PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750486

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750486

Medical Tubing Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

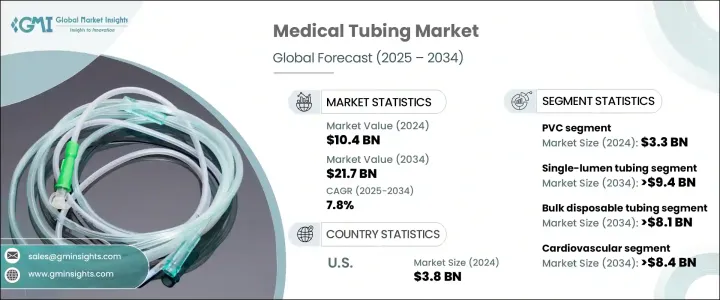

The Global Medical Tubing Market was valued at USD 10.4 billion in 2024 and is estimated to grow at a CAGR of 7.8% to reach USD 21.7 billion by 2034, propelled by increasing healthcare expenditures, technological advancements in medical device manufacturing, and the global surge in chronic illnesses. Rising adoption of high-performance, biocompatible tubing materials enhances patient outcomes and safety, supporting widespread use in surgical and diagnostic procedures. As the preference for less invasive treatments grows, so does the demand for tubing in applications like catheterization and infusion therapy. The aging global population influences this trend, since older patients often require long-term care solutions involving tubes for fluid transfer and vital monitoring.

One key market driver is the increasing preference for disposable medical devices. Single-use tubing is now favored for reducing cross-contamination and hospital-acquired infections. The surge in home healthcare services accelerates this demand, especially for patients needing regular dialysis, IV therapies, or respiratory assistance. Advancements in elastomer-based tubing and sensor-integrated structures have expanded medical tubing applications in modern biomedicine and surgical technologies. These trends, along with ongoing innovation in polymer formulations and tubing design, continue to reshape the landscape of the medical tubing industry.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $10.4 Billion |

| Forecast Value | $21.7 Billion |

| CAGR | 7.8% |

PVC segment accounted for USD 3.3 billion in 2024, reflecting its role as a highly preferred material in the industry. Its flexibility, chemical stability, and compatibility with sterilization make it a go-to choice for manufacturers across drug delivery, dialysis, and catheter products. Market interest has been boosted by the emergence of DEHP-free PVC variants, which comply with regulatory standards while maintaining performance. PVC's ability to support intricate tubing configurations, including multi-lumen and thin-wall types, makes it invaluable for modern healthcare applications.

The bulk disposable tubing segment in the medical tubing market is forecast to maintain its lead with a CAGR of 8.2%, generating USD 8.1 billion by 2034. This segment's strength lies in its extensive use across a wide range of critical healthcare procedures, including respiratory therapy, IV fluid delivery, and various fluid management systems. These tubing solutions are indispensable in hospital and home care environments, where sterility, safety, and single-use functionality are paramount. Their cost-effectiveness and reduced risk of cross-contamination make them ideal for high-frequency usage, particularly in infection-sensitive settings.

United States Medical Tubing Market reached USD 3.8 billion in 2024 and is projected to grow at a CAGR of 7.3% through 2034. The country's leadership in healthcare innovation supports robust adoption of sophisticated tubing technologies, especially in diagnostic imaging, catheterization, minimally invasive procedures, and long-term chronic care. The presence of key industry players such as Gore, Freudenberg, and Tekni-Plex bolsters this growth. These companies focus on R&D investments, leading to advancements in multi-lumen, microbore, and sensor-integrated tubing systems. Hospitals and outpatient centers adopt such systems to support advanced surgeries, precise fluid management, and tailored patient therapies.

To maintain a strong position in the Global Medical Tubing Market, key players like Trelleborg, Zeus, Saint-Gobain, Putnam Plastics, and Spectrum are actively enhancing their capabilities. These companies invest significantly in material science to create tubing with improved durability, biocompatibility, and performance under various conditions. Strategic collaborations with medical device OEMs, along with expanding production sites and cleanroom facilities, allow them to meet global demand efficiently. Several firms focus on sustainability by developing recyclable or DEHP-free options to align with regulatory shifts and hospital procurement preferences. Additionally, robust R&D pipelines and IP protections for proprietary extrusion technologies are helping them differentiate in a competitive market.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of chronic diseases, such as cardiovascular and respiratory conditions

- 3.2.1.2 Growing demand for minimally invasive surgical procedures

- 3.2.1.3 Surging adoption of single-use medical devices to prevent infections

- 3.2.1.4 Rising use of medical tubing in drug delivery systems

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High manufacturing costs associated with advanced materials

- 3.2.2.2 Issues related to material compatibility and durability

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Trump administration tariffs

- 3.5.1 Impact on trade

- 3.5.1.1 Trade volume disruptions

- 3.5.1.2 Retaliatory measures

- 3.5.2 Impact on the Industry

- 3.5.2.1 Supply-side impact (raw materials)

- 3.5.2.1.1 Price volatility in key materials

- 3.5.2.1.2 Supply chain restructuring

- 3.5.2.1.3 Production cost implications

- 3.5.2.2 Demand-side impact (selling price)

- 3.5.2.2.1 Price transmission to end markets

- 3.5.2.2.2 Market share dynamics

- 3.5.2.2.3 Consumer response patterns

- 3.5.2.1 Supply-side impact (raw materials)

- 3.5.3 Key companies impacted

- 3.5.4 Strategic industry responses

- 3.5.4.1 Supply chain reconfiguration

- 3.5.4.2 Pricing and product strategies

- 3.5.4.3 Policy engagement

- 3.5.5 Outlook and future considerations

- 3.5.1 Impact on trade

- 3.6 Technology landscape

- 3.7 Pricing analysis

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Material, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Polyvinyl chloride (PVC)

- 5.3 Silicone

- 5.4 Polyolefins

- 5.5 Polycarbonates

- 5.6 Other materials

Chapter 6 Market Estimates and Forecast, By Structure, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Single-lumen tubing

- 6.3 Multi-lumen tubing

- 6.4 Co-extruded tubing

- 6.5 Other structures

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Bulk disposable tubing

- 7.3 Catheters and cannulas

- 7.4 Drug delivery systems

- 7.5 Other applications

Chapter 8 Market Estimates and Forecast, By Indication 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Cardiovascular

- 8.3 Respiratory

- 8.4 Gastrointestinal

- 8.5 Other indications

Chapter 9 Market Estimates and Forecast, By End Use 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Hospitals and clinics

- 9.3 Ambulatory surgical centers

- 9.4 Diagnostic laboratories

- 9.5 Other end use

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 AdvantaPURE

- 11.2 AngioDynamics

- 11.3 AP Technologies

- 11.4 mdc

- 11.5 FREUDENBERG

- 11.6 Nordson

- 11.7 Parker

- 11.8 POLYZEN

- 11.9 Putnam Plastics

- 11.10 raumedic

- 11.11 SAINT-GOBAIN

- 11.12 SPECTRUM

- 11.13 TRELLEBORG

- 11.14 GORE

- 11.15 ZEUS