PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750286

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750286

Electrochromic and Liquid Crystal Polymer Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

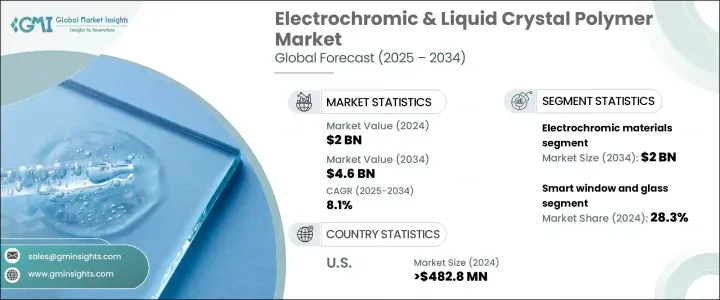

The Global Electrochromic and Liquid Crystal Polymer Market was valued at USD 2 billion in 2024 and is estimated to grow at a CAGR of 8.1% to reach USD 4.6 billion by 2034, driven by the increasing demand for energy-efficient solutions in industries like automotive and construction. Electrochromic materials, which change their optical properties in response to electrical signals, are essential for advanced window technologies. Smart windows are crucial in vehicles and buildings, enabling energy optimization by managing solar energy absorption and minimizing glare. This helps reduce the need for air conditioning, aligning with global efforts to improve energy management and lower greenhouse gas emissions. As industries seek to incorporate more sustainable technologies, the role of electrochromic materials continues to expand in improving energy efficiency.

In the automotive sector, these materials are used in rearview mirrors and sunroofs to enhance driver comfort and safety. They also contribute to the evolution of advanced driver-assistance systems (ADAS) and autonomous driving technologies. Electrochromic materials help maintain an optimal temperature inside vehicles, contributing to energy savings. The increasing demand for liquid crystal polymer products is also fueled by the telecommunications and electronics industries, where high-performance materials are required.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2 Billion |

| Forecast Value | $4.6 Billion |

| CAGR | 8.1% |

The electrochromic materials segment generated USD 901.5 million in 2024, attributed to the materials' versatility in changing colors or transparency when voltage is applied, allowing them to control heat and light passage through windows, mirrors, and displays. These materials are highly energy-efficient, making them ideal for various applications in both functional and aesthetic settings. The development of more sophisticated technology, such as PDLC (polymer-dispersed liquid crystal), further enhances the market's potential by offering more color options and increased energy efficiency.

Smart windows and glass hold the largest application segment, representing 28.3% share. The increasing demand for energy-efficient buildings and vehicles has driven this trend, as these windows are capable of automatically regulating light and heat passage. This results in reduced reliance on artificial lighting and air conditioning. The integration of electrochromic or liquid crystal devices in smart windows helps meet global sustainability goals while also improving comfort and privacy in high-end residential and commercial real estate.

United States Electrochromic and Liquid Crystal Polymer Market generated USD 482.8 million in 2024. Government incentives like tax credits for installing smart glass have played a key role in promoting the adoption of electrochromic windows in commercial and residential buildings. These windows can reduce energy consumption by approximately 20%, contributing to reducing carbon emissions and supporting the transition toward sustainable energy solutions.

Companies in this industry, such as Toray Industries, Sumitomo Chemical Company, Solvay, Saint-Gobain, and AGC, focus on expanding their market share by investing in research and development. They are working on enhancing the performance and affordability of electrochromic products to meet the growing demand across various industries. Companies are also forging strategic partnerships with building contractors and vehicle manufacturers to ensure widespread adoption of these advanced materials in new constructions and vehicle models.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Report scope and objectives

- 1.2 Research design and approach

- 1.3 Data collection methods

- 1.3.1 Primary research

- 1.3.2 Secondary research

- 1.4 Market estimation and forecasting methodology

- 1.5 Assumptions and limitations

- 1.6 Data validation and triangulation techniques

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Market Introduction

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Trade statistics (HS Code)

- 3.3.1 Major exporting countries, 2021-2024 (USD Mn)

- 3.3.2 Major importing countries, 2021-2024 (USD Mn)

- 3.4 Industry value chain analysis

- 3.5 Technology overview

- 3.5.1 Electrochromic materials

- 3.5.2 Liquid crystal polymers

- 3.5.3 Polymer dispersed liquid crystals (PDLC)

- 3.5.4 Comparative analysis of technologies

- 3.6 Market dynamics

- 3.6.1 Market drivers

- 3.6.2 Market restraints

- 3.6.3 Market opportunities

- 3.6.4 Market challenges

- 3.7 Industry impact forces

- 3.7.1 Growth potential analysis

- 3.7.2 Industry pitfalls & challenges

- 3.8 Regulatory framework & standards

- 3.8.1 ASTM standards for electrochromic devices

- 3.8.2 Energy efficiency regulations

- 3.8.3 Building codes & certifications

- 3.8.4 Automotive industry standards

- 3.9 Manufacturing process analysis

- 3.9.1 Electrochromic materials production

- 3.9.2 Liquid crystal polymer synthesis

- 3.9.3 Device fabrication techniques

- 3.10 Raw material analysis & procurement strategies

- 3.11 Pricing analysis

- 3.12 Sustainability & environmental impact assessment

- 3.13 Pestle analysis

- 3.14 Porter's five forces analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Market share analysis

- 4.2 Strategic framework

- 4.2.1 Mergers & acquisitions

- 4.2.2 Joint ventures & collaborations

- 4.2.3 New product developments

- 4.2.4 Expansion strategies

- 4.3 Competitive benchmarking

- 4.4 Vendor landscape

- 4.5 Competitive positioning matrix

- 4.6 Strategic dashboard

- 4.7 Technology adoption & innovation assessment

- 4.8 Market entry strategies for new players

Chapter 5 Market Size and Forecast, By Technology, 2021-2034 (USD Million) (Tons)

- 5.1 Key trends

- 5.2 Electrochromic materials

- 5.2.1 Inorganic electrochromic materials

- 5.2.2 Organic electrochromic materials

- 5.2.3 Hybrid electrochromic materials

- 5.3 Liquid crystal polymers (LCP)

- 5.3.1 Thermotropic LCPS

- 5.3.2 Lyotropic LCPS

- 5.4 Polymer dispersed liquid crystals (PDLC)

- 5.4.1 Normal mode PDLC

- 5.4.2 Reverse mode PDLC

- 5.5 Suspended particle devices (SPD)

- 5.6 Other

Chapter 6 Market Size and Forecast, By Application, 2021-2034 (USD Million) (Tons)

- 6.1 Key trends

- 6.2 Smart windows & glass

- 6.2.1 Architectural windows

- 6.2.2 Automotive windows & sunroofs

- 6.2.3 Aircraft windows

- 6.2.4 Marine windows

- 6.3 Electronic components

- 6.3.1 Connectors

- 6.3.2 Circuit boards

- 6.3.3 Antennas

- 6.3.4 Microelectronic packaging

- 6.4 Displays & visual devices

- 6.4.1 Smart displays

- 6.4.2 Wearable displays

- 6.4.3 Signage & information displays

- 6.5 Automotive components

- 6.5.1 Mirrors

- 6.5.2 Lighting systems

- 6.5.3 Sensors & controls

- 6.5.4 Structural components

- 6.6 Medical devices & equipment

- 6.7 Aerospace & defense applications

- 6.8 Other

Chapter 7 Market Size and Forecast, By End Use Industry, 2021-2034 (USD Million) (Tons)

- 7.1 Key trends

- 7.2 Construction & architecture

- 7.2.1 Residential buildings

- 7.2.2 Commercial buildings

- 7.2.3 Institutional buildings

- 7.2.4 Industrial facilities

- 7.3 Automotive & transportation

- 7.3.1 Passenger vehicles

- 7.3.2 Commercial vehicles

- 7.3.3 Electric vehicles

- 7.3.4 Railways & mass transit

- 7.4 Electronics & telecommunications

- 7.4.1 Consumer electronics

- 7.4.2 Telecommunications equipment

- 7.4.3 Computing & IT hardware

- 7.4.4 5g infrastructure

- 7.5 Aerospace & defense

- 7.6 Healthcare & medical

- 7.7 Energy & power generation

- 7.8 Others

Chapter 8 Market Size and Forecast, By Region, 2021-2034 (USD Million) (Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

- 8.6.4 Rest of Middle East & Africa

Chapter 9 Company Profiles

- 9.1 Saint-Gobain

- 9.2 AGC

- 9.3 Gentex Corporation

- 9.4 Gauzy

- 9.5 Halio

- 9.6 ChromoGenics

- 9.7 Polytronix

- 9.8 Research Frontiers

- 9.9 Celanese Corporation

- 9.10 Solvay

- 9.11 Toray Industries

- 9.12 Sumitomo Chemical Company

- 9.13 Kuraray

- 9.14 Murata Manufacturing

- 9.15 Chiyoda Integre

- 9.16 RTP Company

- 9.17 SABIC

- 9.18 Ynvisible Interactive

- 9.19 Crown Electrokinetics

- 9.20 Smart Glass Group

- 9.21 Smart Films International

- 9.22 Corning Incorporated

- 9.23 Continental

- 9.24 Panasonic Holdings Corporation