PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750434

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750434

Bio-Succinic Acid Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

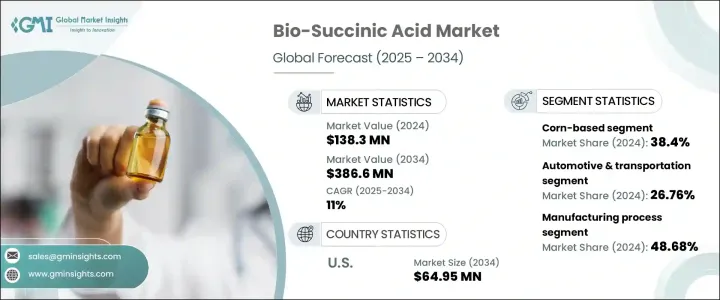

The Global Bio-Succinic Acid Market was valued at USD 138.3 million in 2024 and is estimated to grow at a CAGR of 11% to reach USD 386.6 million by 2034, driven by a rising consumer demand for sustainable, bio-based chemical alternatives to traditional petroleum-based products. As industries and governments alike focus on eco-friendly solutions, bio-succinic acid has gained traction as a green product, offering a renewable and biodegradable option in various applications. The increased emphasis on sustainability, coupled with stricter regulations on environmental impact, has made bio-succinic acid a key player in the chemical industry.

The increasing shift towards sustainable materials in various industries has significantly bolstered the demand for bio-succinic acid, as it is a key building block in the production of bio-based polymers. Among these polymers, polybutylene succinate (PBS) stands out due to its biodegradability, versatility, and potential to replace petroleum-based plastics in numerous applications. This surge in demand for PBS is driving the need for bio-succinic acid, as it is used in the production of PBS and other environmentally friendly polymers, further expanding the market for bio-succinic acid.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $138.3 Million |

| Forecast Value | $386.6 Million |

| CAGR | 11% |

The bio-succinic acid market from the corn segment held 38.4% share in 2024. Corn, being a carbohydrate-rich resource, is particularly well-suited for fermentation-based processes that yield bio-succinic acid. Its availability, cost-effectiveness, and ability to provide a consistent and reliable supply make it a preferred feedstock for large-scale production. The growing adoption of corn-based bio-succinic acid is driven by its established supply chain and the scalability of fermentation technologies. As demand for bio-succinic acid grows, alternative feedstocks are also being explored.

The fermentation-based process segment held 49% share due to its cost-effectiveness and reliance on renewable feedstocks. This method allows for scalable production with reduced environmental impact, making it the preferred choice for large-scale manufacturing. However, new approaches, such as direct synthesis from glucose and sugars, are emerging, offering higher yields under controlled conditions. Chemical catalysis is also gaining attention, although its higher costs and environmental concerns limit its widespread application. The hybrid process, combining fermentation and catalysis, is being explored as a solution to improve production efficiency and sustainability while balancing cost.

U.S Bio-Succinic Acid Market generated USD 22.38 million in 2024, with projections to reach USD 64.95 million by 2034, attributed to government incentives supporting bio-based chemicals and the growing industrial demand for renewable resources. The U.S. is a major producer of bio-succinic acid, benefiting from an advanced manufacturing infrastructure and strong governmental support for green technologies.

Key players in the Global Bio-Succinic Acid Market include Corbion N.V., Kawasaki Kasei Chemicals, BASF SE, Mitsui & Co., Ltd., and Reverdia. Companies are focusing on expanding their product portfolios, improving production efficiency, and exploring new raw materials to enhance their market share. For instance, Corbion N.V. and Reverdia have been leveraging advanced fermentation processes to optimize yields and reduce costs, while Mitsui & Co., Ltd. is exploring the use of renewable raw materials like agricultural waste for production. By adopting these strategies, these companies are positioning themselves to capitalize on the growing demand for bio-succinic acid as industries move toward more sustainable solutions.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.3 Supply-side impact (raw materials)

- 3.2.3.1 Price volatility in key materials

- 3.2.3.2 Supply chain restructuring

- 3.2.3.3 Production cost implications

- 3.2.4 Demand-side impact (selling price)

- 3.2.4.1 Price transmission to end markets

- 3.2.4.2 Market share dynamics

- 3.2.4.3 Consumer response patterns

- 3.2.5 Key companies impacted

- 3.2.6 Strategic Industry Responses

- 3.2.6.1 Supply Chain Reconfiguration

- 3.2.6.2 Pricing and Product Strategies

- 3.2.6.3 Policy Engagement

- 3.2.7 Outlook and Future Considerations

- 3.2.1 Impact on trade

- 3.3 Trade statistics (HS Code)

- 3.3.1 Major Exporting Countries

- 3.3.2 Major Importing Countries

Note: the above trade statistics will be provided for key countries only.

- 3.4 Profit margin analysis

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Rising demand for bio-based chemicals and sustainable alternatives

- 3.6.1.2 Strong consumer preference for sustainable and green products

- 3.6.1.3 Government regulations promoting eco-friendly and biodegradable products

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High production costs compared to petroleum-based alternatives

- 3.6.2.2 Limited availability of raw materials, affecting scalability

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates and Forecast, By Raw Material Source, 2021 – 2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Corn-based

- 5.3 Sugarcane-based

- 5.4 Cassava-based

- 5.5 Lignocellulosic biomass (wood, agricultural waste, etc.)

- 5.6 Others (algae, microbial fermentation, etc.)

Chapter 6 Market Estimates and Forecast, By End Use Industry, 2021 – 2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Automotive & transportation

- 6.3 Packaging industry

- 6.4 Textile industry

- 6.5 Construction & infrastructure

- 6.6 Consumer goods

- 6.7 Healthcare & pharmaceuticals

- 6.8 Agriculture

- 6.9 Energy sector

Chapter 7 Market Estimates and Forecast, By Manufacturing Process, 2021 – 2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Fermentation-based production

- 7.3 Direct synthesis from glucose & sugars

- 7.4 Chemical catalysis

- 7.5 Hybrid process (combination of fermentation & catalysis)

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 AHB Global

- 9.2 BASF SE

- 9.3 Corbion N.V.

- 9.4 Kawasaki Kasei Chemicals

- 9.5 Mitsubishi Chemical Corporation

- 9.6 Mitsui & Co., Ltd

- 9.7 Myriant Corporation

- 9.8 Nippon Shokubai

- 9.9 Reverdia

- 9.10 Roquette Freres