PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750310

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750310

Helideck Monitoring System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

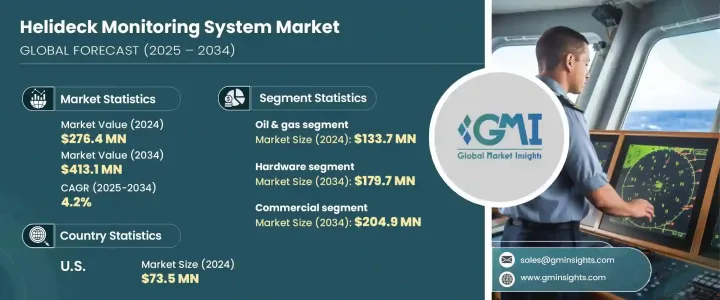

The Global Helideck Monitoring System Market was valued at USD 276.4 million in 2024 and is estimated to grow at a CAGR of 4.2% to reach USD 413.1 million by 2034. This growth trajectory is primarily fueled by the mounting global demand for energy, which continues to drive expansion in offshore exploration and production activities. As energy companies increasingly look toward offshore locations for resource extraction, the need for secure and efficient transportation of personnel and equipment by helicopter has grown substantially. In such environments, accurate monitoring of meteorological and oceanographic conditions becomes critical. HMS platforms deliver real-time environmental data to ensure operational safety and help pilots make informed decisions under dynamic and potentially hazardous conditions. These systems play a crucial role in safeguarding helicopter operations by tracking vital parameters like wind speed, wave height, deck movement, and visibility.

Operating offshore often means contending with volatile weather and harsh marine environments. The ability of helideck monitoring systems to provide reliable and continuous data allows operators to comply with aviation safety standards and mitigate operational risks. HMS adoption is rising as offshore industries increasingly prioritize safety, regulatory compliance, and the efficiency of transport logistics. While traditionally used in oil and gas operations, HMS solutions are also gaining relevance in other offshore sectors, such as renewable energy. As offshore facilities become more technologically advanced, stakeholders are investing in integrated monitoring systems that support decision-making and ensure seamless air transport to and from remote locations. The expanding scope of offshore operations, coupled with heightened safety requirements, is prompting offshore operators to adopt advanced HMS solutions tailored for real-time monitoring and predictive analysis.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $276.4 Million |

| Forecast Value | $413.1 Million |

| CAGR | 4.2% |

The helideck monitoring system market is segmented by vertical into oil & gas, marine, and onshore. The oil & gas sector accounted for USD 133.7 million in 2024, making it the largest segment. Increasing offshore platform installations are amplifying the need for dependable helicopter operation systems that ensure the safe and timely movement of crew and materials. In addition to oil and gas, offshore wind projects are contributing to this growing demand, as these remote installations require robust environmental monitoring for helicopter access and safe personnel transfers.

Based on the system type, the market is categorized into hardware and software. The hardware segment is projected to reach USD 179.7 million by 2034, reflecting consistent demand for high-performance components in offshore settings. Key hardware elements such as wind sensors, motion detectors, visibility meters, and surveillance equipment are critical for capturing accurate and real-time environmental data. These systems are specifically engineered to endure harsh offshore conditions, including strong winds, heavy rainfall, and corrosive marine environments. Their ability to perform reliably under such extreme conditions ensures uninterrupted helicopter operations and reduces downtime due to weather-related delays. The increasing complexity of offshore installations continues to elevate the need for advanced and rugged hardware solutions.

In terms of application, the helideck monitoring system market is bifurcated into commercial and defense segments. The commercial segment is anticipated to reach USD 204.9 million by 2034. In commercial operations, HMS is integral to ensuring safe transport logistics for personnel and equipment via helicopter to offshore platforms and vessels. Sectors such as cargo shipping and offshore passenger transport increasingly rely on these systems for enhanced situational awareness, safety, and regulatory compliance. As offshore logistics become more challenging, the commercial sector is adopting HMS to ensure reliability in mission-critical operations under unpredictable environmental conditions.

Regionally, the United States held a significant share of the global helideck monitoring system market, with a valuation of USD 73.5 million in 2024. The country's substantial offshore infrastructure and increasing investments in alternative energy projects, particularly those located offshore, continue to fuel demand for helideck monitoring systems. Regulatory bodies have also set stringent safety requirements for offshore helicopter operations, which is further accelerating the adoption of HMS solutions. Additionally, the presence of naval operations relying on helicopters for strategic and logistical purposes contributes to the growing demand for helideck monitoring technologies in the region.

The HMS market is characterized by a fragmented competitive landscape, with numerous regional and international players participating in the ecosystem. Collaboration between offshore facility operators, marine safety organizations, and technology developers is driving innovation and facilitating the deployment of advanced HMS solutions. These companies leverage specialized expertise in environmental monitoring, communication systems, and integrated technologies to offer comprehensive HMS solutions. Competition in this space is largely driven by a company's ability to offer reliable, regulation-compliant systems enhanced with proprietary technology and strong after-sales service. Market leaders are focused on forming strategic partnerships, tailoring products to specific customer needs, and investing in research and development to deliver next-generation systems that address emerging offshore safety challenges.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising offshore oil & gas exploration activities

- 3.2.1.2 Stringent safety regulations for offshore helidecks

- 3.2.1.3 Growth in offshore wind energy installations

- 3.2.1.4 Increased deployment of real-time weather monitoring

- 3.2.1.5 Technological advancements in sensor integration and analytics

- 3.2.2 pitfalls and challenges

- 3.2.2.1 High installation and maintenance costs

- 3.2.2.2 Limited adoption in developing offshore markets due to budget constraints

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Vertical, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Oil & gas

- 5.2.1 Fixed offshore rigs

- 5.2.2 Mobile offshore rigs

- 5.3 Marine

- 5.3.1 On-board

- 5.3.2 Naval ship

- 5.3.3 Commercial ship

- 5.4 On-shore

- 5.4.1 port

- 5.4.2 Naval base

Chapter 6 Market Estimates and Forecast, By System, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Hardware

- 6.2.1 Motion sensor

- 6.2.2 Wind sensor

- 6.2.3 Meteorology sensor

- 6.2.4 GPS

- 6.2.5 Gyro

- 6.3 Software

Chapter 7 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Commercial

- 7.3 Defense

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Kongsberg Gruppen ASA

- 9.2 Fugro N.V.

- 9.3 Vaisala Oyj

- 9.4 ABB Ltd.

- 9.5 AWA Marine Ltd.

- 9.6 ASB Systems Private Ltd.

- 9.7 Monitor Systems Scotland Ltd.

- 9.8 Dynamax Inc.

- 9.9 Miros Group AS

- 9.10 Observator Group B.V.

- 9.11 RH Marine B.V.

- 9.12 RIGSTAT LLC

- 9.13 ShoreConnection International AS