PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750314

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750314

Silicon EPI Wafer Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

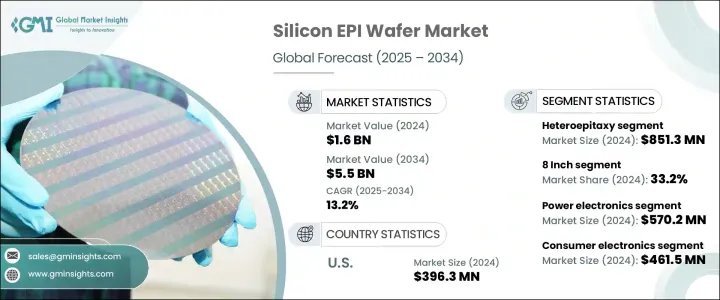

The Global Silicon EPI Wafer Market was valued at USD 1.6 billion in 2024 and is estimated to grow at a CAGR of 13.2% to reach USD 5.5 billion by 2034, driven by rising demand for automotive electronics, the continued rollout of IoT and edge computing devices, and massive investments in global semiconductor manufacturing. As chip demand surges across sectors like consumer electronics, electric vehicles, and telecommunications, epitaxial wafers help improve device efficiency and miniaturization. Advanced logic ICs, 5G networks, and AI-based technologies are accelerating adoption, while national policy support and industrial re-shoring efforts also play a crucial role in shaping future growth.

In the United States, the imposition of tariffs on semiconductor imports from key regions has disrupted domestic pricing dynamics and affected global competitiveness. These trade actions have increased costs for critical inputs like plastic resins and specialty metals, forcing companies to reassess global supply chains. Many firms are relocating or considering localizing production despite the heavy capital outlay required. Government intervention through semiconductor-specific legislation is helping mitigate challenges by boosting domestic wafer manufacturing capabilities and offering financial incentives for new plants.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.6 Billion |

| Forecast Value | $5.5 Billion |

| CAGR | 13.2% |

The heteroepitaxy segment generated USD 851.3 million in 2024, driven by the increasing need for high-performance semiconductor devices in optoelectronics, RF components, and advanced CMOS technology. The ability of heteroepitaxy to layer materials with differing lattice structures, such as silicon-germanium on silicon, offers greater design flexibility in power, speed, and size-sensitive applications. As 3D integration and system-on-chip architectures grow more prevalent, the role of heteroepitaxial processes will become even more essential to meet energy efficiency and miniaturization goals.

The 8-inch wafer category held a 33.2% market share in 2024. Its widespread use in the production of consumer electronics and automotive semiconductors has made this wafer size a mainstay. These wafers support cost-effective mass manufacturing of power devices and sensors, particularly those deployed in smart devices and electric vehicles. As industries shift toward digitalization and smarter systems, the demand for 8-inch wafer-based devices continues to rise.

U.S. Silicon EPI Wafer Market generated USD 396.3 million in 2024, bolstered by strong federal investment in domestic chip fabrication, rising EV production, and the growing integration of AI and HPC technologies. Advanced applications in 5G, IC manufacturing, and automotive electronics boost local demand, especially as companies seek to reduce reliance on overseas suppliers and build resilient regional ecosystems.

Key players in the Global Silicon EPI Wafer Market include Shin-Etsu Handotai (SEH), Siltronic AG, SUMCO Corporation, SK Siltron Co., Ltd., and GlobalWafers Co., Ltd. Strengthening their market presence, leading companies are adopting strategies that focus on capacity expansion, technological innovation, and vertical integration. Firms are heavily investing in upgrading manufacturing capabilities and exploring new wafer technologies that meet the evolving performance standards required for next-generation devices. Strategic collaborations with semiconductor manufacturers ensure steady supply agreements, while geographic diversification reduces risks related to political or trade disruptions.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.1.3 Impact on the industry

- 3.2.1.3.1 Supply-side impact (raw materials)

- 3.2.1.3.1.1 Price volatility in key materials

- 3.2.1.3.1.2 Supply chain restructuring

- 3.2.1.3.1.3 Production cost implications

- 3.2.1.3.2 Demand-side impact (selling price)

- 3.2.1.3.2.1 Price transmission to end markets

- 3.2.1.3.2.2 Market share dynamics

- 3.2.1.3.2.3 Consumer response patterns

- 3.2.1.3.1 Supply-side impact (raw materials)

- 3.2.1.4 Key companies impacted

- 3.2.1.5 Strategic industry responses

- 3.2.1.5.1 Supply chain reconfiguration

- 3.2.1.5.2 Pricing and product strategies

- 3.2.1.5.3 Policy engagement

- 3.2.1.6 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Supplier landscape

- 3.4 Profit margin analysis

- 3.5 Key news & initiatives

- 3.6 Regulatory landscape

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Surge in demand for advanced semiconductor devices

- 3.7.1.2 Expansion of automotive electronics

- 3.7.1.3 Increasing adoption of IoT and edge devices

- 3.7.1.4 Growing investments in semiconductor manufacturing

- 3.7.1.5 Rising growth in power electronics applications

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 High capital and operational costs of epitaxial growth

- 3.7.2.2 Stringent quality and defect control requirements

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Epitaxy Type, 2021-2034 (USD Million & Units)

- 5.1 Key trends

- 5.2 Heteroepitaxy

- 5.3 Homoepitaxy

Chapter 6 Market Estimates & Forecast, By Wafer Size, 2021-2034 (USD Million & Units)

- 6.1 Key trends

- 6.2 6 inch

- 6.3 8 inch

- 6.4 12 inch

- 6.5 Others

Chapter 7 Market Estimates & Forecast, By Application, 2021-2034 (USD Million & Units)

- 7.1 Key trends

- 7.2 Power electronics

- 7.3 MEMS

- 7.4 RF electronics

- 7.5 Photonics

- 7.6 Others

Chapter 8 Market Estimates & Forecast, By End Use, 2021-2034 (USD Million & Units)

- 8.1 Key trends

- 8.2 Consumer electronics

- 8.3 Automotive

- 8.4 Healthcare

- 8.5 Aerospace and defense

- 8.6 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Million & Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Beijing Eswell Technology Group Co., Ltd.

- 10.2 Coherent, Inc.

- 10.3 Episil-Precision Inc.

- 10.4 GlobalWafers Co., Ltd.

- 10.5 IQE PLC

- 10.6 Jenoptik AG

- 10.7 MOSPEC Semiconductor Corporation

- 10.8 NTT Advanced Technology Corporation

- 10.9 Okmetic Oy

- 10.10 Shanghai Simgui Technology Co., Ltd.

- 10.11 Shin-Etsu Handotai

- 10.12 Siltronic AG

- 10.13 SK Siltron Co., Ltd.

- 10.14 SOITEC SA

- 10.15 SRI International

- 10.16 SUMCO Corporation

- 10.17 SweGaN AB

- 10.18 Wafer Works Corporation

- 10.19 Xiamen Powerway Advanced Material Co., Ltd