PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750330

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750330

Artificial Intelligence in Cancer Diagnostics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

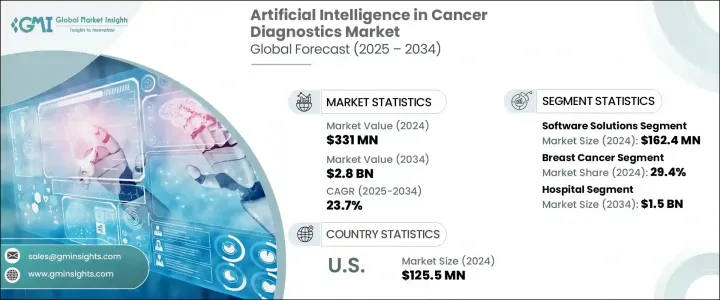

The Global Artificial Intelligence in Cancer Diagnostics Market was valued at USD 331 million in 2024 and is estimated to grow at a CAGR of 23.7% to reach USD 2.8 billion by 2034, driven by increasing demand for precision diagnostics and the rising incidence of cancer worldwide. The integration of artificial intelligence into oncology is revolutionizing the way clinicians detect and interpret cancer-related data. AI tools enhance diagnostic workflows by consolidating vast clinical datasets with medical imaging and pathology results, which streamlines detection and accelerates clinical decision-making. Innovations in non-invasive diagnostics, especially those leveraging AI in genomics and molecular profiling, enable faster, more accurate screening while supporting personalized treatment planning and better patient outcomes.

AI-powered cancer diagnostic systems utilize machine learning and image recognition capabilities to identify abnormalities with higher precision. This tech-driven transformation fosters a shift toward early detection strategies and real-time monitoring essential for cancers that typically progress without symptoms. These smart diagnostic platforms support clinicians by reducing interpretation errors and boosting workflow efficiency. As a result, the implementation of AI is becoming central to next-generation cancer care, bringing value across both clinical and operational dimensions in healthcare. Hospitals, diagnostics labs, and research institutions rely on AI platforms to improve accuracy and reduce turnaround time.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $331 Million |

| Forecast Value | $2.8 Billion |

| CAGR | 23.7% |

In 2024, the hospital segment emerged as the leading end user in the artificial intelligence in cancer diagnostics market and is projected to reach a valuation of USD 1.5 billion by 2034. Hospitals remain at the forefront of adopting cutting-edge AI technologies that assist in the early detection and precise cancer diagnosis. These facilities increasingly rely on AI-based tools such as machine learning algorithms, digital pathology systems, and intelligent imaging platforms to streamline workflows, reduce diagnostic errors, and improve clinical decision-making. Integration of AI also helps hospitals manage large volumes of patient data while enabling faster turnaround times, ultimately enhancing patient care outcomes.

The breast cancer segment held a substantial portion of 29.4% share in 2024, attributed to the widespread incidence of breast cancer globally and the pressing demand for technologies that can detect malignancies at an early, more treatable stage. AI-powered diagnostic solutions are especially impactful in identifying subtle patterns and anomalies in mammograms, ultrasound, and MRI scans, which often go unnoticed during conventional assessments. Integrating AI in breast cancer screening not only enhances sensitivity and specificity but also supports risk stratification and personalized treatment planning. As early diagnosis remains critical in reducing

North America Artificial Intelligence in Cancer Diagnostics Market held 41.3% share in 2024, shaped by advanced healthcare infrastructure, a high volume of cancer cases, and growing demand for AI-integrated diagnostic tools. The country's strong emphasis on medical innovation and collaborative partnerships among academic institutions, healthcare startups, and regulatory agencies has accelerated the pace of AI adoption. Rapid advances in deep learning and imaging interpretation enable clinicians to detect tumors earlier and tailor treatments more effectively, reducing costs and improving patient prognosis.

Major players operating in the artificial intelligence in cancer diagnostics industry include Tempus, Siemens Healthineers, EarlySign, Vuno, Paige AI, Flatiron, Microsoft, Cancer Center.ai, SkinVision, GE Healthcare, Kheiron Medical Technologies, Nanox Imaging, Path AI, and Therapixel.To strengthen their market position in the Global Artificial Intelligence in Cancer Diagnostics Market, companies are focusing on strategic collaborations, software innovation, and regulatory clearances. In the US and North America markets, many players invest in partnerships with hospitals and biotech firms to refine AI models using real-world clinical data. Key companies are also expanding their presence in Europe and Asia Pacific by localizing solutions and engaging in region-specific clinical trials. Furthermore, continuous upgrades in imaging algorithms and cloud-based diagnostic platforms are helping providers scale their offerings globally while addressing evolving clinical demands.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising cancer incidence globally

- 3.2.1.2 Advancements in AI technologies and imaging systems

- 3.2.1.3 Integration of AI with healthcare IT systems

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High implementation and operational costs

- 3.2.2.2 Concerns over data privacy and security

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Trump administration tariffs

- 3.5.1 Impact on the Industry

- 3.5.1.1 Demand-side impact (selling price)

- 3.5.1.1.1 Market share dynamics

- 3.5.1.1.2 Consumer response patterns

- 3.5.1.1 Demand-side impact (selling price)

- 3.5.2 Key companies impacted

- 3.5.3 Strategic industry responses

- 3.5.3.1 Pricing and product strategies

- 3.5.3.2 Policy engagement

- 3.5.4 Outlook and future considerations

- 3.5.1 Impact on the Industry

- 3.6 Future market trends

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Component, 2021-2034 ($ Mn)

- 5.1 Key trends

- 5.2 Software solutions

- 5.3 Hardware

- 5.4 Services

Chapter 6 Market Estimates and Forecast, By Cancer Type, 2021-2034 ($ Mn)

- 6.1 Key trends

- 6.2 Breast cancer

- 6.3 Lung cancer

- 6.4 Colorectal cancer

- 6.5 Prostate cancer

- 6.6 Other cancer types

Chapter 7 Market Estimates and Forecast, By End Use, 2021-2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Diagnostic laboratories

- 7.4 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021-2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Cancer Center.ai

- 9.2 EarlySign

- 9.3 Flatiron

- 9.4 GE Healthcare

- 9.5 Kheiron Medical Technologies

- 9.6 Microsoft

- 9.7 Nanox Imaging

- 9.8 Paige AI

- 9.9 Path AI

- 9.10 Siemens Healthineers

- 9.11 SkinVision

- 9.12 Tempus

- 9.13 Therapixel

- 9.14 Vuno