PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750295

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750295

North America Fuel Cell Electric Vehicle (FCEV) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

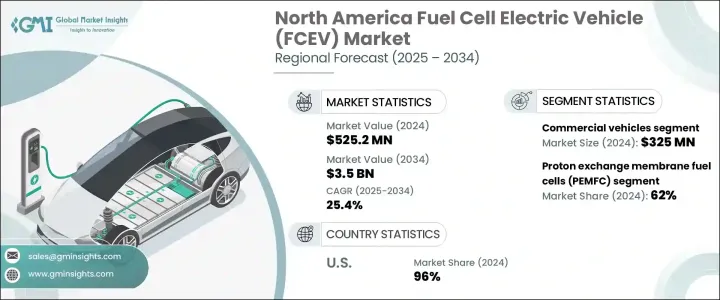

North America Fuel Cell Electric Vehicle Market was valued at USD 525.2 million in 2024 and is estimated to grow at a CAGR of 25.4% to reach USD 3.5 billion by 2034. This significant growth is propelled by increasing investments in hydrogen infrastructure, strong government backing, and a growing demand for zero-emission mobility, especially in the commercial and heavy-duty vehicle sectors. Federal and state-level incentives across the region are accelerating the shift toward clean transportation, with policies designed to cut greenhouse gas emissions, promote green technology, and create economic opportunities around sustainable mobility. As climate concerns rise and environmental regulations become more stringent, FCEVs are emerging as a promising solution for reducing carbon footprints in high-emission sectors.

Technological advancements in hydrogen fuel cell systems are also driving adoption across North America. Ongoing research in electrochemical cell performance, hydrogen storage, and catalyst efficiency is contributing to vehicles that can travel farther, refuel quicker, and operate more reliably. Additionally, improvements in lightweight materials and fuel cell stack designs are enhancing energy efficiency and reducing overall production costs. These innovations are enabling fuel cell vehicles to compete more effectively with both traditional combustion engines and battery electric alternatives, especially in areas requiring extended operational capacity and quicker turnaround times. As infrastructure continues to expand and costs gradually decline, the market is seeing increased momentum across a variety of applications.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $525.2 Million |

| Forecast Value | $3.5 Billion |

| CAGR | 25.4% |

In 2024, commercial vehicles accounted for the largest share of the North American FCEV market, generating USD 325 million in revenue. These vehicles are well-suited for fuel cell technology due to their need for long operational ranges, quick refueling times, and high payload capacity. The performance characteristics of fuel cell systems make them a practical choice for sectors that rely on logistics, transport, and continuous operations. This growing preference for FCEVs in the commercial segment is contributing to the market's overall expansion, supported by ongoing investments in hydrogen fueling infrastructure and industry collaboration to address range and reliability concerns.

When segmented by fuel cell type, proton exchange membrane fuel cells (PEMFCs) led the market with a dominant 62% share in 2024. These fuel cells are favored for their high power density, fast startup capabilities, and compact form factors, making them highly compatible with automotive applications. Their ability to efficiently convert hydrogen into electricity with minimal emissions positions PEMFCs as the technology of choice for automakers developing next-generation fuel cell vehicles. Strong policy support, combined with the growing availability of renewable hydrogen sources, is expected to further reinforce the leadership of this segment over the forecast period.

In terms of vehicle range, the medium-range segment-covering 250 to 500 miles-held the highest market share in 2024. Consumers are increasingly seeking vehicles that offer a practical driving range without compromising on performance or affordability. Vehicles in this category strike a balance between operational capability and refueling convenience, contributing to their widespread adoption. Fuel efficiency, cost-effectiveness, and improved hydrogen refueling infrastructure are critical factors supporting the growth of this segment.

Geographically, the United States dominated the North America FCEV market with an overwhelming 96% share in 2024. This leadership position is largely attributed to extensive government initiatives aimed at building a national hydrogen infrastructure, coupled with strong public and private sector collaboration. The U.S. has made substantial progress in constructing hydrogen refueling stations and supporting pilot programs to integrate FCEVs into municipal and commercial fleets. Canada is also contributing to the market through research and development in fuel cell technologies and participation in cross-border clean energy initiatives. These joint efforts are fostering an environment conducive to innovation and the adoption of hydrogen-powered vehicles.

The growing interest in clean mobility is pushing automotive manufacturers, energy companies, and policymakers to work together on developing high-capacity, fast-refueling hydrogen stations. These collaborations are vital to creating a reliable fuel supply chain, especially in regions with rising demand for low-emission transport alternatives. Strategic investments in this space are not only enhancing fuel accessibility but are also enabling large-scale deployment of FCEVs in urban and intercity transit networks. With increased focus on sustainability, energy efficiency, and emissions reduction, North America's FCEV market is rapidly evolving, paving the way for a cleaner and more resilient transportation future.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 Raw fuel cell suppliers

- 3.1.1.2 Component suppliers

- 3.1.1.3 Manufacturers

- 3.1.1.4 Technology providers

- 3.1.1.5 End use

- 3.1.1 Supplier landscape

- 3.2 Impact of trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on industry

- 3.2.2.1 Supply-side impact (raw Fuel Cells)

- 3.2.2.1.1 Price volatility in key Fuel Cells

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw Fuel Cells)

- 3.2.3 Strategic industry responses

- 3.2.3.1 Supply chain reconfiguration

- 3.2.3.2 Pricing and product strategies

- 3.2.1 Impact on trade

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Key news & initiatives

- 3.7 Regulatory landscape

- 3.8 Cost breakdown analysis

- 3.9 Price trend

- 3.9.1 Region

- 3.9.2 Mode of range

- 3.10 Sustainability & environmental impact

- 3.10.1 Eco-friendly Fuel Cells

- 3.10.2 Carbon footprint of valve seat inserts manufacturing

- 3.10.3 Recycling practices

- 3.10.4 ESG compliance

- 3.11 Impact forces

- 3.11.1 Growth drivers

- 3.11.1.1 Advancements in fuel cell technology

- 3.11.1.2 Government support & zero-emission mandates

- 3.11.1.3 Expansion of hydrogen refueling infrastructure

- 3.11.1.4 Rising demand for clean transportation

- 3.11.1.5 Increasing investment in green hydrogen

- 3.11.2 Industry pitfalls & challenges

- 3.11.2.1 Underdeveloped hydrogen refueling infrastructure

- 3.11.2.2 High vehicle and infrastructure costs

- 3.11.1 Growth drivers

- 3.12 Growth potential analysis

- 3.13 Porter's analysis

- 3.14 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Passenger Vehicles

- 5.2.1 Hatchback

- 5.2.1 Sedan

- 5.2.1 SUV

- 5.3 Commercial Vehicles

- 5.3.1 Light commercial vehicles (LCVs)

- 5.3.2 Medium commercial vehicles (MCVs)

- 5.3.3 Heavy commercial vehicles (HCVs)

Chapter 6 Market Estimates & Forecast, By Fuel Cell, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Proton exchange membrane fuel cells (PEMFC)

- 6.3 Phosphoric acid fuel cells (PAFC)

- 6.4 Solid oxide fuel cells (SOFC)

Chapter 7 Market Estimates & Forecast, By Range, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Short range (Below 250 Miles)

- 7.3 Medium range (250 - 500 Miles)

- 7.4 Long range (Above 500 Miles)

Chapter 8 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 U.S.

- 8.2.1 California

- 8.2.2 Colorado

- 8.2.3 Massachusetts

- 8.2.4 Michigan

- 8.2.5 Illinois

- 8.2.6 New Jersey

- 8.2.7 New York

- 8.2.8 Ohio

- 8.2.9 Oregon

- 8.2.10 Texas

- 8.2.11 Washington

- 8.2.12 Rest of states

- 8.3 Canada

- 8.3.1 British Colombia

- 8.3.2 Quebec

- 8.3.3 Alberta

- 8.3.4 Rest of Canada

Chapter 9 Company Profiles

- 9.1 Daimler Truck

- 9.2 Hino Motors

- 9.3 Hyperion

- 9.4 Hyundai Motor

- 9.5 Hyzon Motors

- 9.6 New Flyer

- 9.7 Nikola

- 9.8 PACCAR

- 9.9 REV

- 9.10 Toyota Motor