 5.3.4 Other viral infections

- 5.4 Fungal infection

- 5.5 Parasitic infection

Chapter 6 Market Estimates and Forecast, By Drug Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Antibiotics

- 6.3 Antivirals

- 6.4 Antifungals

- 6.5 Antiparasitic

- 6.6 Vaccines

- 6.7 Immunotherapies

Chapter 7 Market Estimates and Forecast, By Mode of Administration, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Oral

- 7.3 Parenteral

- 7.4 Intranasal

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospital pharmacies

- 8.3 Retail pharmacies

- 8.4 Online pharmacies

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Abbott Laboratories

- 10.2 AstraZeneca

- 10.3 Bayer

- 10.4 Boehringer Ingelheim International

- 10.5 Bristol-Myers Squibb

- 10.6 F. Hoffmann-La Roche

- 10.7 Gilead Sciences

- 10.8 GlaxoSmithKline (GSK)

- 10.9 Johnson & Johnson (Janssen Pharmaceuticals)

- 10.10 Merck

- 10.11 Novartis

- 10.12 Pfizer

- 10.13 Sandoz International

- 10.14 Sanofi