PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750280

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750280

Robotic Radiotherapy Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

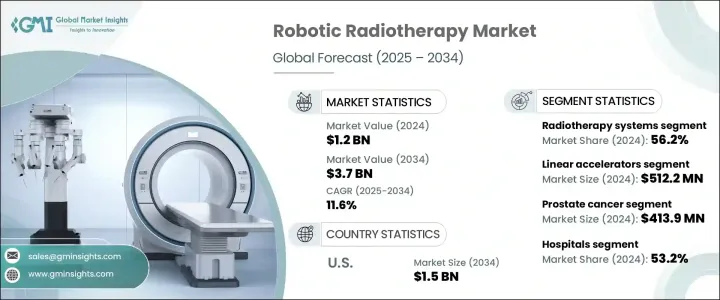

The Global Robotic Radiotherapy Market was valued at USD 1.2 billion in 2024 and is estimated to grow at a CAGR of 11.6% to reach USD 3.7 billion by 2024, driven by the increasing reliance on precision-driven radiation therapies for various tumors and cancers. Robotic radiotherapy enables enhanced targeting accuracy, leading to better treatment outcomes and reduced therapy sessions. As demand for non-invasive and outpatient cancer treatments grows, robotic systems are gaining favor for their ability to deliver high-dose radiation without the need for surgery or hospitalization. This reflects a broader shift toward value-based care and shorter recovery periods in oncology treatment pathways.

Cutting-edge advances in real-time imaging, motion compensation, and AI-powered planning software are further fueling the adoption of robotic radiotherapy technologies. These systems automatically adapt radiation delivery to patient-specific movement or tumor shifts, enabling consistent, accurate dosing. Facilities prefer robotic equipment to treat tumors in delicate anatomical regions without harming nearby healthy tissue. The push for fewer treatment sessions, known as hypofractionation, is also contributing to the popularity of these systems. As a result, both healthcare providers and patients are increasingly opting for robotic platforms that combine real-time monitoring, beam modulation, and smart image-guided therapy.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.2 Billion |

| Forecast Value | $3.7 Billion |

| CAGR | 11.6% |

In 2024, the radiotherapy systems segment in the robotic radiotherapy market held a 56.2% share. Their advanced targeting capabilities, offering sub-millimeter precision, have become indispensable in treating tumors located near vital organs or in hard-to-reach areas. By significantly reducing radiation exposure to surrounding healthy tissue, these systems have transformed the way clinicians manage complex cancer cases. Their integration into oncology practices has elevated patient outcomes and safety profiles, solidifying their role as a standard in next-generation cancer treatment.

Meanwhile, linear accelerators (LINACs) segment generated USD 512.2 million in 2024. These robotic-enabled devices support image-guided and intensity-modulated radiotherapy, delivering highly conformal doses tailored to dynamic tumor positions. Their adaptive planning features are especially valuable for tumors in mobile organs such as the lungs or liver, where breathing or digestion introduces frequent positional shifts. Additionally, LINACs are increasingly utilized in outpatient cancer care, allowing for shorter, more convenient treatment sessions that minimize hospital stays and maximize patient comfort.

U.S. Robotic Radiotherapy Market generated USD 508.3 million in 2024 and is projected to grow to USD 1.5 billion by 2034. Rising cancer prevalence-especially in an aging population-has intensified the need for precise, efficient treatment solutions. Hospitals and cancer centers are expanding investments in robotic platforms to offer non-invasive therapies with reduced recovery times and fewer complications. This patient-centric shift, favoring customized and targeted radiation approaches, continues to fuel technology adoption worldwide.

Key players in the Global Robotic Radiotherapy Market prioritize innovation, strategic collaborations, and geographic expansion to solidify their market standing. Accuray and Elekta are investing heavily in AI-based treatment planning and adaptive therapy systems. Siemens Healthineers and GE Healthcare are advancing integrated imaging and robotic platforms to boost precision. RefleXion and ViewRay are leveraging real-time tumor tracking to differentiate their offerings. Varian, Brainlab, and Hitachi continue to enhance software-driven functionalities and secure regulatory approvals in emerging markets. United Imaging and ZAP are scaling up production to meet growing demand globally, Mitsubishi Electric and Mevion focus on affordability and compact system design to tap mid-tier healthcare segments.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of cancer worldwide

- 3.2.1.2 Growing preference for non-invasive and outpatient treatment methods

- 3.2.1.3 Technological advancements in imaging and motion tracking

- 3.2.1.4 Rising healthcare investments and government funding in oncology care infrastructure

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of robotic radiotherapy systems and maintenance

- 3.2.2.2 Lack of skilled professionals to operate advanced robotic systems

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Trump administration tariffs

- 3.4.1 Impact on trade

- 3.4.1.1 Trade volume disruptions

- 3.4.1.2 Retaliatory measures

- 3.4.2 Impact on the Industry

- 3.4.2.1 Supply-side impact (raw materials)

- 3.4.2.1.1 Price volatility in key materials

- 3.4.2.1.2 Supply chain restructuring

- 3.4.2.1.3 Production cost implications

- 3.4.2.2 Demand-side impact (selling price)

- 3.4.2.2.1 Price transmission to end markets

- 3.4.2.2.2 Market share dynamics

- 3.4.2.2.3 Consumer response patterns

- 3.4.2.1 Supply-side impact (raw materials)

- 3.4.3 Key companies impacted

- 3.4.4 Strategic industry responses

- 3.4.4.1 Supply chain reconfiguration

- 3.4.4.2 Pricing and product strategies

- 3.4.4.3 Policy engagement

- 3.4.5 Outlook and future considerations

- 3.4.1 Impact on trade

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Regulatory landscape

- 3.8 Patent analysis

- 3.9 Gap analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Competitive market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategic outlook matrix

Chapter 5 Market Estimates and Forecast, By Product, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Radiotherapy systems

- 5.3 3D cameras

- 5.4 Software

- 5.5 Other products

Chapter 6 Market Estimates and Forecast, By Technology, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Linear accelerators

- 6.3 Stereotactic radiation therapy systems

- 6.4 Cyberknife

- 6.5 Gamma knife

- 6.6 Particle therapy

- 6.7 Proton beam therapy

- 6.8 Heavy ion beam therapy

Chapter 7 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Prostate cancer

- 7.3 Breast cancer

- 7.4 Lung cancer

- 7.5 Head and neck cancer

- 7.6 Colorectal cancer

- 7.7 Other applications

Chapter 8 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals

- 8.3 Cancer treatment centers

- 8.4 Academic and research institutions

- 8.5 Specialty clinics

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 Japan

- 9.4.2 China

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Mexico

- 9.5.2 Brazil

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Accuray

- 10.2 Brainlab

- 10.3 Elekta

- 10.4 GE Healthcare

- 10.5 Hitachi

- 10.6 Ion Beam Applications

- 10.7 Mevion

- 10.8 Mitsubishi Electric

- 10.9 RefleXion

- 10.10 Shinva

- 10.11 Siemens Healthineers

- 10.12 United Imaging

- 10.13 Varian

- 10.14 ViewRay

- 10.15 ZAP