PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750518

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750518

RTD Tea Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

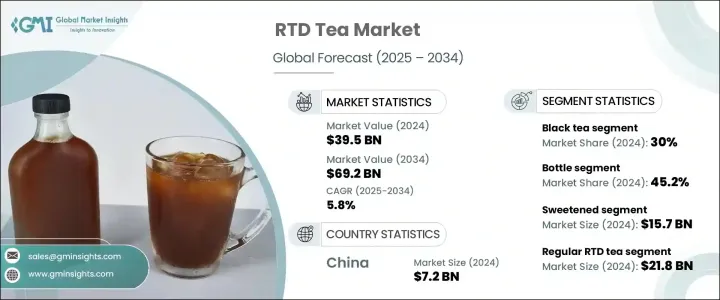

The Global RTD Tea Market was valued at USD 39.5 billion in 2024 and is estimated to grow at a CAGR of 5.8% to reach USD 69.2 billion by 2034, driven by increasing health awareness among consumers and the rising demand for convenient beverage options. As more people look for healthier alternatives to sugary drinks, RTD tea has gained popularity for its natural ingredients like green tea, matcha, and herbal teas. There is a growing preference for clean-label products, and consumers are seeking beverages that offer added health benefits such as antioxidants, probiotics, and adaptogens. Sustainability also plays a significant role, with recyclable packaging materials becoming a key factor in purchasing decisions.

RTD tea serves as a healthier, low-calorie option compared to soft drinks and sugary juices, making it a favorite among office workers, athletes, and health-conscious individuals. It is widely accessible through supermarkets, convenience stores, vending machines, and online platforms, catering to people of all ages. Depending on the variant, RTD tea offers various health benefits, from boosting mental alertness with green and black teas to aiding digestion with herbal or kombucha options. Its portability, variety of flavors, and health advantages make it an ideal choice for many consumers looking for a tasty, convenient drink.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $39.5 Billion |

| Forecast Value | $69.2 Billion |

| CAGR | 5.8% |

The bottle-based packaging segment commands the largest portion of the RTD tea market, holding a substantial 45.2% share in 2024 and projected to grow steadily at a 6% CAGR through 2034. Bottled RTD teas are preferred by consumers largely due to their user-friendly design, particularly the resealable caps that make them ideal for active, on-the-go lifestyles. These bottles offer superior protection against external elements, preserving the product's taste, freshness, and nutritional integrity over time. Their sturdy build, easy handling, and storage, especially in retail and vending environments.

The sweetened RTD tea segment generated USD 15.7 billion in 2024. This category resonates strongly with a wide consumer base, offering a variety of flavors that cater to both mildly sweet and heavily sweetened preferences. Its popularity stems from its refreshing taste and familiarity, making it a go-to beverage for those seeking instant gratification in flavor. Despite its dominance, the segment is gradually evolving as more health-conscious consumers demand reduced sugar content and better-for-you options. This shift has prompted brands to innovate with naturally sweetened and low-calorie formulations to balance indulgence with wellness.

Asia-Pacific RTD Tea Market generated USD 7.2 billion in 2024 and is anticipated to have a CAGR of 5.6% through 2034. China's leadership in the market is deeply rooted in its cultural affinity for tea, strong domestic production capabilities, and increasing consumer awareness around the benefits of functional teas. As the nation's urban population grows and lifestyles become more fast-paced, the convenience and portability of RTD teas are becoming essential for on-the-go hydration. Additionally, the fusion of traditional flavors with modern health benefits has positioned RTD teas as a preferred beverage among the younger, health-aware population.

Companies like Unilever PLC, Nestle S.A., Suntory Holdings, PepsiCo Inc., and The Coca-Cola Company focus on expanding their product ranges, particularly in the functional tea segment. These companies are investing in sustainable packaging solutions, offering flavors, and partnering with local distributors to strengthen their presence in key markets. By improving accessibility through retail and online channels and focusing on health-focused innovations, these players aim to capture more of the growing RTD tea market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Trade statistics (HS Code)

- 3.3.1 Major exporting countries, 2021-2024 (Kilo Tons)

- 3.3.2 Major importing countries, 2021-2024 (Kilo Tons)

Note: the above trade statistics will be provided for key countries only.

- 3.4 Industry value chain analysis

- 3.5 Product overview

- 3.5.1 Tea processing methods

- 3.5.2 RTD tea production process

- 3.5.3 Preservation technologies

- 3.5.4 Flavor enhancement techniques

- 3.6 Market dynamics

- 3.6.1 Market drivers

- 3.6.1.1 Rising demand for healthy and functional beverages

- 3.6.1.2 Increasing urbanization and busy lifestyles

- 3.6.1.3 Innovation in flavors and tea blends

- 3.6.2 Market Restraints

- 3.6.2.1 High competition from other RTD beverages

- 3.6.2.2 Fluctuating raw material (tea leaf) prices

- 3.6.3 Market opportunities

- 3.6.4 Market challenges

- 3.6.1 Market drivers

- 3.7 Industry impact forces

- 3.7.1 Growth potential analysis

- 3.7.2 Industry pitfalls & challenges

- 3.8 Regulatory framework & standards

- 3.8.1 Food safety regulations

- 3.8.2 Labeling requirements

- 3.8.3 Organic & natural product certifications

- 3.8.4 Health claim regulations

- 3.9 Manufacturing process analysis

- 3.9.1 Tea extraction methods

- 3.9.2 Blending & formulation

- 3.9.3 Pasteurization & preservation

- 3.9.4 Packaging technologies

- 3.10 Raw material analysis & procurement strategies

- 3.11 Pricing analysis

- 3.12 Sustainability & environmental impact assessment

- 3.13 PESTLE analysis

- 3.14 Porter's Five Forces Analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Strategic framework

- 4.2.1 Mergers & acquisitions

- 4.2.2 Joint ventures & collaborations

- 4.2.3 New product developments

- 4.2.4 Expansion strategies

- 4.3 Competitive benchmarking

- 4.4 Vendor landscape

- 4.5 Competitive positioning matrix

- 4.6 Strategic dashboard

- 4.7 Brand positioning & consumer perception analysis

- 4.8 Market entry strategies for new players

Chapter 5 Market Size and Forecast, By Product Type 2021 - 2034 (USD Billion, Kilo Tons)

- 5.1 Key trends

- 5.2 Black tea

- 5.2.1 Sweetened black tea

- 5.2.2 Unsweetened black tea

- 5.2.3 Flavored black tea

- 5.3 Green tea

- 5.3.1 Sweetened green tea

- 5.3.2 Unsweetened green tea

- 5.3.3 Flavored green tea

- 5.4 Herbal tea

- 5.4.1 Chamomile

- 5.4.2 Mint

- 5.4.3 Rooibos

- 5.4.4 Other herbal teas

- 5.5 Fruit tea

- 5.5.1 Citrus

- 5.5.2 Berry

- 5.5.3 Tropical

- 5.5.4 Mixed fruit

- 5.6 Oolong Tea

- 5.7 White Tea

- 5.8 Matcha Tea

- 5.9 Kombucha

- 5.10 Other

Chapter 6 Market Size and Forecast, By Packaging, 2021 - 2034 (USD Billion, Kilo Tons)

- 6.1 Key trends

- 6.2 Bottles

- 6.2.1 PET bottles

- 6.2.2 Glass bottles

- 6.2.3 Other bottle types

- 6.3 Cans

- 6.3.1 Aluminum cans

- 6.3.2 Steel cans

- 6.4 Cartons

- 6.4.1 Aseptic cartons

- 6.4.2 Gable top cartons

- 6.5 Pouches

- 6.6 Other

Chapter 7 Market Size and Forecast, By Sweetness Level, 2021 - 2034 (USD Billion, Kilo Tons)

- 7.1 Key trend

- 7.2 Sweetened

- 7.2.1 Regular sugar

- 7.2.2 High fructose corn syrup

- 7.2.3 Honey & natural sweeteners

- 7.3 Reduced sugar

- 7.4 Unsweetened

- 7.5 Artificially sweetened

- 7.5.1 Aspartame

- 7.5.2 Sucralose

- 7.5.3 Stevia

- 7.5.4 Other

Chapter 8 Market Size and Forecast, By Functional Benefits, 2021 - 2034 (USD Billion, Kilo Tons)

- 8.1 Key trend

- 8.2 Regular RTD tea

- 8.3 Fortified RTD tea

- 8.3.1 Vitamin-enriched

- 8.3.2 Mineral-enriched

- 8.3.3 Antioxidant-enhanced

- 8.4 Functional RTD tea

- 8.4.1 Energy-boosting

- 8.4.2 Immunity-supporting

- 8.4.3 Digestive health

- 8.4.4 Relaxation & stress relief

- 8.5 Organic RTD tea

- 8.6 Clean Label RTD tea

Chapter 9 Market Size and Forecast, By Distribution Channel, 2021 - 2034 (USD Billion, Kilo Tons)

- 9.1 Key trend

- 9.2 Supermarkets & hypermarkets

- 9.3 Convenience stores

- 9.4 Specialty stores

- 9.5 Online retail

- 9.6 Foodservice

- 9.6.1 Cafes & restaurants

- 9.6.2 Fast food chains

- 9.6.3 Institutional catering

- 9.7 Vending machines

- 9.8 Other

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Kilo Tons)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Rest of Europe

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Rest of Asia Pacific

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.5.4 Rest of Latin America

- 10.6 Middle East and Africa

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

- 10.6.4 Rets of Middle East & Africa

Chapter 11 Company Profiles

- 11.1 The Coca-Cola Company

- 11.2 PepsiCo, Inc

- 11.3 Unilever PLC

- 11.4 Nestle S.A.

- 11.5 Suntory Holdings Limited

- 11.6 ITO EN, Ltd.

- 11.7 Danone S.A.

- 11.8 Arizona Beverages USA

- 11.9 Keurig Dr Pepper Inc.

- 11.10 Tata Consumer Products Limited

- 11.11 Starbucks Corporation

- 11.12 Honest Tea (Coca-Cola)

- 11.13 Lipton (Unilever/PepsiCo)

- 11.14 Tejava (Crystal Geyser Water Company)

- 11.15 Harney & Sons

- 11.16 The Republic of Tea

- 11.17 Numi Organic Tea

- 11.18 Pokka Corporation

- 11.19 Oi Ocha (ITO EN)

- 11.20 Vita Coco

- 11.21 GT's Living Foods (Kombucha)

- 11.22 Health-Ade Kombucha

- 11.23 Steaz

- 11.24 Pure Leaf (Unilever/PepsiCo)

- 11.25 Gold Peak (Coca-Cola)

- 11.26 Snapple (Keurig Dr Pepper)

- 11.27 Tazo (Unilever)

- 11.28 Fuze Tea (Coca-Cola)