PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750326

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750326

Instrument Landing System and Visual Landing Aids Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

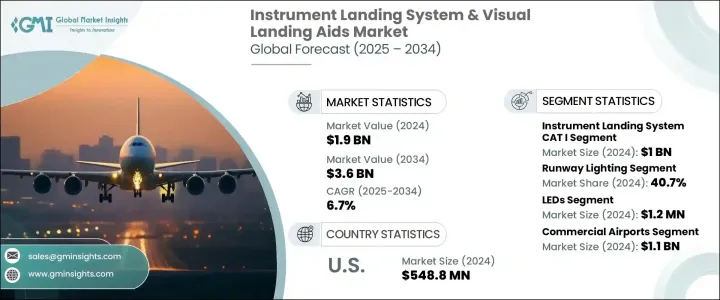

The Global Instrument Landing System and Visual Landing Aids Market was valued at USD 1.9 billion in 2024 and is estimated to grow at a CAGR of 6.7% to reach USD 3.6 billion by 2034, driven by the rise in air traffic, the ongoing modernization of airport infrastructures, and the increasing prevalence of smart airports. As global air travel continues to surge, largely due to the growing fleet of commercial jets and more passengers, there is a growing need for precision landing technologies. Airports are making significant investments in advanced landing systems to ensure safety during low-visibility conditions, reduce delays, and improve operational efficiency. Many emerging economies are constructing new airports, while developed regions are upgrading older facilities to meet international aviation standards. With the increase in air traffic, the demand for ILS and visual guidance systems is rising, as these technologies are critical to enhancing safety and optimizing airport capacity.

Modernization is a key factor fueling the demand for these systems. Governments and other relevant bodies are investing in the construction and upgrading of terminals, runways, and airside facilities to meet international standards. Advanced ILS and visual landing aids are becoming more essential as they help improve safety, traffic flow, and the ability to operate in all weather conditions. Additionally, airport operators are focused on improving infrastructure to support higher traffic volumes, further driving the need for these precision systems.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.9 Billion |

| Forecast Value | $3.6 Billion |

| CAGR | 6.7% |

In terms of ILS categories, the market is divided into CAT I, CAT II, and CAT III systems. In 2024, the CAT I segment accounted for USD 1 billion, as it is favored by regional and mid-sized airports for its cost-effectiveness and ability to operate in most weather conditions. CAT I systems provide safe landings at decision heights of 200 feet, making them a practical choice for airports looking to enhance operational reliability without the added costs of CAT II or CAT III installations.

The market also includes runway, approach, and taxiway lighting, with the runway lighting segment holding a 40.7% share in 2024. As airports grow and the number of flights increases, runway lighting becomes critical for safe nocturnal operations and landings in poor visibility. Advances in LED lighting technology have made maintenance easier and more cost-effective, accelerating the adoption of modern lighting systems. Compliance with international lighting standards and the push for infrastructure modernization are contributing to the demand for these advanced systems.

U.S. Instrument Landing System & Visual Landing Aids Market was valued at USD 548.8 million in 2024, driven by the resurgence in commercial airline traffic and significant efforts to modernize aging airport infrastructure. The country's aviation industry is undergoing a comprehensive upgrade to accommodate the increasing volume of air travel, with a particular emphasis on enhancing safety and operational efficiency. Key initiatives, such as the FAA's NextGen program, are central to these efforts, designed to modernize air traffic control and optimize flight routing systems.

Key players in the Global Instrument Landing System & Visual Landing Aids Market include Collins Aerospace (Raytheon Technologies), Honeywell International Inc., L3Harris Technologies, Indra Sistemas S.A., and Thales Group. Companies are adopting strategies such as product innovation and partnerships to strengthen their market presence. For instance, Thales Group and Collins Aerospace are focusing on developing advanced landing systems to enhance safety and reduce costs. Honeywell International Inc. is investing heavily in the modernization of airport infrastructure, while L3Harris Technologies and Indra Sistemas S.A. are concentrating on integrating smart technologies to improve the efficiency of landing aids. Strategic collaborations and investments in research and development are key to gaining a competitive edge in this rapidly expanding market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Supplier landscape

- 3.4 Profit margin analysis

- 3.5 Key news & initiatives

- 3.6 Regulatory landscape

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Surge in air traffic growth

- 3.7.1.2 Modernization of airport infrastructure

- 3.7.1.3 Emergence of smart airports

- 3.7.1.4 Increasing military aviation & tactical airbases

- 3.7.1.5 Rising technological advancements

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 High capital and maintenance costs

- 3.7.2.2 Complexity and integration challenges

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By ILS Category, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Instrument Landing System CAT I

- 5.3 Instrument Landing System CAT II

- 5.4 Instrument Landing System CAT III

Chapter 6 Market Estimates & Forecast, By Type, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Runway lighting

- 6.3 Approach lighting

- 6.4 Taxiway lighting

Chapter 7 Market Estimates & Forecast, By Technology, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 LEDs

- 7.3 Incandescent lamps

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 (USD Million)

- 8.1 Key trends

- 8.2 Commercial airports

- 8.3 Military airports

- 8.4 Heliports

- 8.5 General aviation

- 8.6 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Million)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Advanced Navigation & Positioning Corporation (ANPC)

- 10.2 Aeronautical & General Instruments Limited

- 10.3 AGI Holdings LLC

- 10.4 ATG Airports Ltd

- 10.5 Carmanah Technologies Corp.

- 10.6 Collins Aerospace (Raytheon Technologies)

- 10.7 HENAME Co., Ltd

- 10.8 Honeywell International Inc.

- 10.9 Indra Sistemas S.A.

- 10.10 Intelcan Technosystems Inc.

- 10.11 L3Harris Technologies

- 10.12 NEC Corporation

- 10.13 Normarc Flight Systems AS (a brand under Indra)

- 10.14 Systems Interface Ltd

- 10.15 Thales Group