PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750528

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750528

Bench-top Dental Autoclaves Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

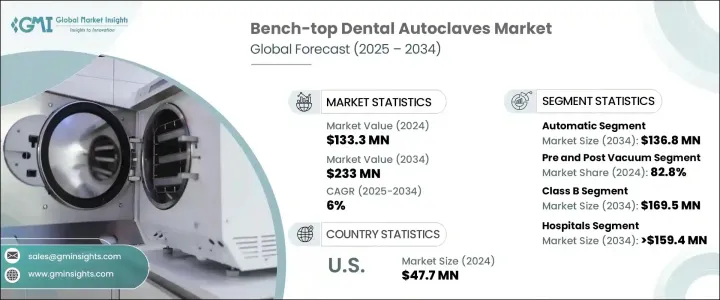

The Global Bench-top Dental Autoclaves Market was valued at USD 133.3 million in 2024 and is estimated to grow at a CAGR of 6% to reach USD 233 million by 2034. Bench-top dental autoclaves are essential for sterilizing equipment used during dental procedures, and the demand for these devices is rising due to factors like the increasing elderly population and heightened awareness of infection control. As the global population ages, dental issues such as tooth loss from gum disease, tooth decay, and other oral health problems become increasingly prevalent. These conditions are more common among older adults, prompting a greater demand for dental treatments and, consequently, sterilization solutions. The need to ensure equipment remains free from harmful bacteria and viruses further drives the adoption of bench-top dental autoclaves.

In addition to the aging population, there is a growing global awareness of the importance of hygiene and infection control within dental practices. This has led to stricter regulations and higher standards for sterilization in dental clinics, contributing significantly to the bench-top dental autoclave market. As dental professionals strive to meet these rigorous standards, the demand for advanced sterilization devices is steadily rising.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $133.3 Million |

| Forecast Value | $233 Million |

| CAGR | 6% |

The rising demand for automated sterilization processes drives the market, as dental clinics are more efficient and precise equipment. The automatic autoclaves segment is projected to grow at a CAGR of 6.1% by 2034. These devices help dental professionals maintain high standards of sterilization with minimal human intervention, reducing errors and ensuring consistent, reliable results. The technological advancements, including touch-screen interfaces and self-diagnostics, make these autoclaves more user-friendly and efficient. In addition, they align with the growing emphasis on stringent infection control protocols.

The bench-top dental autoclave market has two major technology categories: pre- and post-vacuum and gravity. The pre- and post-vacuum segment holds the largest share, accounting for 82.8% in 2024, and this trend is expected to continue. These autoclaves use advanced technology to remove air and moisture from the chamber before and after sterilization, ensuring superior steam penetration and faster drying times. As a result, they are increasingly favored in dental practices that require rapid sterilization cycles and compliance with high sterilization standards.

United States Bench-top Dental Autoclaves Market was valued at USD 47.7 million in 2024 and is expected to grow at a CAGR of 5.3% through 2034, driven by the increased focus on patient safety and the need for highly effective sterilization processes. U.S. dental clinics are under constant pressure to maintain high hygiene standards, leading them to invest in more advanced and efficient sterilization equipment. The U.S. healthcare sector, known for its innovative approach, encourages the development of cutting-edge autoclaves that feature faster sterilization cycles, more intuitive user interfaces, and compliance with the most stringent health and safety regulations.

Key players in the market include companies like Biolab Scientific, Bionics Scientific, Dentsply Sirona, Flight Dental Systems, and FONA. These companies focus on continuous product innovation, improving user interfaces, enhancing sterilization efficiency, and complying with regulatory standards to strengthen their presence in the market. To strengthen their market position, companies invest in R&D to develop next-generation autoclaves with advanced features like faster sterilization cycles, user-friendly touch-screen controls, and enhanced safety mechanisms. They focus on expanding their global reach by entering emerging markets, offering cost-effective solutions, and forming strategic partnerships with dental equipment distributors to cater to the growing demand for sterilization in dental clinics.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing demand for automatic bench-top dental autoclaves

- 3.2.1.2 Growing focus on infection control

- 3.2.1.3 Technological advancement in autoclave

- 3.2.1.4 Rising prevalence of dental disorders

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Adoption of refurbished dental autoclaves

- 3.2.2.2 Limited awareness in developing economies

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Technological landscape

- 3.5 Regulatory landscape

- 3.6 Trump administration tariffs

- 3.6.1 Impact on trade

- 3.6.1.1 Trade volume disruptions

- 3.6.1.2 Country-wise response

- 3.6.2 Impact on the industry

- 3.6.2.1 Supply-side impact (Cost of manufacturing)

- 3.6.2.1.1 Price volatility in key materials

- 3.6.2.1.2 Supply chain restructuring

- 3.6.2.1.3 Production cost implications

- 3.6.2.2 Demand-side impact (Cost to consumers)

- 3.6.2.2.1 Price transmission to end markets

- 3.6.2.2.2 Market share dynamics

- 3.6.2.2.3 Consumer response patterns

- 3.6.2.1 Supply-side impact (Cost of manufacturing)

- 3.6.3 Key companies impacted

- 3.6.4 Strategic industry responses

- 3.6.4.1 Supply chain reconfiguration

- 3.6.4.2 Pricing and product strategies

- 3.6.4.3 Policy engagement

- 3.6.5 Outlook and future considerations

- 3.6.1 Impact on trade

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Automatic

- 5.3 Semi-automatic

- 5.4 Manual

Chapter 6 Market Estimates and Forecast, By Technology, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Pre and post vacuum

- 6.3 Gravity

Chapter 7 Market Estimates and Forecast, By Class, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Class B

- 7.3 Class N

- 7.4 Class S

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals and dental clinics

- 8.3 Dental laboratories

- 8.4 Academic and research institutes

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Biolab Scientific

- 10.2 Bionics Scientific

- 10.3 Dentsply Sirona

- 10.4 Flight Dental Systems

- 10.5 FONA

- 10.6 Labocon

- 10.7 Life Steriware

- 10.8 Matachana

- 10.9 Midmark Corporation

- 10.10 NSK

- 10.11 RAYPA

- 10.12 Steelco

- 10.13 Thermo Fisher Scientific

- 10.14 Tuttnauer

- 10.15 W&H