PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750430

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750430

Dental Microsurgery Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

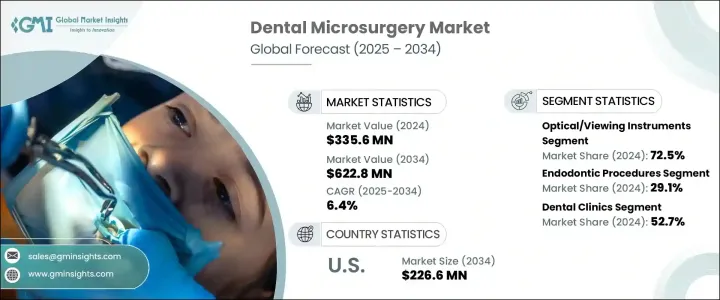

The Global Dental Microsurgery Market was valued at USD 335.6 million in 2024 and is estimated to grow at a 6.4% CAGR, to reach USD 622.8 million by 2034, driven using advanced surgical techniques to perform precise procedures while minimizing tissue damage and enhancing healing times. This field relies heavily on specialized tools such as surgical microscopes, micro-instruments, and fine sutures, allowing detailed, magnified operations. The increasing global aging population plays a significant role in this market's expansion, as age-related dental conditions like gum recession, tooth loss, and chronic periodontitis require highly accurate surgical interventions. Additionally, the rise in oral health issues, including tooth decay and periodontitis, contributes to the demand for dental microsurgery.

Factors such as inadequate oral hygiene, unhealthy dietary habits, and the rising prevalence of chronic conditions like diabetes and hypertension are significantly contributing to the worsening of oral health issues. These factors not only accelerate the development of conditions like tooth decay, periodontitis, and gum disease but also make these issues more challenging. As these oral health problems continue to rise globally, the demand for advanced surgical solutions that offer precision, efficiency, and quicker recovery times is growing. Dental microsurgery has become a preferred choice for many professionals because it allows for highly controlled, minimally invasive procedures with better visual clarity, which is especially important in complex cases.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $335.6 Million |

| Forecast Value | $622.8 Million |

| CAGR | 6.4% |

The optical and viewing instruments segment held a 72.5% share in 2024. Dental operating microscopes, loupes, and endoscopes are critical for improving surgical precision and clinical outcomes. These devices enhance magnification and lighting, enabling practitioners to view intricate details, improving diagnosis and reducing errors. Innovations like high-definition imaging and ergonomic designs are accelerating the adoption of these tools, especially for root canal procedures.

Another key driver in the market is the endodontic procedures segment, which accounted for the largest share of USD 29.1% in 2024. The rise in pulp necrosis and periapical diseases necessitates precise interventions like root canal therapy, driving the demand for microsurgery in this area. The use of advanced microsurgical visualization aids has enhanced the success rates of these treatments, leading to growing market interest.

United States Dental Microsurgery Market generated USD 123.6 million in 2024 and is expected to reach USD 226.6 million by 2034. The growing demand for advanced procedures such as root-end surgeries and periodontal regeneration is a major driver of this expansion. The high adoption rates of these services in the U.S., particularly among the aging population, are further accelerating market growth. As more dental professionals embrace microsurgical techniques, the U.S. market is expected to remain a dominant player in the global landscape.

Major players in the industry include B. Braun Melsungen, Dentsply Sirona, MediThinQ, Microsurgery Instruments, Kerr, Global Surgical, Henry Schein, Peter LAZIC, Zeiss International, Microsurgical Technology, Zimmer Biomet, Institut Straumann, Hu-Friedy, and Danaher. Key strategies employed by companies in the Dental Microsurgery Market to strengthen their position include continuous innovation in advanced surgical instruments, increasing their focus on user-friendly designs, and expanding their product offerings to cater to diverse dental procedures. Additionally, partnerships with dental practices and educational institutions help enhance awareness and training of the dental workforce, boosting market penetration. Investment in R&D to develop technologies and devices further strengthens their competitive edge and ensures they remain at the forefront of the rapidly evolving market.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing prevalence of dental disorders globally

- 3.2.1.2 Increasing elderly population worldwide

- 3.2.1.3 Rising demand for minimally invasive dental procedures

- 3.2.1.4 Advancements in dental operating microscopes and visualization technologies

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Limited reimbursement policies

- 3.2.2.2 High cost of microsurgical equipment and procedures

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Trump administration tariffs

- 3.5.1 Impact on trade

- 3.5.1.1 Trade volume disruptions

- 3.5.1.2 Country-wise response

- 3.5.2 Impact on the Industry

- 3.5.2.1 Supply-side impact (cost of manufacturing)

- 3.5.2.1.1 Price volatility in key materials

- 3.5.2.1.2 Supply chain restructuring

- 3.5.2.1.3 Production cost implications

- 3.5.2.2 Demand-side impact (cost to consumers)

- 3.5.2.2.1 Price transmission to end markets

- 3.5.2.2.2 Market share dynamics

- 3.5.2.2.3 Consumer response patterns

- 3.5.2.1 Supply-side impact (cost of manufacturing)

- 3.5.3 Key companies impacted

- 3.5.4 Strategic industry responses

- 3.5.4.1 Supply chain reconfiguration

- 3.5.4.2 Pricing and product strategies

- 3.5.4.3 Policy engagement

- 3.5.5 Outlook and future considerations

- 3.5.1 Impact on trade

- 3.6 Technological landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Optical/viewing instruments

- 5.3 Microsurgical instrumentation

- 5.4 Other products

Chapter 6 Market Estimates and Forecast, By Procedure, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Dental implants

- 6.3 Diagnostic procedures

- 6.4 Apicoectomy

- 6.5 Periodontal surgery

- 6.6 Endodontic procedures

- 6.7 Other procedures

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Dental clinics

- 7.3 Hospitals

- 7.4 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 B. Braun Melsungen

- 9.2 Danaher

- 9.3 Dentsply Sirona

- 9.4 Global Surgical

- 9.5 Henry Schein

- 9.6 Hu-Friedy

- 9.7 Institut Straumann

- 9.8 Kerr

- 9.9 MediThinQ

- 9.10 Microsurgery Instruments

- 9.11 Microsurgical Technology

- 9.12 Peter LAZIC

- 9.13 Zeiss International

- 9.14 Zimmer Biomet