PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750474

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750474

Electric Vehicle Sound Generator Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

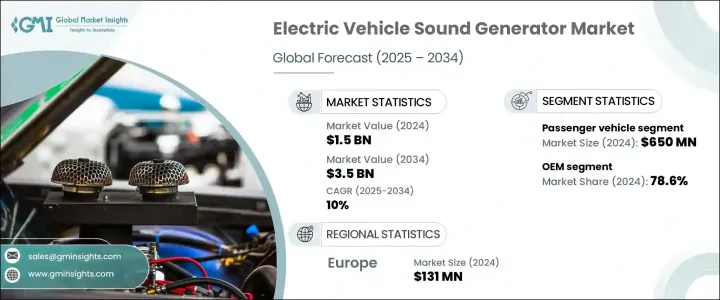

The Global Electric Vehicle Sound Generator Market was valued at USD 1.5 billion in 2024 and is estimated to grow at a CAGR of 10% to reach USD 3.5 billion by 2034, as electric vehicles (EVs) become more widespread, the demand for sound generators continues to rise. EVs are almost silent at low speeds, which poses safety risks in urban and pedestrian-heavy areas. Regulatory bodies worldwide have responded by requiring EVs to produce synthetic sounds to alert pedestrians, especially those who are visually impaired. This growing regulatory pressure pushes automakers to adopt EVSGs as a standard feature. The convergence of rising EV production and increasing safety concerns fuels this demand, particularly in densely populated cities.

As electric mobility continues to expand across multiple segments-from individual passenger cars to commercial fleets and public transit-electric vehicle sound generators (EVSGs) are evolving from optional features to mandatory safety components. With cities growing more congested and pedestrian zones increasing, the near-silent operation of EVs at low speeds poses a real risk to public safety. Sound generators help bridge this gap by producing audible cues that alert pedestrians, cyclists, and other road users to an approaching vehicle.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.5 Billion |

| Forecast Value | $3.5 Billion |

| CAGR | 10% |

The passenger vehicles segment in the electric vehicle sound generator market held a 40% share, reaching a valuation of USD 650 million in 2024, as these vehicles are most often used in urban areas where pedestrian interaction is frequent. As drivers travel longer distances, the need to ensure regulatory compliance and enhance safety prompts automakers to integrate sound generators in these vehicles. Manufacturers are also turning to custom-designed EV sounds not only to meet legal mandates but also to build distinctive brand identities. The fusion of safety and brand marketing is accelerating the adoption of advanced EVSG systems in passenger electric vehicles.

Original equipment manufacturers (OEMs) held the largest market share of 78.6% in 2024. Installing EV sound systems during vehicle production allows for seamless integration with onboard electronics and systems, including powertrains and infotainment units. This approach ensures legal compliance from the outset, which helps preserve warranties and streamline certification processes. OEMs benefit by reducing costs through large-scale purchasing and assembly, offering consumers built-in, regulation-ready sound solutions while maintaining manufacturing efficiency. Regulatory bodies favor OEM installation since it guarantees adherence before the vehicle hits the road.

Germany Electric Vehicle Sound Generator Market generated USD 131 million in 2024. The country's dominance is attributed to its strong automotive manufacturing base and aggressive push toward electrification. German manufacturers are among the earliest adopters of EVSG systems, leveraging regulatory requirements and innovation to stay ahead in the competitive landscape. Their approach blends strict adherence to EU sound regulations with a focus on acoustic branding, allowing automakers to create signature sound profiles that align with brand identity. The high output of electric vehicles, supported by large-scale production facilities and advanced R&D capabilities, further fuels demand for seamlessly integrated EVSG solutions.

Leading players in the EVSG market include Hyundai, ECCO, STMicroelectronics, Continental, Harman International, Aptiv, Denso, Forvia Hella, Brigade Electronics, and Ansys. To stay competitive, these companies are adopting key strategies such as advancing digital sound architecture, expanding partnerships with OEMs, and investing in AI-based sound generation. Many focus on scalable solutions for different EV types while enhancing in-vehicle integration and user experience.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Raw material supplier

- 3.2.2 Component manufacturers

- 3.2.3 Software developers and acoustic engineers

- 3.2.4 System integrators

- 3.2.5 End use

- 3.3 Profit margin analysis

- 3.4 Impact of Trump administration tariffs

- 3.4.1 Impact on trade

- 3.4.1.1 Trade volume disruptions

- 3.4.1.2 Retaliatory measures

- 3.4.2 Impact on industry

- 3.4.2.1 Supply-side impact (raw materials)

- 3.4.2.1.1 Price volatility in key materials

- 3.4.2.1.2 Supply chain restructuring

- 3.4.2.1.3 Production cost implications

- 3.4.2.2 Demand-side impact (selling price)

- 3.4.2.2.1 Price transmission to end markets

- 3.4.2.2.2 Market share dynamics

- 3.4.2.2.3 Consumer response patterns

- 3.4.2.1 Supply-side impact (raw materials)

- 3.4.3 Key companies impacted

- 3.4.4 Strategic industry responses

- 3.4.4.1 Supply chain reconfiguration

- 3.4.4.2 Pricing and product strategies

- 3.4.4.3 Policy engagement

- 3.4.5 Outlook & future considerations

- 3.4.1 Impact on trade

- 3.5 Technology & innovation landscape

- 3.6 Patent analysis

- 3.7 Price trend

- 3.7.1 Region

- 3.7.2 Product

- 3.8 Cost breakdown analysis

- 3.9 Key news & initiatives

- 3.10 Regulatory landscape

- 3.11 Impact forces

- 3.11.1 Growth drivers

- 3.11.1.1 Regulatory mandates for pedestrian safety

- 3.11.1.2 Increasing adoption of EVs

- 3.11.1.3 Advancements in sound design and technology

- 3.11.1.4 OEM integration and brand differentiation

- 3.11.2 Industry pitfalls & challenges

- 3.11.2.1 High cost of advanced systems

- 3.11.2.2 Technical and standardization barriers

- 3.11.1 Growth drivers

- 3.12 Growth potential analysis

- 3.13 Porter's analysis

- 3.14 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 External sound generators

- 5.3 Internal sound generators

- 5.4 Customizable sound systems

Chapter 6 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Battery electric vehicles (BEV)

- 6.3 Hybrid electric vehicles (HEV)

- 6.4 Plug-in hybrid electric vehicles (PHEV)

- 6.5 Fuel cell electric vehicles (FCEV)

Chapter 7 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Passenger vehicle

- 7.2.1 Sedan

- 7.2.2 SUV

- 7.2.3 Hatchback

- 7.3 Commercial vehicle

- 7.3.1 LCV

- 7.3.2 MCV

- 7.3.3 HCV

- 7.4 Two and three wheelers

- 7.5 Off-highway vehicles

Chapter 8 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 OEM

- 8.3 Aftermarket

Chapter 9 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 Hardware

- 9.2.1 Speakers

- 9.2.2 Amplifiers

- 9.2.3 Controllers

- 9.2.4 Actuators

- 9.2.5 Wiring harnesses

- 9.3 Software

- 9.3.1 Sound design applications

- 9.3.2 Control systems

- 9.3.3 User interface systems

Chapter 10 Market Estimates & Forecast, By Speed Range, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 Low-speed sound generators (0-30 km/h)

- 10.3 Full-speed range sound generators (more than 30 km/h)

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.3.7 Nordics

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.4.6 Southeast Asia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MEA

- 11.6.1 UAE

- 11.6.2 South Africa

- 11.6.3 Saudi Arabia

Chapter 12 Company Profiles

- 12.1 Ansys

- 12.2 Aptiv

- 12.3 Brigade Electronics

- 12.4 Continental

- 12.5 Denso

- 12.6 ECCO

- 12.7 ESI Group (Keysights)

- 12.8 Forvia Hella

- 12.9 General Motors

- 12.10 Harman International

- 12.11 Hyundai

- 12.12 Mercedes-Benz

- 12.13 Softeq

- 12.14 Soundracer

- 12.15 STMicroelectronics

- 12.16 Thor

- 12.17 TVS

- 12.18 Volkswagen

- 12.19 Volvo