PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750506

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750506

Galvanized And Coated Iron and Steel Sheets Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

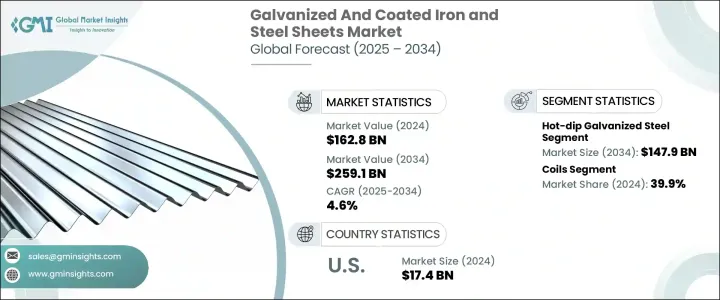

The Global Galvanized And Coated Iron and Steel Sheets Market was valued at USD 162.8 billion in 2024 and is estimated to grow at a CAGR of 4.6% to reach USD 259.1 billion by 2034, shaped by the surge in demand from industries such as automotive, construction, and consumer goods. Rapid urbanization and industrial expansion in developed and emerging economies help boost demand for durable and corrosion-resistant steel materials. These sheets offer longevity, structural integrity, and cost-effectiveness, essential in heavy-duty and long-term applications.

Additionally, the development of advanced surface treatments that enhance corrosion resistance, durability, and aesthetic appeal is expanding the application range of galvanized and coated iron and steel sheets. Manufacturers incorporate eco-friendly coating formulations that reduce toxic emissions and energy consumption during production. This aligns with growing regulatory pressures and customer demand for greener building and manufacturing materials. As a result, these innovations not only improve performance but also support compliance with sustainability standards, making them more appealing for use in construction, automotive, and industrial applications globally.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $162.8 Billion |

| Forecast Value | $259.1 Billion |

| CAGR | 4.6% |

Within the market, hot-dip galvanized steel continues to be the most widely used coating technique. This segment generated USD 95.7 billion in 2024 and is projected to reach USD 147.9 billion by 2034. Its dominance stems from superior durability, long-term corrosion protection, and affordability. The hot-dip process creates a zinc-steel bond that acts as a shield in aggressive environments, making it an ideal material for high-impact use in agriculture, infrastructure, transportation, and industrial projects.

Galvanized and coated steel in coil form remains a popular choice among large-scale users due to its ease of transportation and reduced inventory costs. In 2024, the coils segment accounted for a 39.9% share. Coils can be processed into specific dimensions on-site, minimizing waste and optimizing material usage. These characteristics make them ideal for streamlined operations in automotive production lines, modular housing projects, and prefabricated structures. Additionally, galvanized coils are seeing heightened demand as key raw materials in painted and aesthetic-grade building components, aligning with growing interest in green and energy-efficient construction.

United States Galvanized And Coated Iron and Steel Sheets Market stood at USD 17.4 billion in 2024 and is expected to register a CAGR of 4.9% through 2034. Robust demand is driven by the country's expanding automotive and infrastructure sectors, where corrosion resistance and extended material lifespan are critical requirements. Projects in bridges, commercial buildings, and transport networks continue to adopt these steel products due to their resilience and performance in various environments.

Key players in this market include POSCO, ArcelorMittal, Baowu Steel Group, TATA Steel, and Nippon Steel Corporation. These companies are strengthening their competitive edge by investing in advanced galvanizing technology, expanding production capacities, and forming strategic partnerships with end-use industries. A strong emphasis is placed on environmentally responsible methods and automation in manufacturing to reduce costs and support long-term scalability.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Report scope and objectives

- 1.2 Research design and approach

- 1.3 Data collection methods

- 1.3.1 Primary research

- 1.3.2 Secondary research

- 1.4 Market estimation and forecasting methodology

- 1.5 Assumptions and limitations

- 1.6 Data validation and triangulation techniques

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Galvanized and coated steel: fundamentals and evolution

- 3.1.1 Definition and classification of galvanized and coated steel products

- 3.1.2 Historical development of coating technologies

- 3.1.3 Raw materials and composition

- 3.1.3.1 Base steel types and properties

- 3.1.3.2 Zinc and zinc alloys

- 3.1.3.3 Aluminum and aluminum-zinc alloys

- 3.1.3.4 Polymers and organic coatings

- 3.1.3.5 Other coating materials

- 3.1.4 Manufacturing processes

- 3.1.4.1 Hot-dip galvanizing

- 3.1.4.2 Electro galvanizing

- 3.1.4.3 Galvannealing

- 3.1.4.4 Aluminizing and galvalume coating

- 3.1.4.5 Pre-painting and color coating

- 3.1.4.6 Other coating technologies

- 3.1.5 Comparative analysis: galvanized vs. Other coated steel products

- 3.1.6 Technological advancements in coating processes

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Trade statistics (HS Code)

- 3.3.1 Major exporting countries, 2021-2024 (USD Mn)

- 3.3.2 Major importing countries, 2021-2024 (USD Mn)

- 3.4 Summary

- 3.4.1 Market overview and key findings

- 3.4.2 Market size and growth projections

- 3.4.3 Key market drivers and restraints

- 3.4.4 Competitive landscape snapshot

- 3.4.5 Investment opportunities and strategic recommendations

- 3.4.6 Future outlook and market potential

- 3.5 Global galvanized and coated steel market overview

- 3.5.1 Market definition and scope

- 3.5.2 Market size and growth analysis

- 3.5.3 Market dynamics

- 3.5.3.1 Market drivers

- 3.5.3.1.1 Growing demand for corrosion-resistant materials

- 3.5.3.1.2 Expansion in construction and infrastructure development

- 3.5.3.1.3 Rising automotive production and lightweight trends

- 3.5.3.1.4 Increasing adoption in renewable energy applications

- 3.5.3.2 Market restraints

- 3.5.3.2.1 Volatility in raw material prices

- 3.5.3.2.2 Competition of alternative materials

- 3.5.3.2.3 Environmental concerns and regulatory challenges

- 3.5.3.3 Market opportunities

- 3.5.3.3.1 Growing demand in emerging markets

- 3.5.3.3.2 Innovations in coating technologies

- 3.5.3.3.3 Expansion in renewable energy infrastructure

- 3.5.3.4 Market challenges

- 3.5.3.4.1 Stringent Environmental Regulations

- 3.5.3.4.2 Supply chain disruptions

- 3.5.3.4.3 Fluctuating energy costs

- 3.5.3.1 Market drivers

- 3.5.4 Impact of covid-19 and post-pandemic recovery

- 3.5.5 Porter's five forces analysis

- 3.5.6 Pestle analysis

- 3.5.7 Value chain analysis

- 3.5.7.1 Raw material suppliers

- 3.5.7.2 Manufacturers

- 3.5.7.3 Distributors and retailers

- 3.5.7.4 End users

- 3.6 Manufacturing and production analysis

- 3.6.1 Manufacturing process overview

- 3.6.1.1 Raw material procurement and preparation

- 3.6.1.2 Base steel production

- 3.6.1.3 Surface preparation

- 3.6.1.4 Coating application processes

- 3.6.1.5 Post-coating treatments

- 3.6.1.6 Quality control and testing

- 3.6.2 Production cost analysis

- 3.6.2.1 Raw material costs

- 3.6.2.2 Energy costs

- 3.6.2.3 Labor costs

- 3.6.2.4 Manufacturing overheads

- 3.6.2.5 Cost optimization strategies

- 3.6.3 Manufacturing facilities analysis

- 3.6.3.1 Key manufacturing locations

- 3.6.3.2 Production capacity assessment

- 3.6.3.3 Facility expansion plans

- 3.6.4 Supply chain challenges and solutions

- 3.6.5 Sustainability in manufacturing processes

- 3.6.5.1 Energy efficiency measures

- 3.6.5.2 Waste reduction strategies

- 3.6.5.3 Water conservation practices

- 3.6.5.4 Eco-friendly coating technologies

- 3.6.1 Manufacturing process overview

- 3.7 Regulatory landscape and standards

- 3.7.1 Global regulatory framework

- 3.7.2 Regional regulatory frameworks

- 3.7.2.1 North America

- 3.7.2.1.1 ASTM standards

- 3.7.2.1.2 Building codes and regulations

- 3.7.2.1.3 Environmental regulations

- 3.7.2.2 Europe

- 3.7.2.2.1 EN standards

- 3.7.2.2.2 CE marking requirements

- 3.7.2.2.3 Environmental regulations

- 3.7.2.3 Asia-pacific

- 3.7.2.3.1 JIS standards (Japan)

- 3.7.2.3.2 GB standards (China)

- 3.7.2.3.3 BIS standards (India)

- 3.7.2.4 Rest of the world

- 3.7.2.1 North America

- 3.7.3 Product certification and standards

- 3.7.3.1 Quality standards

- 3.7.3.2 Safety standards

- 3.7.3.3 Environmental standards

- 3.7.4 Compliance challenges and strategies

- 3.7.5 Future regulatory trends and their implications

- 3.8 Environmental, social, and governance (ESG) analysis

- 3.8.1 Environmental impact assessment

- 3.8.1.1 Carbon footprint analysis

- 3.8.1.2 Life cycle assessment (LCA)

- 3.8.1.3 Energy consumption and emissions

- 3.8.1.4 Waste management and recycling

- 3.8.2 Social implications

- 3.8.2.1 Labor practices and working conditions

- 3.8.2.2 Community impact and engagement

- 3.8.2.3 Health and safety considerations

- 3.8.3 Governance and ethical considerations

- 3.8.3.1 Corporate governance practices

- 3.8.3.2 Ethical supply chain management

- 3.8.3.3 Transparency and reporting

- 3.8.4 ESG performance benchmarking of key players

- 3.8.5 ESG risk assessment and mitigation strategies

- 3.8.6 Future ESG trends in the galvanized and coated steel industry

- 3.8.1 Environmental impact assessment

- 3.9 Consumer behavior and market trends analysis

- 3.9.1 Consumer preferences and purchasing patterns

- 3.9.2 Factors influencing purchase decisions

- 3.9.2.1 Price sensitivity

- 3.9.2.2 Quality and performance requirements

- 3.9.2.3 Environmental considerations

- 3.9.2.4 Aesthetic preferences

- 3.9.3 Industry-specific preferences

- 3.9.3.1 Construction industry preferences

- 3.9.3.2 Automotive industry preferences

- 3.9.3.3 Appliance industry preferences

- 3.9.4 Regional variations in consumer behavior

- 3.9.5 Impact of digital transformation on consumer engagement

- 3.9.6 Future consumer trends and their implications

- 3.10 Technological landscape and innovation analysis

- 3.10.1 Current technological trends in galvanized and coated steel

- 3.10.2 Emerging technologies and their potential impact

- 3.10.2.1 Advanced coating formulations

- 3.10.2.2 Nanotechnology applications

- 3.10.2.3 Digital manufacturing and industry 4.0

- 3.10.2.4 Automation and robotics in coating processes

- 3.10.3 R&D activities and innovation hubs

- 3.10.4 Technology adoption trends across applications

- 3.10.5 Technology readiness assessment

- 3.10.6 Future technology roadmap 2025–2033

- 3.11 Pricing analysis and economic factors

- 3.11.1 Pricing trends analysis

- 3.11.1.1 Historical price trends

- 3.11.1.2 Current pricing scenario

- 3.11.1.3 Price forecast

- 3.11.2 Factors affecting pricing

- 3.11.2.1 Raw material costs

- 3.11.2.2 Energy prices

- 3.11.2.3 Labor costs

- 3.11.2.4 Supply-demand dynamics

- 3.11.2.5 Trade policies and tariffs

- 3.11.3 Regional price variations

- 3.11.4 Price-value relationship analysis

- 3.11.5 Economic indicators impacting the market

- 3.11.5.1 GDP growth and construction activity

- 3.11.5.2 Industrial production index

- 3.11.5.3 Automotive production trends

- 3.11.5.4 Infrastructure investment

- 3.11.6 Pricing strategies for key market players

- 3.11.1 Pricing trends analysis

- 3.12 Sustainability and circular economy

- 3.12.1 Sustainable sourcing of raw materials

- 3.12.2 Energy efficiency in production

- 3.12.3 Waste reduction and recycling initiatives

- 3.12.4 Carbon footprint reduction strategies

- 3.12.5 Circular economy models in galvanized and coated steel

- 3.12.5.1 Product life extension strategies

- 3.12.5.2 End-of-life management

- 3.12.5.3 Recycling and upcycling opportunities

- 3.12.6 Case studies of sustainable practices

- 3.12.7 Future of sustainability in the industry

- 3.13 Market opportunities and strategic recommendations

- 3.13.1 Untapped market opportunities

- 3.13.2 Strategic recommendations for market participants

- 3.13.2.1 For manufacturers

- 3.13.2.2 For investors

- 3.13.2.3 For end-user industries

- 3.13.3 New product development opportunities

- 3.13.4 Market entry strategies for new players

- 3.13.5 Diversification opportunities

- 3.13.6 Strategic partnerships and collaboration opportunities

- 3.14 Investment analysis and market attractiveness

- 3.14.1 Current investment scenario

- 3.14.2 Investment opportunities by segment

- 3.14.3 Investment opportunities by region

- 3.14.4 Roi analysis

- 3.14.5 Venture capital and private equity landscape

- 3.14.6 M&A activity analysis

- 3.14.7 Future investment outlook

- 3.15 Risk assessment and mitigation strategies

- 3.15.1 Market risks

- 3.15.2 Technological risks

- 3.15.3 Regulatory risks

- 3.15.4 Competitive risks

- 3.15.5 Supply chain risks

- 3.15.6 Environmental and sustainability risks

- 3.15.7 Risk mitigation strategies

- 3.16 Future outlook and market evolution

- 3.16.1 Long-term market forecast

- 3.16.2 Emerging applications and use cases

- 3.16.3 Technological evolution scenarios

- 3.16.4 Future market dynamics

- 3.16.5 Potential disruptors and game-changers

- 3.16.6 Future competitive landscape

Chapter 4 Competitive Landscape, 2024

- 4.1 Market share analysis of key players

- 4.2 Competitive positioning matrix

- 4.3 Competitive strategies adopted by key players

- 4.3.1 Product innovation and development

- 4.3.2 Mergers and acquisitions

- 4.3.3 Partnerships and collaborations

- 4.3.4 Expansion strategies

- 4.4 Swot analysis of key players

- 4.5 Detailed company profiles of major market players

- 4.5.1 ArcelorMittal

- 4.5.2 Nippon steel corporation

- 4.5.3 POSCO

- 4.5.4 Tata steel

- 4.5.5 Baowu steel group

- 4.5.6 JFE steel corporation

- 4.5.7 Nucor corporation

- 4.5.8 Thyssenkrupp

- 4.5.9 United States steel corporation

- 4.5.10 Cleveland-cliffs

- 4.5.11 Steel dynamics

- 4.5.12 Hyundai steel

- 4.5.13 Bluescope steel

- 4.5.14 Jindal steel & power

- 4.5.15 Other notable players

- 4.6 Emerging players and startups in galvanized and coated steel market

- 4.7 Patent analysis and intellectual property landscape

- 4.7.1 Recent patent filings

- 4.7.2 Patent ownership analysis

- 4.7.3 Technology trend analysis based on patents

Chapter 5 Market Size and Forecast, By Coating Type, 2021-2034 (USD Million) (Tons)

- 5.1 Key trends

- 5.2 Hot-dip galvanized steel

- 5.3 Electrogalvanized steel

- 5.4 Galvannealed steel

- 5.5 Galvalume (zinc-aluminum coated) steel

- 5.6 Aluminized steel

- 5.7 Pre-painted galvanized steel (PPGI)

- 5.8 Other

Chapter 6 Market Size and Forecast, By Product Form, 2021-2034 (USD Million) (Tons)

- 6.1 Key trends

- 6.2 Coils

- 6.3 Sheets

- 6.4 Plates

- 6.5 Bars and wires

- 6.6 Others

Chapter 7 Market Size and Forecast, By Coating Weight, 2021-2034 (USD Million) (Tons)

- 7.1 Key trends

- 7.2 Light coating (G30–G60)

- 7.3 Medium coating (G90–G235)

- 7.4 Heavy coating (G240 and above)

Chapter 8 Market Size and Forecast, By Base Steel Grade, 2021-2034 (USD Million) (Tons)

- 8.1 Key trends

- 8.2 Commercial steel

- 8.3 Drawing steel

- 8.4 Structural steel

- 8.5 High-strength low-alloy steel (HSLA)

- 8.6 Advanced high-strength steel (AHSS)

- 8.7 Others

Chapter 9 Market Size and Forecast, By End Use Industry, 2021-2034 (USD Million) (Tons)

- 9.1 Key trends

- 9.2 Construction and infrastructure

- 9.2.1 Residential construction

- 9.2.2 Commercial construction

- 9.2.3 Industrial construction

- 9.2.4 Infrastructure development

- 9.3 Automotive and transportation

- 9.3.1 Passenger vehicles

- 9.3.2 Commercial vehicles

- 9.3.3 Railway and metro systems

- 9.3.4 Shipbuilding

- 9.4 Home appliances and electronics

- 9.4.1 White goods

- 9.4.2 HVAC systems

- 9.4.3 Electronic enclosures

- 9.5 Energy and power

- 9.5.1 Solar energy systems

- 9.5.2 Wind energy infrastructure

- 9.5.3 Power transmission and distribution

- 9.6 Agriculture

- 9.7 Industrial equipment and machinery

- 9.8 Others

Chapter 10 Market Size and Forecast, By Specific Applications, 2021-2034 (USD Million) (Tons)

- 10.1 Key trends

- 10.2 Roofing and cladding

- 10.3 Structural components

- 10.4 Automotive body parts

- 10.5 Appliance casings

- 10.6 Electrical conduits and enclosures

- 10.7 HVAC ductwork

- 10.8 Others

Chapter 11 Market Size and Forecast, By Distribution Channel, 2021-2034 (USD Million) (Tons)

- 11.1 Key trends

- 11.2 Direct sales

- 11.3 Distributors and service centers

- 11.4 Retail outlets

- 11.5 E-commerce

- 11.6 Others

Chapter 12 Market Size and Forecast, By Region, 2021-2034 (USD Million) (Tons)

- 12.1 Key trends

- 12.2 North America

- 12.2.1 U.S.

- 12.2.2 Canada

- 12.3 Europe

- 12.3.1 UK

- 12.3.2 Germany

- 12.3.3 France

- 12.3.4 Italy

- 12.3.5 Spain

- 12.3.6 Rest of Europe

- 12.4 Asia Pacific

- 12.4.1 China

- 12.4.2 India

- 12.4.3 Japan

- 12.4.4 South Korea

- 12.4.5 Australia

- 12.4.6 Rest of Asia Pacific

- 12.5 Latin America

- 12.5.1 Brazil

- 12.5.2 Mexico

- 12.5.3 Argentina

- 12.5.4 Rest of Latin America

- 12.6 MEA

- 12.6.1 South Africa

- 12.6.2 Saudi Arabia

- 12.6.3 UAE

- 12.6.4 Rest of Middle East & Africa

Chapter 13 Company Profiles

- 13.1 ArcelorMittal

- 13.2 Nippon Steel Corporation

- 13.3 POSCO

- 13.4 Tata Steel

- 13.5 Baowu Steel

- 13.6 JFE Steel Corporation

- 13.7 Nucor Corporation

- 13.8 ThyssenKrupp

- 13.9 United States Steel

- 13.10 Cleveland-Cliffs

- 13.11 Steel Dynamics

- 13.12 Hyundai Steel

- 13.13 BlueScope Steel

- 13.14 Jindal Steel & Power