PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750337

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750337

Nitinol-based Medical Device Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

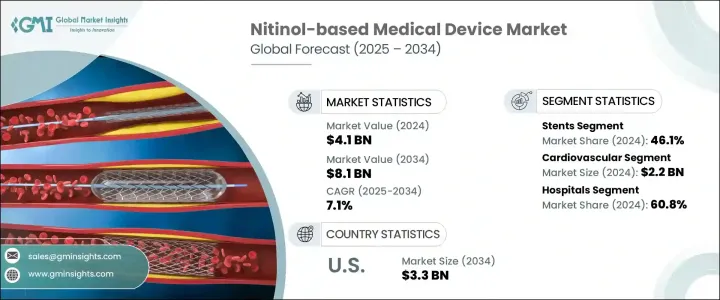

The Global Nitinol-based Medical Device Market was valued at USD 4.1 billion in 2024 and is estimated to grow at a CAGR of 7.1% to reach USD 8.1 billion by 2034 driven by the increasing prevalence of chronic diseases such as cardiovascular conditions, peripheral artery disease, and neurological disorders, which necessitate advanced, minimally invasive medical interventions. Nitinol, a nickel-titanium alloy known for its unique properties of superelasticity and shape memory, is increasingly utilized in medical devices to improve patient outcomes.

Nitinol's ability to return to a predetermined shape after deformation and its resistance to mechanical stress make it ideal for various medical applications. These properties are particularly beneficial in devices like stents, guidewires, and orthopedic implants, where flexibility and durability are crucial. The material's biocompatibility and corrosion resistance further enhance its suitability for long-term implantation. These properties ensure that nitinol devices maintain their functionality and structural integrity within the human body over extended periods, reducing the risk of rejection or degradation. This reliability makes nitinol a preferred choice for permanent implants used in cardiovascular, neurovascular, and orthopedic treatments. As the demand for minimally invasive procedures grows, the adoption of nitinol-based devices is expected to rise, contributing to the market's expansion.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.1 Billion |

| Forecast Value | $8.1 Billion |

| CAGR | 7.1% |

The hospital segment held a 60.8% share in 2024, driven by the increasing incorporation of advanced medical devices aimed at reducing operative time, minimizing patient trauma, and improving recovery outcomes. Nitinol-based devices-such as stents, guidewires, filters, and orthopedic implants-have become integral to hospitals due to their unique properties like shape memory and super-elasticity, which are critical in minimally invasive interventions. Their superior performance in navigating complex anatomies, particularly during cardiovascular and neurovascular procedures, translates into higher procedural success rates and reduced length of hospital stays.

In 2024, the stents segment maintained its leading position with a 46.1% share, fueled by the rising prevalence of vascular disorders and the clinical advantages provided by nitinol stents. These stents are valued for their self-expanding properties and ability to conform seamlessly to complex vascular pathways, especially in patients with peripheral artery disease or coronary blockages. The demand continues to rise as healthcare providers prioritize less invasive, highly effective treatment options for managing arterial conditions.

North America Nitinol-based Medical Device Market held 40% share in 2024, attributed to the region's robust healthcare infrastructure, well-established reimbursement systems, and early adoption of advanced medical technologies. The presence of leading manufacturers and widespread clinical integration of nitinol-based tools in hospitals and specialty clinics has further reinforced North America's stronghold in this rapidly evolving medical device space.

Key players in the Global Nitinol-Based Medical Device Industry include Boston Scientific Corporation, Medtronic plc, Abbott Laboratories, Terumo Corporation, and B. Braun Melsungen AG. These companies are focusing on research and development to innovate and enhance the performance of nitinol-based devices. Strategic collaborations, mergers, and acquisitions are common as companies aim to expand their product portfolios and market reach. To strengthen their market position, companies in the nitinol-based medical device industry are adopting several key strategies. These include investing in research and development to innovate and improve the performance of nitinol-based devices. Strategic collaborations, mergers, and acquisitions are common as companies aim to expand their product portfolios and market reach.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing demand for minimally invasive surgeries

- 3.2.1.2 Rising prevalence of cardiovascular and orthopedic disorders

- 3.2.1.3 Technological advancements in medical device manufacturing

- 3.2.1.4 Growing geriatric population globally

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of nitinol-based devices

- 3.2.2.2 Stringent regulatory approval processes

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Trump administration tariffs

- 3.4.1 Impact on trade

- 3.4.1.1 Trade volume disruptions

- 3.4.1.2 Retaliatory measures

- 3.4.2 Impact on the Industry

- 3.4.2.1 Supply-side impact (raw materials)

- 3.4.2.1.1 Price volatility in key materials

- 3.4.2.1.2 Supply chain restructuring

- 3.4.2.1.3 Production cost implications

- 3.4.2.2 Demand-side impact (selling price)

- 3.4.2.2.1 Price transmission to end markets

- 3.4.2.2.2 Market share dynamics

- 3.4.2.2.3 Consumer response patterns

- 3.4.2.1 Supply-side impact (raw materials)

- 3.4.3 Key companies impacted

- 3.4.4 Strategic industry responses

- 3.4.4.1 Supply chain reconfiguration

- 3.4.4.2 Pricing and product strategies

- 3.4.4.3 Policy engagement

- 3.4.5 Outlook and future considerationsTrump administration tariffs

- 3.4.1 Impact on trade

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Regulatory landscape

- 3.8 Patent analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Competitive market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategic outlook matrix

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Stents

- 5.3 Guidewires

- 5.4 Catheters

- 5.5 Other products

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Cardiovascular

- 6.3 Orthopedic

- 6.4 Dental

- 6.5 Neurological

- 6.6 Urology

- 6.7 Other applications

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Ambulatory surgical centers

- 7.4 Specialty clinics

- 7.5 Research and academic institutes

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 Japan

- 8.4.2 China

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Mexico

- 8.5.2 Brazil

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Abbott Laboratories

- 9.2 Acandis

- 9.3 Admedes Schuessler

- 9.4 Arthrex

- 9.5 B Braun

- 9.6 Becton, Dickinson and Company

- 9.7 Biotronik

- 9.8 Boston Scientific

- 9.9 Cook Medical

- 9.10 Endosmart

- 9.11 Jotec

- 9.12 Medtronic

- 9.13 MicroPort

- 9.14 Stryker

- 9.15 Terumo