PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750489

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750489

Carbon Fiber-Infused Polymers Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

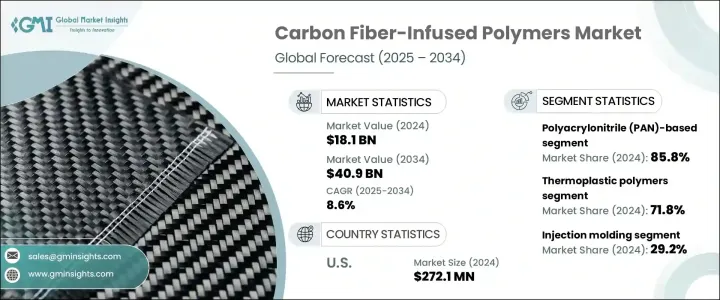

The Global Carbon Fiber-Infused Polymers Market was valued at USD 18.1 billion in 2024 and is estimated to grow at a CAGR of 8.6% to reach USD 40.9 billion by 2034, driven by the increasing demand across various industries, including automotive, aerospace, defense, and renewable energy sectors. The unique properties of carbon fiber-infused polymers-such as high strength-to-weight ratios, corrosion resistance, and thermal stability-make them ideal for applications requiring lightweight and durable materials. In the automotive industry, these materials contribute to fuel efficiency and reduced emissions, aligning with stringent environmental regulations.

Similarly, in aerospace and defense, adopting these composites enhances performance and reduces operational costs. The renewable energy industry, especially the wind power segment, continues to gain from integrating carbon fiber composites into turbine blade production. These materials allow lighter, more durable blades that capture wind energy while enhancing operational efficiency. Their high strength-to-weight ratio supports the design of longer blades, which leads to greater energy output without compromising structural integrity-an essential factor for large-scale wind installations both onshore and offshore.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $18.1 Billion |

| Forecast Value | $40.9 Billion |

| CAGR | 8.6% |

Within the carbon fiber-infused polymers market, segmentation by polymer type highlights thermoplastic and thermoset variants. The thermoplastic polymers segment held 71.8% share in 2024, favored for their recyclability, fast processing times, and ability to withstand repeated heating and reshaping. These features make them attractive for high-volume applications in automotive and aerospace manufacturing, where sustainability and cost-efficiency are becoming increasingly important.

The injection molding segment held a 29.2% share in 2024 due to its ability to deliver precise, durable parts at scale. The automotive sector, in particular, benefits from this process, as it enables the production of lightweight yet robust structural parts that contribute to improved vehicle performance and fuel efficiency. Injection molding's adaptability to complex geometries and compatibility with thermoplastic composites further amplify its market relevance.

United States Carbon Fiber-Infused Polymers Market held 85% share in 2024, driven by the nation's strategic investment in innovation and advanced manufacturing. Public and private sector funding has facilitated the establishment of dedicated research centers and test beds focused on optimizing composite material production. These efforts aim to lower the cost of carbon fiber and improve its performance for commercial use, particularly in key sectors like defense, mobility, and clean energy.

Key companies operating in the Global Carbon Fiber-Infused Polymers Market include Toray Industries Inc., Teijin Limited, Hexcel Corporation, SGL Carbon, and Solvay S.A. These companies are at the forefront of innovation, focusing on developing advanced materials and manufacturing processes to meet the growing demands of various industries. To strengthen their market position, companies in the carbon fiber-infused polymers industry are adopting several strategic initiatives. These include investing in research and development to innovate and improve material properties, establishing joint ventures and partnerships to expand market reach, and enhancing manufacturing capabilities to meet increasing demand.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research methodology

- 1.1.1 Initial data exploration

- 1.1.2 Primary research methodology

- 1.1.3 Secondary research methodology

- 1.1.4 Market size estimation approach

- 1.1.5 Data triangulation techniques

- 1.1.6 Research assumptions

- 1.2 Market definition and scope

- 1.2.1 Base year and forecast period

- 1.2.2 Market segmentation

- 1.2.3 Regional scope

- 1.2.4 Currency conversion rates

- 1.3 Information procurement

- 1.3.1 Purchased database

- 1.3.2 GMI's internal database

- 1.3.3 Secondary sources

- 1.3.4 Primary research

- 1.4 Information analysis

- 1.4.1 Data analysis models

- 1.4.2 Market breakdown and data triangulation

Chapter 2 Executive Summary

- 2.1 Carbon fiber-infused polymers industry 3600 synopsis, 2021-2034

- 2.1.1 Business trends

- 2.1.2 Regional trends

- 2.1.3 Polymer type trends

- 2.1.4 Carbon fiber type trends

- 2.1.5 Manufacturing process trends

- 2.1.6 End use industry trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Raw material suppliers

- 3.1.2 Manufacturers

- 3.1.3 Distributors

- 3.1.4 End use

- 3.1.5 Profit margin analysis

- 3.1.6 Value chain disruptions due to COVID-19

- 3.2 Impact of trump administration tariffs – structured overview

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1.1 Supply-side impact (raw materials)

- 3.2.2.1.2 Price volatility in key materials

- 3.2.2.1.3 Supply chain restructuring

- 3.2.2.1.4 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Trade statistics (HS code)

- 3.3.1 Major exporting countries

- 3.3.2 Major importing countries

Note: the above trade statistics will be provided for key countries only.

- 3.4 Profit margin analysis

- 3.5 Key news & initiatives

- 3.5.1 Technology landscape

- 3.5.2 Traditional manufacturing technologies

- 3.5.3 Advanced manufacturing technologies

- 3.5.4 Emerging technologies

- 3.5.5 Patent analysis

- 3.6 Regulatory landscape

- 3.6.1 North America

- 3.6.2 Europe

- 3.6.3 Asia Pacific

- 3.6.4 Latin America

- 3.6.5 MEA

- 3.7 Market dynamics

- 3.7.1 Market drivers

- 3.7.1.1 Increasing demand for lightweight materials in the automotive and aerospace industries

- 3.7.1.2 Growing focus on fuel efficiency and emission reduction

- 3.7.1.3 Rising adoption in sports and leisure applications

- 3.7.1.4 Expanding the renewable energy sector

- 3.7.1.5 Technological advancements in manufacturing processes

- 3.7.2 Industry pitfalls and challenges

- 3.7.2.1 High production costs

- 3.7.2.2 Complex manufacturing processes

- 3.7.2.3 Recycling and end-of-life challenges

- 3.7.2.4 Supply chain vulnerabilities

- 3.7.1 Market drivers

- 3.8 Growth potential analysis

- 3.9 Porter's analysis

- 3.9.1 Supplier power

- 3.9.2 Buyer power

- 3.9.3 Threat of new entrants

- 3.9.4 Threat of substitutes

- 3.9.5 Industry rivalry

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Market share analysis, 2024

- 4.2 Competitive dashboard

- 4.3 Strategic initiatives

- 4.3.1 Mergers & acquisitions

- 4.3.2 Joint ventures

- 4.3.3 Product launches

- 4.3.4 Expansion plans

- 4.3.5 R&D investments

- 4.4 Competitive benchmarking

- 4.5 Vendor adoption matrix

- 4.6 Competitive positioning matrix

Chapter 5 Market Estimates and Forecast, By Polymer Type, 2021 - 2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Thermoplastic polymers

- 5.2.1 Polyamide (PA)

- 5.2.2 Polypropylene (PP)

- 5.2.3 Polyether ether ketone (PEEK)

- 5.2.4 Polyphenylene sulfide (PPS)

- 5.2.5 Polyetherimide (PEI)

- 5.2.6 Others

- 5.3 Thermoset polymers

- 5.3.1 Epoxy

- 5.3.2 Polyester

- 5.3.3 Vinyl ester

- 5.3.4 Polyurethane

- 5.3.5 Others

Chapter 6 Market Estimates and Forecast, By Carbon Fiber Type, 2021 - 2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Polyacrylonitrile (PAN)-based

- 6.2.1 Standard modulus

- 6.2.2 Intermediate modulus

- 6.2.3 High modulus

- 6.3 Pitch-based

- 6.4 Rayon-based

- 6.5 Recycled carbon fiber

Chapter 7 Market Estimates and Forecast, By Manufacturing Process, 2021 - 2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Injection molding

- 7.3 Compression molding

- 7.4 Resin transfer molding

- 7.5 Pultrusion

- 7.6 Filament winding

- 7.7 Additive manufacturing

- 7.8 Others

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Aerospace & defense

- 8.2.1 Aircraft components

- 8.2.2 Space applications

- 8.2.3 Defense equipment

- 8.3 Automotive

- 8.3.1 Structural components

- 8.3.2 Interior components

- 8.3.3 Powertrain components

- 8.3.4 Electric vehicle applications

- 8.4 Wind energy

- 8.4.1 Blades

- 8.4.2 Nacelles

- 8.4.3 Other components

- 8.5 Sports & leisure

- 8.5.1 Bicycles

- 8.5.2 Tennis rackets

- 8.5.3 Golf clubs

- 8.5.4 Others

- 8.6 Construction

- 8.6.1 Reinforcement materials

- 8.6.2 Structural components

- 8.6.3 Others

- 8.7 Marine

- 8.7.1 Hull structures

- 8.7.2 Deck components

- 8.7.3 Others

- 8.8 Medical

- 8.8.1 Prosthetics

- 8.8.2 Imaging equipment

- 8.8.3 Others

- 8.9 Industrial equipment

- 8.10 Others

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Rest of Latin America

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East and Africa

Chapter 10 Company Profiles

- 10.1 Carbon Fiber Composite Design

- 10.2 Composite Horizons LLC

- 10.3 Cytec Industries Inc.

- 10.4 DowAksa

- 10.5 Formosa Plastics Corporation

- 10.6 Hexcel Corporation

- 10.7 Hyosung Advanced Materials

- 10.8 Kureha Corporation

- 10.9 Mitsubishi Chemical Holdings Corporation

- 10.10 Nippon Carbon Co., Ltd.

- 10.11 Plasan Carbon Composites

- 10.12 SABIC

- 10.13 SGL Carbon

- 10.14 Sigmatex

- 10.15 Solvay S.A.

- 10.16 Teijin Limited

- 10.17 Toho Tenax Co., Ltd.

- 10.18 Toray Industries, Inc.

- 10.19 Zhongfu Shenying Carbon Fiber Co., Ltd.

- 10.20 Zoltek Companies, Inc.