PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750448

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750448

Satellite Phased Array Antenna Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

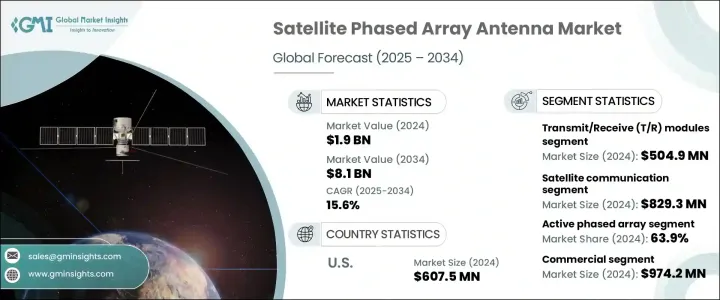

The Global Satellite Phased Array Antenna Market was valued at USD 1.9 billion in 2024 and is estimated to grow at a CAGR of 15.6% to reach USD 8.1 billion by 2034, driven by increasing investments from both government and private sectors, the roll-out of 5G technology, the rise of Internet of Things (IoT) devices, and the expanding use of Low Earth Orbit (LEO) satellites. As more organizations and governments focus on improving communications infrastructure and space exploration, the need for high-performance, beam-steering antennas becomes critical for reliable connectivity and surveillance.

However, challenges such as tariffs imposed on Chinese imports, particularly by the Trump administration, had a notable impact on the market. These tariffs raised the production costs for U.S.-based manufacturers by increasing the price of assembly components such as semiconductors and RF modules, which are often sourced from China. This disruption in the global supply chain led companies to explore new trade sources and adjust production strategies, adding complexity to the market. Additionally, the ongoing defense modernization initiatives and increased government investments in space exploration and satellite-based infrastructure are significantly contributing to the demand for advanced satellite communication systems. As countries prioritize enhancing their military capabilities, the need for reliable, high-performance satellite communication technologies has become essential for national security, intelligence gathering, and surveillance.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.9 Billion |

| Forecast Value | $8.1 Billion |

| CAGR | 15.6% |

In 2024, Transmit/Receive (T/R) modules contributed USD 504.9 million. These modules play a vital role in ensuring the high-speed, low-latency functionality required for satellite communication systems. The increasing demand for smaller, energy-efficient antennas that incorporate miniaturized T/R modules is expanding across both military and commercial sectors. These antennas, with superior signal integrity and thermal management, provide enhanced versatility for high-performance, electronically steerable satellite communication systems.

The market is also segmented by array type, with active phased arrays expected to dominate with a market share of 63.9% in 2024. Active arrays offer significant advantages in beam agility, signal gain, and precision. These antennas have individual transmit/receive modules for each element, enabling dynamic beamforming, redundancy, and improved signal strength. These features make active phased arrays ideal for applications in LEO satellite constellations, defense systems, and mobile communication platforms, where rapid tracking and robust connectivity are essential.

United States Satellite Phased Array Antenna Market generated USD 607.5 million in 2024, driven by increasing investments in satellite communication, defense, and space exploration. The demand for LEO satellite constellations and advanced military communication systems continues to drive the market forward, with strong support from agencies like NASA and the Department of Defense.

Companies in the Global Satellite Phased Array Antenna Market, including ViaSat, Boeing, Honeywell International, and ALCAN Systems, are adopting key strategies to solidify their positions. These companies are focusing on expanding their product offerings, particularly in beam-steering technology, to meet the growing demand for high-performance satellite systems. Collaboration with government organizations and private space companies has also been a critical strategy, enabling them to leverage funding for space exploration and defense projects. Additionally, market leaders are investing heavily in research and development to enhance antenna efficiency and miniaturization, ensuring that they remain competitive as the demand for more agile, scalable solutions rises. These strategies ensure their ongoing dominance in the global market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.1.3 Impact on the industry

- 3.2.1.3.1 Supply-side impact (raw materials)

- 3.2.1.3.1.1 Price volatility in key materials

- 3.2.1.3.1.2 Supply chain restructuring

- 3.2.1.3.1.3 Production cost implications

- 3.2.1.3.2 Demand-side impact (selling price)

- 3.2.1.3.2.1 Price transmission to end markets

- 3.2.1.3.2.2 Market share dynamics

- 3.2.1.3.2.3 Consumer response patterns

- 3.2.1.3.1 Supply-side impact (raw materials)

- 3.2.1.4 Key companies impacted

- 3.2.1.5 Strategic industry responses

- 3.2.1.5.1 Supply chain reconfiguration

- 3.2.1.5.2 Pricing and product strategies

- 3.2.1.5.3 Policy engagement

- 3.2.1.6 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Supplier landscape

- 3.4 Profit margin analysis

- 3.5 Key news & initiatives

- 3.6 Regulatory landscape

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Surge in demand for global connectivity

- 3.7.1.2 Growth in government and private sector investments

- 3.7.1.3 Rollout of 5G technology and the proliferation of Internet of Things (IoT) devices

- 3.7.1.4 Increasing applications of satellite phased array antenna in military and defense

- 3.7.1.5 Rising advancements in antenna technology

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 High manufacturing cost associated with the satellite phased array antenna

- 3.7.2.2 Complexity in beam steering and control

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Component, 2021-2034 (USD Million & Units)

- 5.1 Key trends

- 5.2 Microcontrollers / microprocessors

- 5.3 Field programmable gate arrays (FPGAs)

- 5.4 Power amplifiers (PAs)

- 5.5 Low noise amplifiers (LNAs)

- 5.6 Phase shifters

- 5.7 Transmit/receive (T/R) modules

- 5.8 Others

Chapter 6 Market Estimates & Forecast, By Array Type, 2021-2034 (USD Million & Units)

- 6.1 Key trends

- 6.2 Active phased array

- 6.3 Passive phased array

Chapter 7 Market Estimates & Forecast, By Application, 2021-2034 (USD Million & Units)

- 7.1 Key trends

- 7.2 Satellite communication

- 7.3 Radar & sensing

- 7.4 Navigation & tracking

- 7.5 Mobile connectivity

- 7.6 Earth observation

- 7.7 Electronic warfare

- 7.8 Others

Chapter 8 Market Estimates & Forecast, By End Use, 2021-2034 (USD Million & Units)

- 8.1 Key trends

- 8.2 Commercial

- 8.3 Defense & security

- 8.4 Research & academic institutions

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Million & Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Airbus

- 10.2 Av-Comm Space & Defence

- 10.3 ALCAN Systems

- 10.4 Anokiwave

- 10.5 AST & Science

- 10.6 Boeing

- 10.7 C-COM Satellite Systems

- 10.8 Chengdu Ruidiwei

- 10.9 Get SAT Ltd

- 10.10 Honeywell International Inc.

- 10.11 Iridium Communications Inc

- 10.12 KEYCOM Corporation

- 10.13 Requtech

- 10.14 ThinKom Solutions, Inc.

- 10.15 ViaSat