PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750441

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750441

Off-highway Electric Vehicle Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

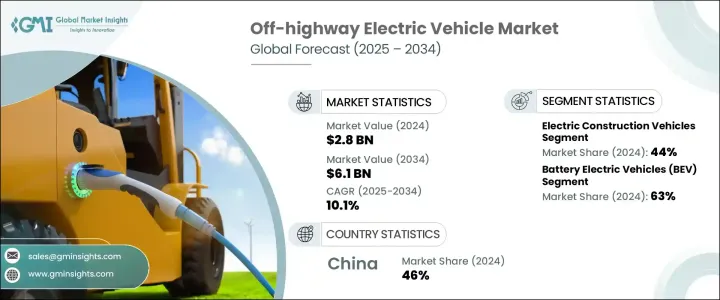

The Global Off-highway Electric Vehicle Market was valued at USD 2.8 billion in 2024 and is estimated to grow at a CAGR of 10.1% to reach USD 6.1 billion by 2034 driven by stringent environmental regulations and emissions reduction targets, particularly in industries like construction, mining, and agriculture, which traditionally rely on heavy diesel-powered machinery. Governments worldwide are enforcing tighter emissions standards, pushing companies to adopt electric vehicles as a cleaner alternative to comply with local and international environmental standards.

Urbanization and infrastructure expansion are key growth drivers for the OHEV market due to the increasing demand for sustainable and efficient construction equipment in growing cities. As cities continue to grow and infrastructure demands increase, the pressure to reduce noise and air pollution on construction sites has never been higher. Electric off-highway vehicles not only meet this demand but also align with sustainability goals set by municipalities and governments. These vehicles are especially well-suited for urban environments where emissions limits and noise ordinances are strictly enforced. Additionally, the operational cost savings-thanks to fewer moving parts and lower fuel expenses-make electric models an increasingly attractive investment for contractors. As technology continues to improve, electric vehicles are becoming more powerful and efficient, further enhancing their capability to handle intensive construction tasks while supporting the global shift toward environmentally responsible development.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.8 Billion |

| Forecast Value | $6.1 Billion |

| CAGR | 10.1% |

The electric construction vehicles segment held a 44% share and is expected to grow at a CAGR of 10.5% during 2025-2034. Electric construction vehicles hold the highest market share in the OHEV market due to the sector's rapid urbanization, infrastructure development, and growing pressure to reduce emissions on job sites. Construction activities often occur in densely populated urban areas where noise and air pollution are major concerns, making electric vehicles highly suitable. Additionally, governments are enforcing stricter emissions regulations for construction zones, especially in developed and environmentally sensitive regions.

The Battery Electric Vehicles segment held 63% share and is expected to grow at a CAGR of 10.2% from 2025 - 2034. Advancements in lithium-ion battery technology have significantly improved energy density, charging speed, and lifespan, making BEVs more practical and cost-effective for off-highway applications like construction and mining. BEVs offer zero emissions during operation, aligning with global regulatory pressures and sustainability goals, especially in urbanized areas where reducing air pollution is critical. Moreover, BEVs have lower operational and maintenance costs compared to internal combustion engine vehicles, as they have fewer moving parts and require less upkeep.

China Off-highway Electric Vehicle Market held a 46% share and generated USD 557.2 million in 2024 due to strong government support, robust infrastructure, and a growing demand for sustainable construction and mining equipment. Policies promoting carbon neutrality and subsidies for electric vehicles have accelerated adoption. Chinese OEMs are investing heavily in R&D, focusing on battery efficiency and intelligent systems. The region benefits from a well-established battery manufacturing ecosystem and increasing urbanization, driving demand for low-emission equipment.

Major players operating in the Global Off-Highway Electric Vehicle Industry include XCMG, Hitachi Construction Machinery, Kubota, Caterpillar, Sany, Liebherr, Komatsu, Wacker Neuson, Volvo AB, and Deere & Company. These companies are focusing on introducing new technologies to strengthen their position in the market. The development in vehicles aims to improve fuel efficiency, delivering optimal job performance , speed, and reduce noise levels. Such innovations are expected to enhance the adoption of electric off-highway vehicles in various industries.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Raw material suppliers

- 3.2.2 Battery manufacturers and suppliers

- 3.2.3 Original Equipment Manufacturers (OEMs)

- 3.2.4 Technology and software providers

- 3.2.5 Distribution, sales, and aftermarket service providers

- 3.3 Profit margin analysis

- 3.4 Trump administration tariffs

- 3.4.1 Impact on trade

- 3.4.1.1 Trade volume disruptions

- 3.4.1.2 Retaliatory measures by other countries

- 3.4.2 Impact on the industry

- 3.4.2.1 Price Volatility in key materials

- 3.4.2.2 Supply chain restructuring

- 3.4.2.3 Production cost implications

- 3.4.3 Key companies impacted

- 3.4.4 Strategic industry responses

- 3.4.4.1 Supply chain reconfiguration

- 3.4.4.2 Pricing and product strategies

- 3.4.5 Outlook and future considerations

- 3.4.1 Impact on trade

- 3.5 Technology & innovation landscape

- 3.6 Price trends

- 3.7 Cost breakdown analysis

- 3.8 Patent analysis

- 3.9 Key news & initiatives

- 3.10 Regulatory landscape

- 3.11 Impact forces

- 3.11.1 Growth drivers

- 3.11.1.1 Stringent environmental regulations and emissions reduction targets

- 3.11.1.2 Growing awareness of sustainability and environmental concerns

- 3.11.1.3 Technological advancements in batteries and motors

- 3.11.1.4 Government incentives and subsidies

- 3.11.1.5 Urbanization and infrastructure expansion

- 3.11.2 Industry pitfalls & challenges

- 3.11.2.1 High initial purchase cost

- 3.11.2.2 Limited battery range and operating time

- 3.11.1 Growth drivers

- 3.12 Growth potential analysis

- 3.13 Porter's analysis

- 3.14 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Electric construction vehicles

- 5.2.1 Excavators

- 5.2.2 Bulldozers

- 5.2.3 Loaders

- 5.3 Electric agricultural vehicles

- 5.3.1 Tractors

- 5.3.2 Harvesters

- 5.3.3 Sprayers

- 5.4 Electric mining vehicles

- 5.4.1 Haul trucks

- 5.4.2 Drills

- 5.5 Others

Chapter 6 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Battery electric vehicles (BEV)

- 6.3 Plug-in hybrid electric vehicles (PHEV)

- 6.4 Hybrid electric vehicles (HEV)

- 6.5 Fuel cell electric vehicles (FCEVs)

Chapter 7 Market Estimates & Forecast, By Battery Capacity, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Less than 50 kWh

- 7.3 50–200 kWh

- 7.4 More than 200 kWh

Chapter 8 Market Estimates & Forecast, By Power Output, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Less than 50 HP

- 8.3 50–150 HP

- 8.4 More than 150 HP

Chapter 9 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 9.1 Construction

- 9.2 Agriculture

- 9.3 Mining

- 9.4 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 ANZ

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 Saudi Arabia

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 Bell Equipment

- 11.2 Caterpillar

- 11.3 CNH Industrial

- 11.4 Deere & Company

- 11.5 DEUTZ AG

- 11.6 Doosan

- 11.7 Hitachi Construction Machinery

- 11.8 JCB

- 11.9 Komatsu

- 11.10 Kubota

- 11.11 Liebherr

- 11.12 Manitou Group

- 11.13 Sany

- 11.14 Solectrac

- 11.15 Stihl Holding

- 11.16 Sumitomo Heavy Industries

- 11.17 Terex Corporation

- 11.18 Volvo AB

- 11.19 Wacker Neuson

- 11.20 XCMG