PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750320

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750320

Aluminum Foil Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

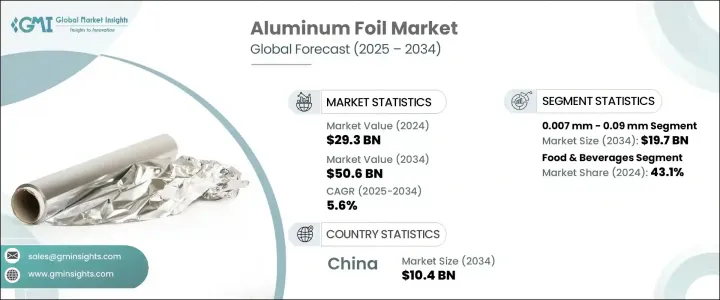

The Global Aluminum Foil Market was valued at USD 29.3 billion in 2024 and is estimated to grow at a CAGR of 5.6% to reach USD 50.6 billion by 2034. This growth is primarily fueled by rising demand across the food and pharmaceutical packaging sectors, as well as increasing applications in industrial insulation and automotive thermal shielding. As aluminum foil is known for its lightweight nature, strong barrier properties, and recyclability, it has become a key material in modern packaging solutions, especially as the focus on sustainable materials gains momentum worldwide. In developing nations, the surge in consumption of packaged foods is further contributing to market expansion, pushing manufacturers and suppliers to meet evolving packaging standards.

A combination of factors is accelerating this growth, including compliance with environmental and packaging regulations, consumer preference for convenient and easy-to-use products, and growing attention to the recyclability of packaging materials. Particularly in the pharmaceutical space, aluminum foil plays a vital role due to strict requirements surrounding product shelf life and contamination prevention. The demand for foil laminates is expected to climb in this context. Additionally, technological advancements are unlocking new market opportunities, such as active and biodegradable foil solutions, nano-laminated products, and foil-based composites, all of which offer greater performance and sustainability benefits. Meanwhile, industries such as construction and automotive are turning to lighter, more energy-efficient materials, further widening the use of aluminum foil beyond packaging.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $29.3 Billion |

| Forecast Value | $50.6 Billion |

| CAGR | 5.6% |

Investments focused on cleaner production processes, such as green energy-powered smelting and recycling capabilities, are also contributing to reduced environmental impact. These efforts are likely to reshape the value chain, enhancing the overall sustainability of aluminum foil manufacturing. As countries modernize production facilities and shift toward eco-conscious operations, the long-term benefits will continue to support growth in the sector.

When segmented by thickness, the aluminum foil market includes categories such as 0.007 mm - 0.09 mm, 0.09 mm - 0.2 mm, 0.2 mm - 0.4 mm, and others. Among these, the 0.007 mm - 0.09 mm segment accounted for the largest revenue share, generating USD 11.3 billion in 2024. This segment is forecast to reach USD 19.7 billion by 2034, growing at a CAGR of 5.8%. Its dominance is attributed to its adaptability across various applications, including food packaging, pharmaceutical products, household wraps, and industrial insulation. The balance of cost-effectiveness, barrier strength, and flexibility makes it a preferred choice for both consumer and commercial needs. It is especially valued for its ability to shield contents from moisture, oxygen, and light, making it ideal for single-use items and recyclable formats.

In terms of end-use industries, the market is categorized into food and beverages, pharmaceuticals, personal care and cosmetics, household, industrial, and others. The food and beverages segment held the largest share in 2024, accounting for 43.1% of global market revenue. The widespread use of foil in this sector is driven by its effective protection against external elements such as moisture, light, and air. It helps extend shelf life, maintain product freshness, and ensure safety-key requirements in the packaged food industry. Foil finds extensive use in flexible pouches, lids, containers, and laminated wraps, serving a variety of consumable products.

Regionally, the market in China recorded a revenue of USD 5.9 billion in 2024 and is projected to reach USD 10.4 billion by 2034, registering a CAGR of 5.8%. China continues to dominate global production, accounting for roughly 60% of the world's aluminum foil output by 2025. Domestic production levels have also witnessed significant growth, reflecting a broader trend toward increased consumption. In response to challenges like overcapacity and environmental concerns, the country is steering away from expanding primary smelting operations and moving toward greener alternatives. These include utilizing renewable energy sources and enhancing recycling capabilities, with a targeted goal to recycle over 15 million tons of aluminum annually by 2027.

The global aluminum foil industry remains moderately consolidated, with five leading companies collectively holding over 40% market share as of 2024. Many businesses are focusing on emerging markets to meet the growing demand for advanced foil types across industries like healthcare, insulation, and electronics. This strategic shift emphasizes not just expansion in output but also innovation in product offerings, including premium foils with features like embossing, multi-layering, and increased hardness. As the market evolves, competitive dynamics are likely to be shaped by sustainability, technological innovation, and global trade alignment.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Impact of trump administration tariffs - structured overview

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Supplier landscape

- 3.4 Profit margin analysis

- 3.5 Key news & initiatives

- 3.6 Regulatory landscape

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Fluctuating raw material prices

- 3.7.1.2 Competition from alternative packaging materials

- 3.7.1.3 Environmental concerns

- 3.7.1.4 Health concerns related to aluminum leaching

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 Fluctuating raw material prices

- 3.7.2.2 Competition from alternative packaging materials

- 3.7.2.3 Environmental concerns

- 3.7.2.4 Health concerns related to aluminum leaching

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

- 3.11 Value chain analysis

- 3.11.1 Raw material suppliers

- 3.11.2 Aluminum foil manufacturers

- 3.11.3 Converters & processors

- 3.11.4 Distributors

- 3.11.5 End use

- 3.12 Pricing analysis

- 3.12.1 Cost structure analysis

- 3.12.2 Price trends analysis

- 3.12.3 Price forecast

- 3.13 Technology landscape

- 3.13.1 Manufacturing process overview

- 3.13.1.1 Casting

- 3.13.1.2 Hot rolling

- 3.13.1.3 Cold rolling

- 3.13.1.4 Annealing

- 3.13.1.5 Finishing & slitting

- 3.13.2 Technological advancements

- 3.13.3 Automation in aluminum foil production

- 3.13.4 Quality control technologies

- 3.13.1 Manufacturing process overview

- 3.14 Regulatory framework

- 3.14.1 Food contact materials regulations

- 3.14.2 Fda regulations (us)

- 3.14.3 Eu regulations

- 3.14.4 Other regional regulations

- 3.15 Environmental regulations

- 3.15.1 Trade policies & tariffs

- 3.15.2 Impact of regulations on market growth

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates and Forecast, By Thickness, 2021 - 2034 (USD Billion) (Tons)

- 5.1 Key trends

- 5.2 0.007 mm - 0.09 mm

- 5.3 0.09 mm - 0.2 mm

- 5.4 0.2 mm - 0.4 mm

- 5.5 Others

Chapter 6 Market Estimates and Forecast, By Foil Type, 2021 - 2034 (USD Billion) (Tons)

- 6.1 Key trends

- 6.2 Printed aluminum foil

- 6.3 Unprinted aluminum foil

- 6.4 Laminated aluminum foil

- 6.5 Backed aluminum foil

- 6.6 Others

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Billion) (Tons)

- 7.1 Key trends

- 7.2 Bags & pouches

- 7.3 Wraps & rolls

- 7.4 Blisters

- 7.5 Lids

- 7.6 Laminated tubes

- 7.7 Trays

- 7.8 Others

Chapter 8 Market Estimates and Forecast, By End Use Industry, 2021 - 2034 (USD Billion) (Tons)

- 8.1 Key trends

- 8.1.1 Food & beverages

- 8.1.2 Bakery & confectionery

- 8.1.3 Ready-to-eat meals

- 8.1.4 Dairy products

- 8.1.5 Beverages

- 8.1.6 Others

- 8.2 Pharmaceuticals

- 8.2.1 Blister packaging

- 8.2.2 Strip packaging

- 8.2.3 Others

- 8.3 Personal care & cosmetics

- 8.4 Household

- 8.5 Industrial

- 8.5.1 Heat insulation

- 8.5.2 Electrical applications

- 8.5.3 Others

- 8.6 Others

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of MEA

Chapter 10 Company Profiles

- 10.1 Alcoa Corporation

- 10.2 Aleris Corporation

- 10.3 Alufoil Products

- 10.4 Amco India

- 10.5 Amcor

- 10.6 Assan Aluminyum

- 10.7 China Hongqiao Group

- 10.8 Constellium

- 10.9 Ess Dee Aluminium

- 10.10 Eurofoil

- 10.11 Hindalco Industries

- 10.12 Huawei Aluminum

- 10.13 Norsk Hydro

- 10.14 Novelis

- 10.15 Reynolds Consumer Products

- 10.16 Symetal Aluminium Foil Industry

- 10.17 UACJ Corporation

- 10.18 United Company RUSAL

- 10.19 Xiamen Xiashun Aluminium Foil

- 10.20 Zhejiang Junma Aluminium Industry