PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750490

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750490

Metal Closures Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

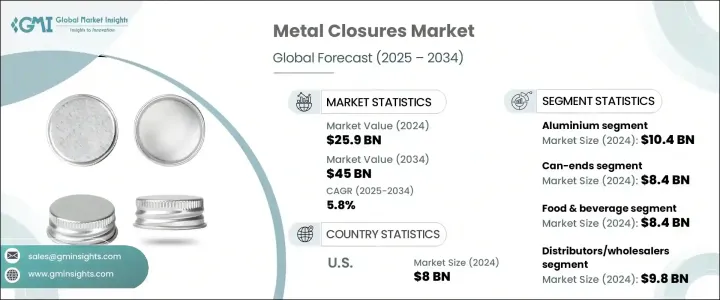

The Global Metal Closures Market was valued at USD 25.9 billion in 2024 and is estimated to grow at a CAGR of 5.8% to reach USD 45 billion by 2034. This growth is primarily driven by the increasing demand for packaged food and beverages, along with rising consumption of alcoholic drinks across both developed and emerging economies. As consumer lifestyles become more fast-paced and urbanized, the need for convenient, durable, and tamper-proof packaging solutions has grown substantially, fueling the adoption of metal closures. These closures are favored due to their ability to preserve product integrity, offer extended shelf life, and support sustainable packaging efforts. In recent years, market players have responded to evolving regulations and consumer expectations by incorporating environmentally friendly features and prioritizing recyclable materials.

The imposition of tariffs on imported aluminum and steel under the Trump administration significantly impacted the industry. These measures led to raw material cost surges-up to 25%-causing widespread disruptions for manufacturers reliant on imports. Domestic players faced tightened margins and had to pass on higher costs to customers. While some local metal producers benefited from the temporary pricing advantage, the broader industry dealt with heightened volatility and rising operational expenses. These challenges also encouraged firms to re-evaluate sourcing strategies, with many shifting towards automation and exploring alternative materials to stabilize production costs.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $25.9 Billion |

| Forecast Value | $45 Billion |

| CAGR | 5.8% |

By material, the market is segmented into aluminum, steel, tin, and others. The aluminum segment dominated in 2024, generating over USD 10.4 billion. Aluminum closures are widely chosen for their lightweight nature, which reduces logistics expenses, and their durability, which provides reliable sealing solutions. This material is especially favored for its resistance to corrosion and compatibility with acidic products. Its alignment with circular economy initiatives and rising corporate commitments toward sustainability are boosting its adoption across various industries.

In terms of product type, the market includes crown, can-ends, screw, twist, and other closures. The can-ends category emerged as the leading segment, surpassing USD 8.4 billion in 2024. Their increasing use in the packaging of food and beverages has significantly accelerated demand. These closures provide excellent sealing performance, making them ideal for maintaining freshness and preventing contamination. The popularity of convenient packaging solutions has also contributed to the rapid growth of this segment, especially in sectors where longevity and user-friendliness are essential.

Based on end-use, the metal closures market is divided into personal care and cosmetics, food and beverage, consumer goods, pharmaceuticals, and others. The food and beverage sector led the market in 2024 with a valuation of USD 8.4 billion. Changing consumption habits, increased preference for ready-to-eat meals, and the widespread use of airtight containers in processed food have all played a vital role in driving demand. Metal closures offer barrier properties that protect contents from moisture and oxygen, helping extend shelf life and maintain quality, especially for carbonated and fermented beverages.

Regarding distribution channels, the market is segmented into direct sales, distributors/wholesalers, retailers, and e-commerce. Distributors and wholesalers accounted for the highest market share in 2024, reaching USD 9.8 billion. The growth of this segment is attributed to bulk purchasing by manufacturers across various industries, ensuring reliable supply chain continuity. These distributors often cater to mid-sized firms with flexible order sizes and custom options, enabling them to meet the needs of niche markets and specialty packaging requirements.

The United States held the largest regional share in 2024, valued at USD 8 billion. The country's robust pharmaceutical production infrastructure, combined with stringent safety and packaging standards, has driven the adoption of advanced closure systems. Metal closures designed with tamper-evident and child-resistant features have become increasingly important for compliance and consumer safety. Demand is also being fueled by the rising popularity of premium packaged goods, along with increased consumption of alcohol-based beverages, all of which require secure and efficient sealing technologies.

Competition in the metal closures industry is intense, with the presence of both global and regional manufacturers. The top three companies- Silgan Holdings Inc., Crown Holdings Inc., and Guala Closures Group-together held a market share of over 12.8% in 2024. Leading firms continue to invest in research and development to introduce next-generation products focusing on lightweight materials, enhanced recyclability, and innovative sealing mechanisms. Features such as smart closures equipped with QR codes and NFC chips are gaining momentum as companies look to boost consumer engagement, traceability, and product safety. Additionally, the rising importance of health-conscious and traceable packaging is prompting manufacturers to develop closures with features like BPA-NI linings and high-barrier technologies. The growing popularity of online retail, direct-to-consumer brands, and craft production across industries is also amplifying the need for customizable, short-run closures that combine functionality with aesthetic appeal.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Rising demand for packaged food & beverages

- 3.3.1.2 Booming pharmaceutical industry

- 3.3.1.3 Increasing alcoholic beverage consumption

- 3.3.1.4 Long shelf life and hermetic sealing

- 3.3.1.5 Sustainability & recyclability appeal

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 Volatility in raw material prices

- 3.3.2.2 Substitution by lightweight flexible packaging

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Material, 2021 - 2034 (USD Million and Billion Units)

- 5.1 Key trends

- 5.2 Aluminum

- 5.3 Steel

- 5.4 Tin

- 5.5 Others

Chapter 6 Market Estimates and Forecast, By Type, 2021 - 2034 (USD Million and Billion Units)

- 6.1 Key trends

- 6.2 Crown

- 6.3 Can-ends

- 6.4 Screw

- 6.5 Twist

- 6.6 Others

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 (USD Million and Billion Units)

- 7.1 Key trends

- 7.2 Food & beverages

- 7.3 Pharmaceuticals

- 7.4 Consumer goods

- 7.5 Personal care & cosmetics

- 7.6 Others

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD Million and Billion Units)

- 8.1 Key trends

- 8.2 Direct sales

- 8.3 Distributors / wholesalers

- 8.4 Retailer

- 8.5 E-commerce

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million and Billion Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Amcor

- 10.2 AptarGroup

- 10.3 Berry Global

- 10.4 CL Smith

- 10.5 Closure Systems International

- 10.6 Crown Holdings

- 10.7 Finn-Korkki

- 10.8 Guala Closures

- 10.9 MJS Packaging

- 10.10 Metal Closures

- 10.11 Nippon Closures

- 10.12 O. Berk

- 10.13 Pelliconi

- 10.14 Silgan Holdings

- 10.15 Sonoco Products

- 10.16 Tecnocap