PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750497

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750497

Disposable Surgical Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

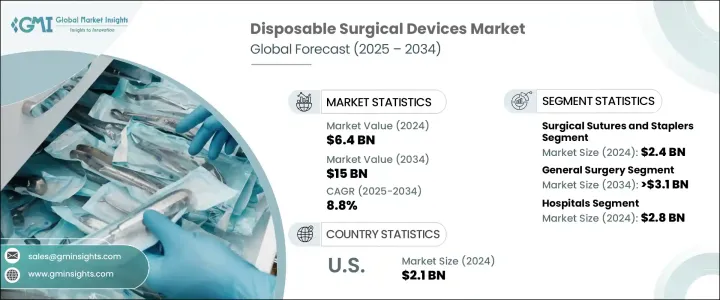

The Global Disposable Surgical Devices Market was valued at USD 6.4 billion in 2024 and is estimated to grow at a CAGR of 8.8% to reach USD 15 billion by 2034, driven by increasing surgical volumes, heightened infection control measures, and the rising global preference for minimally invasive procedures. Disposable instruments are gaining traction due to their efficiency, ease of use, and ability to maintain sterile conditions. As healthcare systems across developed and emerging economies look to streamline operations and reduce the risk of cross-contamination, single-use surgical tools are becoming a top priority. The shift toward automation and ergonomically advanced tools further supports adoption, particularly in high-throughput medical settings.

In the wake of the pandemic, healthcare providers adhere to stricter infection control policies. This has accelerated the move toward disposable surgical solutions, particularly as the number of elective and emergency procedures rebounds. These instruments offer clear benefits in hygiene, eliminate sterilization steps, and reduce turnaround times in operating rooms. Designed for single-use scenarios, they are proving vital in surgical environments that demand both speed and patient safety. From basic tools to advanced staplers and trocars, disposables ensure sterile conditions while improving procedural consistency.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.4 Billion |

| Forecast Value | $15 Billion |

| CAGR | 8.8% |

Among product types, the surgical sutures and staplers segment led the market with USD 2.4 billion in 2024. Their consistent usage in both traditional and minimally invasive procedures makes them indispensable. These tools help in wound management, ensuring proper closure, minimizing infections, and aiding faster recovery. Innovations like ergonomic designs, barbed sutures requiring no knots, and antimicrobial coatings have significantly enhanced their safety and efficiency, making them the top-performing product category.

The general surgery segment is projected to reach USD 3.1 billion by 2034, growing at a CAGR of 8.5%. This category covers several procedures, contributing to consistent demand for disposable surgical tools. The increasing rate of outpatient and inpatient interventions, along with the growing prevalence of chronic and acute conditions, is boosting demand for these devices. Medical institutions rely on single-use surgical tools for safety compliance and streamlined patient care, especially in high-volume environments.

U.S. Disposable Surgical Devices Market accounted for USD 2 billion in 2024 and is expected to grow at a CAGR of 7.7%. A strong regulatory framework, sophisticated healthcare infrastructure, and favorable reimbursement models all support rapid adoption of disposable instruments. Additionally, major medical device companies headquartered in the U.S. continue to drive market momentum.

Key players in this market include Smith+Nephew, CooperSurgical, Xenco Medical, BD, Johnson & Johnson, ZIMMER BIOMET, B Braun, Medtronic, Ambu, Surgical Innovations, Accutome, and Boston Scientific. To strengthen their foothold, companies prioritize innovation through R&D investments to enhance usability, safety, and performance. Many are expanding product portfolios with smart features such as antimicrobial coatings and knotless sutures. Strategic collaborations with hospitals and surgical centers are also helping secure supply contracts and deepen market penetration. Furthermore, manufacturers leverage automation and precision manufacturing to meet growing demand while maintaining cost-efficiency, enhancing their competitive edge across global markets.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising global surgical volume

- 3.2.1.2 Rapid technological innovation

- 3.2.1.3 Stringent infection control standards favoring disposable devices

- 3.2.1.4 Rising preference for minimally invasive procedures

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Environmental sustainability concerns

- 3.2.2.2 Cost and reimbursement barriers

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Trump administration tariffs

- 3.5.1 Impact on trade

- 3.5.1.1 Trade volume disruptions

- 3.5.1.2 Retaliatory measures

- 3.5.2 Impact on the Industry

- 3.5.2.1 Supply-side impact (raw materials)

- 3.5.2.1.1 Price volatility in key materials

- 3.5.2.1.2 Supply chain restructuring

- 3.5.2.1.3 Production cost implications

- 3.5.2.2 Demand-side impact (selling price)

- 3.5.2.2.1 Price transmission to end markets

- 3.5.2.2.2 Market share dynamics

- 3.5.2.2.3 Consumer response patterns

- 3.5.2.1 Supply-side impact (raw materials)

- 3.5.3 Key companies impacted

- 3.5.4 Strategic industry responses

- 3.5.4.1 Supply chain reconfiguration

- 3.5.4.2 Pricing and product strategies

- 3.5.4.3 Policy engagement

- 3.5.5 Outlook and future considerations

- 3.5.1 Impact on trade

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Surgical sutures and staplers

- 5.3 Handheld surgical devices

- 5.4 Disposable endoscopy devices

- 5.5 Electrosurgical devices

Chapter 6 Market Estimates and Forecast, By Procedure, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 General surgery

- 6.3 Plastic and reconstructive Surgery

- 6.4 Orthopedic surgery

- 6.5 Cardiovascular surgery

- 6.6 Neurosurgery

- 6.7 Obstetrics and gynecology

- 6.8 Wound closure

- 6.9 Other procedures

Chapter 7 Market Estimates and Forecast, By End Use 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Ambulatory surgical centers

- 7.4 Specialty clinics

- 7.5 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Accutome

- 9.2 Ambu

- 9.3 B Braun

- 9.4 BD

- 9.5 Boston Scientific

- 9.6 CooperSurgical

- 9.7 Johnson & Johnson

- 9.8 Medtronic

- 9.9 Smith+Nephew

- 9.10 Surgical Innovations

- 9.11 Xenco Medical

- 9.12 ZIMMER BIOMET