PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750476

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750476

Image-guided Therapy Systems Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

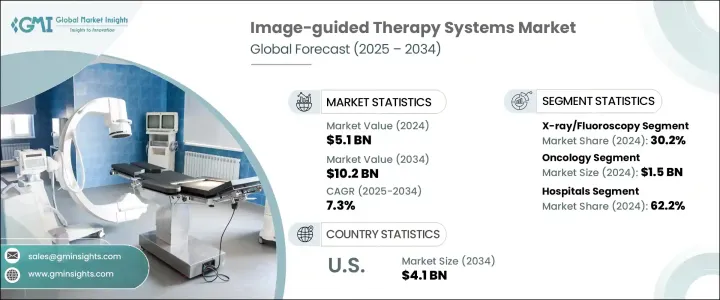

The Global Image-guided Therapy Systems Market was valued at USD 5.1 billion in 2024 and is estimated to grow at a CAGR of 7.3% to reach USD 10.2 billion by 2034, driven by the rising prevalence of chronic illnesses, including neurological disorders, cardiovascular conditions, and cancer. Increasing reliance on precision medicine, coupled with a strong push for minimally invasive procedures, has significantly boosted demand for systems that allow real-time, image-based guidance. Medical advancements such as AI-enabled imaging, robotic-assisted navigation, and 3D visualization are transforming surgery by enhancing precision, shortening procedure durations, and improving clinical outcomes.

Patients and providers alike are increasingly favoring less invasive approaches due to benefits like reduced pain, quicker recovery times, and shorter hospital stays. Artificial intelligence and machine learning optimize the utility of image-guided therapy by streamlining diagnostics, improving imaging interpretation, and automating procedural navigation. As global healthcare systems move toward patient-centered and value-based care, image-guided solutions are becoming an essential part of surgical planning and execution. The adoption of hybrid operating rooms is accelerating and integrating advanced imaging tools directly into the surgical suite for seamless intraoperative use, which enhances decision-making and lowers the risk of complications.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.1 Billion |

| Forecast Value | $10.2 Billion |

| CAGR | 7.3% |

Among product categories, X-ray and fluoroscopy-guided systems accounted for a 30.2% share in 2024, reflecting strong demand in fields such as cardiology, orthopedics, and interventional radiology. The ability to perform real-time image-guided interventions with minimal trauma is a key factor behind their widespread adoption across hospitals and ambulatory settings. Improved imaging functionality in these systems enables physicians to carry out complex procedures with higher accuracy and reduced risk, which is contributing to ongoing segment growth.

The oncology segment generated USD 1.5 billion in 2024. As cancer cases continue to rise globally, clinicians are turning to image-guided systems for more targeted therapies, including radiation, biopsies, and ablations. Real-time integration of imaging tools like MRI, PET, CT, and ultrasound has greatly enhanced intra-procedural guidance, allowing for better tumor localization, smaller incisions, and personalized treatments that spare surrounding tissue. This has accelerated the use of these systems in procedures such as brachytherapy, SBRT, and RF ablation.

U.S. Image-guided Therapy Systems Market was valued at USD 2.1 billion in 2024 and is projected to double by 2034. The country's push for outcome-driven healthcare is encouraging the adoption of technologies that deliver both clinical and cost efficiency. A growing elderly population facing chronic illnesses is also expanding the addressable market. Hospitals and outpatient centers integrate image-guided therapy systems to improve procedural precision and minimize patient recovery time. The shift toward value-based reimbursement models incentivizes providers to invest in equipment that supports better outcomes with fewer complications.

To strengthen their presence, leading firms like Stryker, Medtronic, Siemens Healthineers, Canon Medical Systems, and Intuitive Surgical are investing in AI-powered software, cloud-integrated imaging platforms, and advanced surgical robotics. These companies are forming strategic partnerships with hospitals, acquiring specialized startups, and expanding R&D efforts to support next-generation product pipelines. They focus on market-specific device customization and post-operative analytics tools to enhance procedural outcomes and extend brand loyalty among healthcare providers.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of chronic diseases

- 3.2.1.2 Advancements in imaging and navigation technologies

- 3.2.1.3 Growing demand for minimally invasive surgeries

- 3.2.1.4 Supportive government policies and private investments

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High capital and maintenance costs

- 3.2.2.2 Limited access in emerging markets

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Trump administration tariffs

- 3.4.1 Impact on trade

- 3.4.1.1 Trade volume disruptions

- 3.4.1.2 Retaliatory measures

- 3.4.2 Impact on the Industry

- 3.4.2.1 Supply-side impact (raw materials)

- 3.4.2.1.1 Price volatility in key materials

- 3.4.2.1.2 Supply chain restructuring

- 3.4.2.1.3 Production cost implications

- 3.4.2.2 Demand-side impact (selling price)

- 3.4.2.2.1 Price transmission to end markets

- 3.4.2.2.2 Market share dynamics

- 3.4.2.2.3 Consumer response patterns

- 3.4.2.1 Supply-side impact (raw materials)

- 3.4.3 Key companies impacted

- 3.4.4 Strategic industry responses

- 3.4.4.1 Supply chain reconfiguration

- 3.4.4.2 Pricing and product strategies

- 3.4.4.3 Policy engagement

- 3.4.5 Outlook and future considerationsTrump administration tariffs

- 3.4.1 Impact on trade

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Regulatory landscape

- 3.8 Gap analysis

- 3.9 Patent analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 X-ray/fluoroscopy

- 5.3 Ultrasound

- 5.4 Computed tomography

- 5.5 Magnetic resonance imaging

- 5.6 Positron emission tomography

- 5.7 Other product types

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Cardiac surgery

- 6.3 Neurosurgery

- 6.4 Orthopedic surgery

- 6.5 Gastroenterology

- 6.6 Urology

- 6.7 Oncology

- 6.8 ENT surgery

- 6.9 Other applications

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Ambulatory surgical centers

- 7.4 Specialty clinics

- 7.5 Research and academic institutions

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 Japan

- 8.4.2 China

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Mexico

- 8.5.2 Brazil

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Accuray

- 9.2 Analogic

- 9.3 Brainlab

- 9.4 Canon Medical Systems

- 9.5 Fujifilm Holdings

- 9.6 GE HealthCare

- 9.7 Intuitive Surgical

- 9.8 Karl Storz

- 9.9 Koninklijke Philips

- 9.10 Medtronic

- 9.11 Olympus

- 9.12 Siemens Healthineers

- 9.13 Smith & Nephew

- 9.14 Stryker

- 9.15 Zimmer Biomet