PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892816

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892816

Congestive Heart Failure Drugs Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

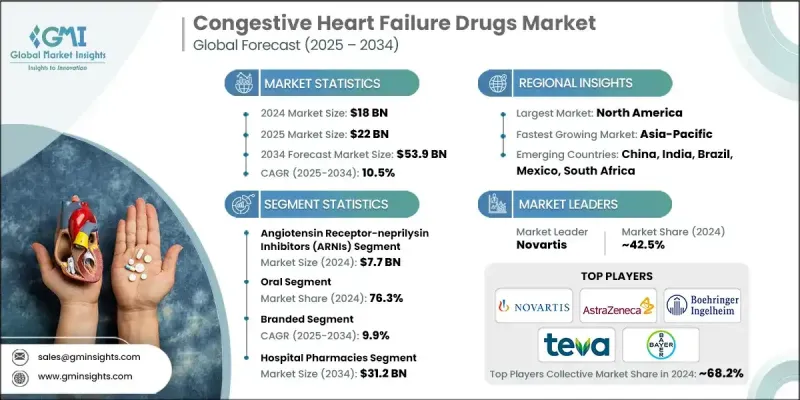

The Global Congestive Heart Failure Drugs Market was valued at USD 18 billion in 2024 and is estimated to grow at a CAGR of 10.5% to reach USD 53.9 billion by 2034.

Market growth is driven by the rising prevalence of heart failure, advances in drug development, and the expansion of guideline-directed medical therapy. Growing adoption of novel classes such as SGLT2 inhibitors and ARNIs, alongside established therapies like ACE inhibitors, beta-blockers, and diuretics, is improving survival outcomes and reducing hospitalizations, thereby expanding the addressable patient pool. Increasing integration of telemedicine and remote monitoring is enabling earlier intervention, tighter therapy optimization, and better long-term adherence, which in turn is boosting drug utilization across acute and chronic care settings. Pharmaceutical companies are also focusing heavily on pipeline innovation, combination therapies, and label expansions into broader heart failure phenotypes, further accelerating market momentum over the forecast horizon.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $18 Billion |

| Forecast Value | $53.9 Billion |

| CAGR | 10.5% |

The Congestive Heart Failure Drugs Market is primarily segmented by route of administration, where the oral segment held 76.3% in 2024. Oral therapies are preferred due to their convenience, ease of self-administration, lower administration costs, and suitability for long-term, home-based management of chronic heart failure. Extended-release, once-daily, and fixed-dose combination formulations simplify complex regimens, improving adherence and outcomes for patients managing multiple comorbidities. In addition, the expanding availability of potent oral agents such as ACE inhibitors, beta-blockers, and SGLT2 inhibitors reinforces the dominance of this segment in both outpatient and telemedicine-enabled care models.

By distribution channel, the hospital pharmacies segment generated USD 31.2 billion in 2024, underpinned by the high burden of acute decompensated heart failure cases requiring intensive, protocol-driven therapy. These settings manage complex combinations of intravenous inotropes, diuretics, and advanced therapies like ARNIs and SGLT2 inhibitors, driving substantial drug consumption and positioning hospital pharmacies as a critical node in treatment initiation and optimization.

North America Congestive Heart Failure Drugs Market held a 53.9% share in 2024. This dominance is supported by a high diagnosed patient base, early adoption of innovative therapies, strong reimbursement frameworks, and robust clinical research infrastructure that accelerates guideline updates and uptake of new molecules.

Key companies operating in the Global Congestive Heart Failure Drugs Market include Novartis, AstraZeneca, Boehringer Ingelheim, Bayer, Teva Pharmaceutical, Pfizer, Sanofi, Johnson & Johnson, GlaxoSmithKline, Merck & Co., Merck KGaA, Lexicon Pharmaceuticals, Zensun Sci & Tech, Amgen, and AdvaCare Pharma, which collectively shape the competitive landscape through extensive portfolios, global commercial footprints, and active R&D strategies. In the Congestive Heart Failure Drugs Market, leading companies are adopting a mix of product innovation, lifecycle management, strategic collaborations, and geographic expansion to strengthen their market foothold. Many players are investing heavily in R&D for novel mechanisms of action, including SGLT2 inhibitors, ARNI-based combinations, vasodilators, and other advanced drug classes, while also pursuing label expansions into broader heart failure populations such as HFpEF and patients with comorbid diabetes or chronic kidney disease.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Drug class trends

- 2.2.3 Route of administration trends

- 2.2.4 Type trends

- 2.2.5 Distribution channel trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of heart failure

- 3.2.1.2 Advancements in drug development

- 3.2.1.3 Increasing awareness and screening

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Stringent regulatory approval

- 3.2.2.2 High cost of advanced medications

- 3.2.3 Industry pitfalls and challenges

- 3.2.3.1 Development of novel drug classes

- 3.2.3.2 Integration of telemedicine and remote monitoring for CHF management

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 U.S.

- 3.4.1.2 Canada

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.4.1 North America

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Pipeline analysis

- 3.7 Future market trends

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.2.4 Asia Pacific

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

Chapter 5 Market Estimates and Forecast, By Drug Class, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 ACE inhibitors

- 5.3 Beta blockers

- 5.4 Diuretics

- 5.5 Angiotensin 2 receptor blockers

- 5.6 Mineralocorticoid receptor antagonists (MRAs)

- 5.7 Angiotensin receptor-neprilysin inhibitors (ARNIs)

- 5.8 Inotropes

- 5.9 SGLT2 inhibitors

- 5.10 Other drug classes

Chapter 6 Market Estimates and Forecast, By Route of Administration, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Oral

- 6.3 Parenteral

Chapter 7 Market Estimates and Forecast, By Type, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Branded

- 7.3 Generic

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospital pharmacies

- 8.3 Retail pharmacies

- 8.4 Online pharmacies

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Alnylam Pharmaceuticals

- 10.2 Amgen

- 10.3 AstraZeneca

- 10.4 Bayer

- 10.5 Boehringer Ingelheim International

- 10.6 Bristol-Myers Squibb Company

- 10.7 Eli Lilly and Company

- 10.8 GlaxoSmithKline

- 10.9 Johnson & Johnson

- 10.10 Merck

- 10.11 Novartis

- 10.12 Otsuka Pharmaceutical

- 10.13 Pfizer

- 10.14 Sanofi

- 10.15 Teva Pharmaceutical Industries