PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750317

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750317

Surgical Scissors Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

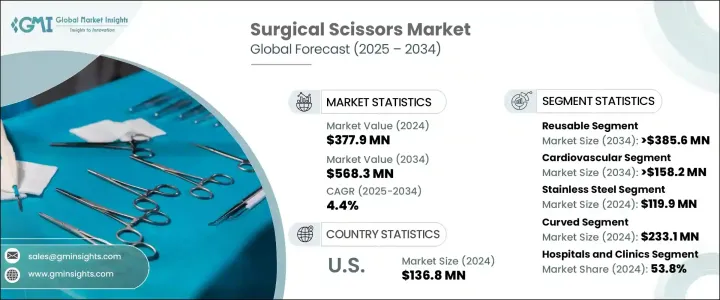

The Global Surgical Scissors Market was valued at USD 377.9 million in 2024 and is estimated to grow at a CAGR of 4.4% to reach USD 568.3 million by 2034, fueled by the growing number of surgeries driven by an aging global population and an uptick in chronic disease cases. As healthcare systems respond to rising demand, hospitals and surgical centers invest in advanced, high-precision surgical instruments. Innovations in minimally invasive procedures further push the need for surgical tools that are both durable and designed to support better patient outcomes. As precision and safety become top priorities, high-quality scissors have become essential in supporting efficient surgical performance.

With the rise in chronic diseases such as cardiovascular disorders, cancer, and diabetes, the number of surgical interventions continues to grow. This trend, especially among elderly populations, fuels demand for highly reliable and efficient surgical scissors. Many healthcare facilities invest in technologically enhanced power tools to improve procedural accuracy and reduce operation time. Emerging markets are seeing a similar rise in demand due to developing surgical infrastructure, which is pushing procurement of sophisticated tools. Among various types, reusable scissors are gaining strong traction because they reduce long-term operational costs and align with healthcare sustainability goals. These scissors are crafted from materials like tungsten carbide or premium stainless steel and offer enhanced longevity, sharper cuts, and higher performance.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $ 377.9 Million |

| Forecast Value | $568.3 Million |

| CAGR | 4.4% |

The market for surgical scissors is divided into two main types: reusable and disposable. The reusable scissors segment is expected to grow with a projected CAGR of 4.7%, reaching USD 385.6 million by 2034. As healthcare facilities focus on reducing long-term costs, they are shifting toward reusable instruments. Surgical centers and hospitals are increasingly adopting scissors that can be sterilized and reused multiple times, thus minimizing waste from disposable alternatives. Additionally, reusable scissors are made from high-quality materials like stainless steel or tungsten carbide, which enhances their precision and durability. These materials improve the reliability of sutures during surgeries.

The cardiovascular procedures segment of the surgical scissors market is projected to grow at a CAGR of 4.8% and reach USD 158.2 million by 2034, driven by the precise demands of heart surgeries, where small, accurate incisions are critical for patient survival. Cardiovascular surgical scissors are specially designed with exceptionally sharp blades to minimize damage to delicate heart tissues, ensuring better surgical outcomes. The advanced engineering of these scissors allows for a high level of precision, essential for such complex and high-stakes procedures.

U.S. Surgical Scissors Market generated USD 136.8 million in 2024, benefiting from a strong healthcare system, a high volume of surgeries, and continuous innovations in surgical tool technology. The U.S. remains a leader in the market, with frequent new product introductions and advancements that improve the availability and specialization of surgical instruments across various fields. As a result, the U.S. market continues to attract significant investment, driving the development of more sophisticated and specialized tools for precise and efficient surgeries.

To secure a competitive edge, companies like Elixir Surgical, Surgicalholdings, INTEGRA, Storz, WPI, Teleflex, Aspen, HuFriedy, Stryker, KLS Martin, Medline, B. Braun, Millennium Surgical, BD, and Scanlan are heavily investing in R&D and precision manufacturing. These firms focus on designing ergonomic, specialty scissors, expanding their product portfolios, and strengthening global distribution partnerships to meet increasing surgical demands worldwide.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates & calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Advancements in surgical scissors technology

- 3.2.1.2 Rising prevalence of chronic diseases

- 3.2.1.3 Demand for minimally invasive procedures

- 3.2.1.4 Surge in outpatient surgeries

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Short product lifecycle

- 3.2.2.2 Concerns over infection risks with reusable instruments

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Trump administration tariffs

- 3.5.1 Impact on trade

- 3.5.1.1 Trade volume disruptions

- 3.5.1.2 Country-wise response

- 3.5.2 Impact on the industry

- 3.5.2.1 Supply-side impact (Cost of manufacturing)

- 3.5.2.1.1 Price volatility in key materials

- 3.5.2.1.2 Supply chain restructuring

- 3.5.2.1.3 Production cost implications

- 3.5.2.2 Demand-side impact (Cost to consumers)

- 3.5.2.2.1 Price transmission to end markets

- 3.5.2.2.2 Market share dynamics

- 3.5.2.2.3 Consumer response patterns

- 3.5.2.1 Supply-side impact (Cost of manufacturing)

- 3.5.3 Key companies impacted

- 3.5.4 Strategic industry responses

- 3.5.4.1 Supply chain reconfiguration

- 3.5.4.2 Pricing and product strategies

- 3.5.4.3 Policy engagement

- 3.5.5 Outlook and future considerations

- 3.5.1 Impact on trade

- 3.6 Pricing analysis

- 3.7 Technology landscape

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

- 3.11 Future market trends

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Scissors Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Reusable

- 5.3 Disposable

Chapter 6 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Cardiovascular

- 6.3 Orthopedic surgery

- 6.4 Gastroenterology

- 6.5 Neurology

- 6.6 Other applications

Chapter 7 Market Estimates and Forecast, By Materials, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Stainless steel

- 7.3 Titanium

- 7.4 Tungsten

- 7.5 Ceramic

- 7.6 Other materials

Chapter 8 Market Estimates and Forecast, By Tip Shapes, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Curved

- 8.3 Straight

- 8.4 Other tip shapes

Chapter 9 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Hospitals & clinics

- 9.3 Ambulatory surgery centers

- 9.4 Other end users

Chapter 10 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Aspen

- 11.2 B. Braun

- 11.3 Becton, Dickinson and Company

- 11.4 ELIXIR SURGICAL

- 11.5 HuFriedy

- 11.6 INTEGRA

- 11.7 STORZ

- 11.8 KLS Martin

- 11.9 MEDLINE

- 11.10 MILLENNIUM SURGICAL

- 11.11 SCANLAN

- 11.12 stryker

- 11.13 Surgicalholdings

- 11.14 Teleflex

- 11.15 WPI