PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750502

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750502

Vessel Traffic Management Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

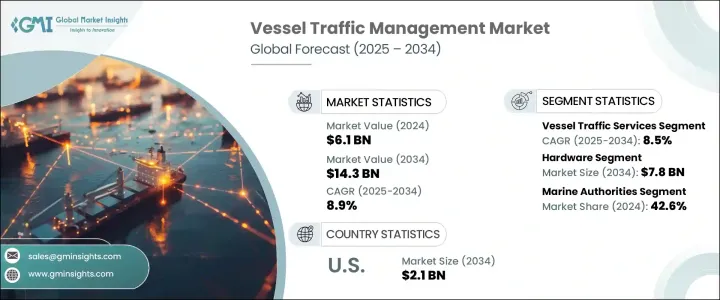

The Global Vessel Traffic Management Market was valued at USD 6.1 billion in 2024 and is estimated to grow at a CAGR of 8.9% to reach USD 14.3 billion by 2034, driven by the demand for smarter traffic systems capable of handling increasing vessel volumes efficiently and safely. Global port infrastructure is under pressure due to growing ship movements, driving the adoption of high-performance systems that enhance navigation, reduce bottlenecks, and boost port operations. Industry shifts caused by international trade policies and material price volatility prompt companies to localize production and rethink their supply chain strategies to reduce geopolitical risks. As ports face rising congestion, the need for technologies that can streamline operations while ensuring compliance with safety regulations is more important than ever.

The market is heavily influenced by the rising need for real-time ship monitoring in congested sea routes. Enhanced vessel traffic management systems that incorporate radar, VHF communications, and automatic identification technologies are becoming essential for both commercial and defense maritime authorities. These systems enable seamless coordination, situational awareness, and safer navigation through high-density traffic zones. One segment, Vessel Traffic Services, is experiencing significant traction due to growing interest in digital maritime infrastructure and increasing investments in port security and surveillance systems. With a focus on minimizing environmental risk and improving maritime logistics, demand for intelligent and connected technologies is surging across regions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.1 Billion |

| Forecast Value | $14.3 Billion |

| CAGR | 8.9% |

From a component standpoint, hardware holds a strong presence in the vessel traffic management ecosystem and is forecasted to hit USD 7.8 billion by 2034. This includes a wide range of maritime equipment necessary for data collection and transmission, such as sensors, radar, and communication modules. Tighter regulatory enforcement for ship safety continues to drive this demand. Although hardware dominates, the services segment is poised for accelerated growth as ports look for integrated solutions that include data analytics, remote management, and predictive maintenance.

Based on end-use, the marine authorities segment accounted for a 42.6% share in 2024, dominating the segment due to their critical role in regulating navigation safety and environmental standards. These authorities turn to vessel traffic systems to enhance control over ship traffic and ensure smooth operations in national and international waters. The reliance on real-time monitoring tools like radar, AIS, and integrated communications systems allows them to proactively manage maritime risks, mitigate congestion, and respond swiftly to emergencies.

U.S. Vessel Traffic Management Market is expected to reach USD 2.1 billion by 2034, supported by the push for stricter safety protocols and cutting-edge VTMS deployments. Federal mandates and Coast Guard initiatives have accelerated the rollout of modern monitoring systems across high-traffic zones. Furthermore, the nation's emphasis on upgrading port infrastructure and integrating AI-driven tools has spurred consistent demand for intelligent VTM platforms. However, budget constraints among smaller port operators, coupled with trade uncertainties and geopolitical tensions, remain barriers to rapid expansion in certain regions.

To solidify their competitive edge, companies like Northrop Grumman Corporation, Leonardo S.p.A., Kongsberg Gruppen, ST Engineering, and Saab AB are investing heavily in research and innovation. They leverage artificial intelligence, IoT, and predictive analytics to deliver smarter, scalable vessel traffic management solutions. Collaborations with governments and port authorities are also prioritized to gain access to high-potential markets. Many players are enhancing their service portfolios with end-to-end VTMS capabilities to address growing operational complexity and regulatory demands globally.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1.1 Supply chain reconfiguration

- 3.2.4.1.2 Pricing and product strategies

- 3.2.4.1.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Industry impact forces

- 3.3.1 Growth

- 3.3.1.1.1 Rising global maritime trade volumes

- 3.3.1.1.2 Increasing port congestion and demand for operational efficiency

- 3.3.1.1.3 Advancements in AI, ML, and real-time monitoring technologies

- 3.3.1.1.4 Stringent maritime safety and environmental regulations

- 3.3.1.1.5 Investments in port infrastructure modernization

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1.1 High installation and maintenance costs

- 3.3.2.1.2 Limited interoperability between legacy and modern systems

- 3.3.1 Growth

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By System Type, 2021 – 2034 (USD Billion)

- 5.1 Key trends

- 5.2 Vessel traffic services (VTS)

- 5.3 Port management systems (PMS)

- 5.4 Automatic identification system (AIS)

- 5.5 Radar-based systems

Chapter 6 Market Estimates and Forecast, By Component, 2021 – 2034 (USD Billion)

- 6.1 Key trends

- 6.2 Hardware

- 6.3 Software

- 6.4 Services

Chapter 7 Market Estimates and Forecast, By End Use, 2021 – 2034 (USD Billion)

- 7.1 Key trends

- 7.2 Marine authorities

- 7.3 Ports and harbours

- 7.4 Commercial vessel operators

- 7.5 Naval forces

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Billion)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Elcome International LLC

- 9.2 Frequentis

- 9.3 Furuno

- 9.4 Hensoldt

- 9.5 Indra Sistemas

- 9.6 Japan Radio Co. Ltd.

- 9.7 Kongsberg Gruppen

- 9.8 Leonardo S.p.A.

- 9.9 Marlink AS

- 9.10 Northrop Grumman Corporation

- 9.11 Saab

- 9.12 ST Engineering

- 9.13 Terma

- 9.14 Thales Group

- 9.15 Wartsilä