PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750291

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750291

Hot-Rolled or Cold-Finished Alloy Steel Bars Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

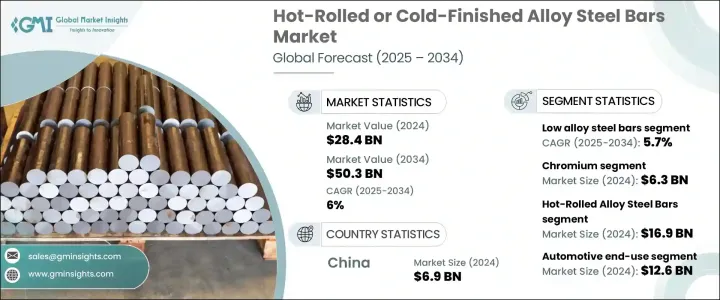

The Global Hot-Rolled or Cold-Finished Alloy Steel Bars Market was valued at USD 28.4 billion in 2024 and is estimated to grow at a CAGR of 6% to reach USD 50.3 billion by 2034, driven by the increasing industrialization and expansion of manufacturing sectors. As industries grow, the demand for durable, high-performance materials like alloy steel bars has consistently risen.

These bars play a pivotal role across various industries, offering exceptional strength, durability, and ease of machinability. In the automotive sector, they are used to produce essential vehicle components, such as suspension parts, engine blocks, and structural elements, where their ability to withstand stress and provide longevity is critical. Similarly, in the construction and infrastructure sectors, these bars are fundamental in reinforcing concrete structures and creating durable frameworks for buildings, bridges, and roads. Their versatility also extends to heavy machinery production utilized in manufacturing components that require high tensile strength and resistance to wear and tear. The demand for these bars continues to grow as industries increasingly seek materials that offer superior performance and cost efficiency, making them an essential component in various manufacturing processes.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $28.4 Billion |

| Forecast Value | $50.3 Billion |

| CAGR | 6% |

The low-alloy steel bars segment, valued at USD 10.6 billion in 2024, is expected to expand at a CAGR of 5.7% between 2025 and 2034. Low and medium-alloy steel bars are widely used in industries such as automotive, construction, and heavy machinery, due to their affordability and durability. These alloys are highly valued for their strength, versatility, and cost-effectiveness, making them an attractive option for manufacturers seeking materials that balance performance and price.

The automotive sector accounted for USD 12.6 billion, with a share of 24% in 2024 and is anticipated to grow at a CAGR of 6.1% through 2034. Alloy steel bars are integral to producing vehicle components, particularly in suspension units and fuel systems, where strength and durability are critical. With the global automotive production on the rise, the demand for high-quality steel bars is set to increase. The need for these materials will also continue to grow as the automotive industry moves towards more advanced fuel systems and better-performing suspension units.

China Hot-Rolled or Cold-Finished Alloy Steel Bars Market was valued at USD 6.9 billion in 2024 and is projected to grow at a 5.9% CAGR from 2025 to 2034. As one of the largest producers and exporters of steel, China plays a crucial role in the global steel market. The country's ability to produce and export massive quantities of steel is reshaping global supply chains, although the overproduction of steel has led to challenges in domestic markets, particularly real estate, while shifting focus toward international markets.

The leading players in the Global Hot-Rolled or Cold-Finished Alloy Steel Bars Industry include Tata Steel, ArcelorMittal, United States Steel Corporation (U.S. Steel), JFE Steel Corporation, and Nippon Steel Corp. These companies are focusing on innovations to enhance steel production processes, improve product quality, and meet the evolving demands of industries such as automotive, construction, and heavy machinery. To strengthen their market positions, companies like Tata Steel and ArcelorMittal are focusing on expanding their production capabilities and diversifying their product offerings. By investing in advanced manufacturing technologies, they aim to increase production efficiency and meet the rising demand for alloy steel bars.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Trade statistics (hs code)

- 3.3.1 Major exporting countries

- 3.3.2 Major importing countries

- 3.4 Profit margin analysis

- 3.5 Key news & initiatives

- 3.6 Regulatory landscape

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Surge in automotive lightweighting boosting demand for high-performance alloy steel bars.

- 3.7.1.2 Infrastructure expansion projects globally increasing usage of hot-rolled steel bars.

- 3.7.1.3 Aerospace industry's growth fueling need for precision-grade cold-finished alloy bars.

- 3.7.1.4 Rising investments in renewable energy projects supporting steel bar consumption.

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 Volatile raw material prices impacting production stability and profit margins.

- 3.7.2.2 Growing substitution by composite and alternative lightweight materials in key industries.

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Composition, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Low alloy steel bars

- 5.3 Medium alloy steel bars

- 5.4 High alloy steel bars

- 5.5 Stainless steel bars

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Alloying Elements, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Nickel

- 6.3 Chromium

- 6.4 Molybdenum

- 6.5 Vanadium

- 6.6 Manganese

- 6.7 Silicon

- 6.8 Multi-element alloys

- 6.9 Others

Chapter 7 Market Estimates & Forecast, By Processing Method, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Hot-rolled alloy steel bars

- 7.2.1 Round bars

- 7.2.2 Square bars

- 7.2.3 Hexagonal bars

- 7.2.4 Flat bars

- 7.2.5 Other shapes

- 7.3 Cold-finished alloy steel bars

- 7.3.1 Cold-drawn bars

- 7.3.2 Cold-rolled bars

- 7.3.3 Turned and polished bars

- 7.3.4 Ground and polished bars

Chapter 8 Market Estimates & Forecast, By End Use, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Automotive industry

- 8.2.1 Powertrain components

- 8.2.2 Chassis components

- 8.2.3 Suspension systems

- 8.2.4 Steering components

- 8.2.5 Transmission components

- 8.3 Aerospace and defense

- 8.3.1 Aircraft structural components

- 8.3.2 Landing gear components

- 8.3.3 Engine components

- 8.3.4 Defense equipment

- 8.4 Construction and infrastructure

- 8.4.1 Structural components

- 8.4.2 Reinforcement applications

- 8.4.3 Bridge construction

- 8.5 Machinery and equipment

- 8.5.1 Industrial machinery

- 8.5.2 Agricultural equipment

- 8.5.3 Mining equipment

- 8.5.4 Material handling equipment

- 8.6 Oil and gas industry

- 8.6.1 Drilling equipment

- 8.6.2 Exploration components

- 8.6.3 Refining equipment

- 8.7 Power generation

- 8.7.1 Conventional power plants

- 8.7.2 Nuclear power plants

- 8.7.3 Renewable energy equipment

- 8.8 Railway and transportation

- 8.8.1 Rail components

- 8.8.2 Rolling stock

- 8.9 Heavy engineering

- 8.9.1 Shipbuilding

- 8.9.2 Heavy equipment manufacturing

- 8.10 Tool and die manufacturing

- 8.10.1 Cutting tools

- 8.10.2 Dies and molds

- 8.11 Other applications

- 8.11.1 Medical equipment

- 8.11.2 Consumer goods

- 8.11.3 Sports equipment

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 ArcelorMittal

- 10.2 Tata Steel

- 10.3 Nippon Steel

- 10.4 JFE Steel

- 10.5 U.S. Steel

- 10.6 POSCO

- 10.7 Steel Dynamics

- 10.8 Hyundai Steel

- 10.9 Baosteel

- 10.10 Thyssenkrupp

- 10.11 Nucor Corporation

- 10.12 Sumitomo Metal Industries

- 10.13 Voestalpine

- 10.14 China Steel Corporation

- 10.15 Schmolz + Bickenbach

- 10.16 KOBE Steel

- 10.17 AK Steel

- 10.18 Outokumpu

- 10.19 Severstal