PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750457

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750457

Complementary and Alternative Medicine for Anti-Aging and Longevity Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

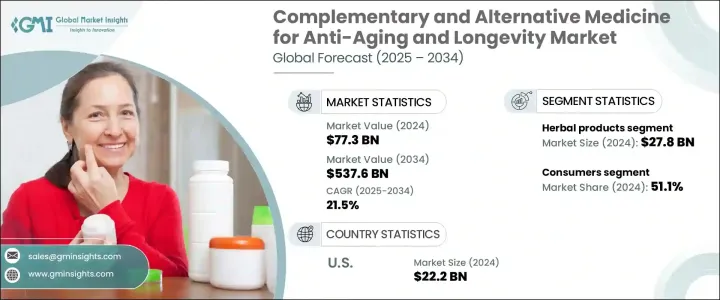

The Global Complementary and Alternative Medicine for Anti-Aging and Longevity Market was valued at USD 77.3 billion in 2024 and is estimated to grow at a CAGR of 21.5% to reach USD 537.6 billion by 2034, driven by the rapid growth of consumers increasingly opting for non-invasive and holistic methods to manage aging and boost vitality. The rising emphasis on wellness and prevention has amplified demand for CAM therapies that support cellular repair, hormonal balance, and stress reduction.

Consumers around the globe are becoming increasingly proactive in addressing the aging process, seeking alternatives beyond traditional pharmaceutical treatments. They are turning to natural therapies that promise not only to enhance energy and improve appearance but also to extend their lifespan. As the wellness industry becomes more personalized, there is a notable shift towards customized regimens that blend ancient healing practices with cutting-edge technology, such as AI and genomics. This fusion allows for tailored approaches to aging, targeting individual needs more precisely than ever. The growing interest in complementary and alternative medicine (CAM) is a key driver of this trend. It reflects a broader cultural shift towards integrative approaches to health, where holistic methods work alongside conventional medicine to provide a more comprehensive solution for aging.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $77.3 Billion |

| Forecast Value | $537.6 Billion |

| CAGR | 21.5% |

The herbal products segment generated USD 27.8 billion in 2024 due to their long-standing use and increasing scientific validation. Natural products formulated with plant-based ingredients are favored for their antioxidant and anti-inflammatory properties that promote healthy aging. Growing interest in precision extraction techniques and smart formulations improves product potency and consumer outcomes.

Consumer segment in the complementary and alternative medicine for anti-aging and longevity market held 51% share, driven by the rising demand from consumers seeking holistic aging support. While older adults continue to dominate usage, younger populations are joining in, adopting CAM to manage stress, boost immunity, and slow visible signs of aging. This demographic shift is driven by wellness culture, social media influence, and a growing preference for preventative care rather than reactive treatment. The desire for longevity, combined with awareness of non-drug alternatives, influences buying behavior across all age groups.

United States Complementary and Alternative Medicine for Anti-Aging and Longevity Market was valued at USD 22.2 billion in 2024 and remains a critical hub for CAM adoption. The rise of wellness-focused clinics, therapeutic spas, and integrative healthcare practices has transformed the landscape. With an aging population and growing awareness around healthy living, US consumers are investing more in holistic options to support cognitive health, joint mobility, and skin rejuvenation. As accessibility improves and CAM merges with conventional care, demand across the country will grow significantly over the next decade.

Companies in the Global Complementary and Alternative Medicine for Anti-Aging and Longevity Market are investing heavily in personalized wellness, expanding global reach, and diversifying their natural product lines. iHerb and Dabur India leverage e-commerce platforms to penetrate new regions and scale distribution. Herbivore Botanicals and Sulwhasoo are focusing on premium skincare with herbal formulations to reverse visible aging. Patanjali Ayurved and Kama Ayurveda emphasize traditional remedies infused with modern science to capture the growing preference for clean-label solutions. Meanwhile, Mountain Rose Herbs and Rocky Mountain Oils are expanding their portfolios with targeted supplements and essential oils. Players like SEVA Experience and Maya Reiki School are enhancing brand loyalty through experiential wellness services. These strategies are reshaping market dynamics and intensifying global competition.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising consumer awareness about holistic wellness and longevity

- 3.2.1.2 Growing aging population and rising demand for youthful appearances

- 3.2.1.3 Advancements in natural formulations and CAM techniques

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Lack of scientific validation for CAM practices

- 3.2.2.2 High costs associated with specialized anti-aging therapies

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Trump administration tariffs

- 3.5.1 Impact on trade

- 3.5.1.1 Trade volume disruptions

- 3.5.1.2 Retaliatory measures

- 3.5.2 Impact on the Industry

- 3.5.2.1 Supply-side impact (raw materials)

- 3.5.2.1.1 Price volatility in key materials

- 3.5.2.1.2 Supply chain restructuring

- 3.5.2.1.3 Production cost implications

- 3.5.2.2 Demand-side impact (selling price)

- 3.5.2.2.1 Price transmission to end markets

- 3.5.2.2.2 Market share dynamics

- 3.5.2.2.3 Consumer response patterns

- 3.5.2.1 Supply-side impact (raw materials)

- 3.5.3 Key companies impacted

- 3.5.4 Strategic industry responses

- 3.5.4.1 Supply chain reconfiguration

- 3.5.4.2 Pricing and product strategies

- 3.5.4.3 Policy engagement

- 3.5.5 Outlook and future considerations

- 3.5.1 Impact on trade

- 3.6 Porter's analysis

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Intervention Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Herbal products

- 5.2.1 Ayurveda

- 5.2.2 Naturopathic medicine

- 5.2.3 Traditional chinese medicine

- 5.2.4 Zang fu theory

- 5.2.5 Other herbal products

- 5.3 Mind-body intervention

- 5.3.1 Yoga

- 5.3.2 Acupuncture and massage

- 5.3.3 Chiropractic

- 5.3.4 Qigong and tai chi

- 5.3.5 Meditation and mindfulness

- 5.3.6 Other mind-body intervention

- 5.4 External energy healing

- 5.4.1 Magnetic and electromagnetic therapy

- 5.4.2 Chakra healing

- 5.4.3 Reiki

- 5.4.4 Other external energy healing

- 5.5 Sensory healing

- 5.5.1 Aromatherapy

- 5.5.2 Sound healing

Chapter 6 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Consumers

- 6.3 Healthcare practitioners

- 6.4 Corporate wellness programs

- 6.5 Other end use

Chapter 7 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Netherlands

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Japan

- 7.4.3 India

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.6 Middle East and Africa

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 Dabur India

- 8.2 First Natural Brands

- 8.3 Herb Pharm

- 8.4 Herbivore Botanicals

- 8.5 iHerb

- 8.6 Kama Ayurveda

- 8.7 Maya Reiki School

- 8.8 Mountain Rose Herbs

- 8.9 Patanjali Ayurved

- 8.10 Rocky Mountain Oils

- 8.11 SEVA Experience

- 8.12 Sulwhasoo

- 8.13 Wei Beauty