PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750533

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750533

Algae-based Ingredients Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

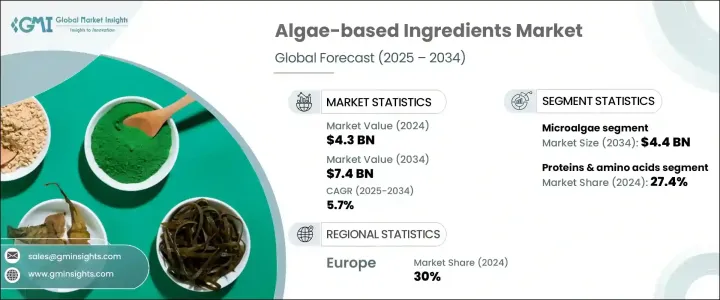

The Global Algae-based Ingredients Market was valued at USD 4.3 billion in 2024 and is estimated to grow at a CAGR of 5.7% to reach USD 7.4 billion by 2034, driven by the rising demand for plant-based and functional ingredients, as consumers increasingly seek nutritional alternatives to combat lifestyle-related diseases. With metabolic disorders such as obesity, cardiovascular conditions, and type 2 diabetes becoming more common due to poor eating habits and sedentary lifestyles, there's a growing preference for natural health-supportive ingredients. Algae-derived compounds offer a unique set of benefits, including omega-3 fatty acids, antioxidants, essential amino acids, and plant-based proteins. These properties have positioned algae as a go-to ingredient in functional foods, dietary supplements, and nutraceutical formulations.

As wellness becomes a global priority, algae-based ingredients continue gaining recognition for their preventative and therapeutic roles in human health. Consumers are increasingly drawn to natural, plant-derived solutions that align with clean-label and sustainable living trends, and algae fits perfectly into this narrative. These ingredients offer a rare combination of high nutritional density, bioactive compounds, and functional benefits that support immunity, cardiovascular health, cognitive function, and inflammation reduction. Their versatility allows them to be incorporated across various applications, from dietary supplements and fortified foods to skincare and pharmaceutical formulations.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.3 Billion |

| Forecast Value | $7.4 Billion |

| CAGR | 5.7% |

The microalgae segment is expected to reach USD 4.4 billion by 2034, due to their nutrient-rich profile and broad application across food, nutraceutical, and cosmetic products. Compounds like spirulina and astaxanthin are gaining traction thanks to their high protein, lipid, and antioxidant content. Innovations in cultivation methods, such as photobioreactors, are improving the efficiency and scalability of microalgae production. On the other hand, macroalgae remain relevant due to their utility in hydrocolloid production. Extracts like agar, alginate, and carrageenan are vital in the food industry for their stabilizing and thickening properties, making macroalgae an essential raw material.

Based on product segmentation, the proteins and amino acids segment held the largest market share in 2024, accounting for 27.4%, and is expected to grow steadily at a CAGR of 5.7% through 2034. The surge in vegetarian and vegan lifestyles creates demand for algae-based protein alternatives. Improved extraction technologies have allowed these proteins to compete more effectively with conventional animal- and plant-based proteins. Whole algae proteins are becoming increasingly popular due to their balanced amino acid profile and high nutrient density. Their presence is growing in sports nutrition, meal replacements, and functional snacks. Algae-derived omega-3 fatty acids are also becoming integral in health-focused product lines, especially for infant formulas and heart health supplements.

Europe Algae-based Ingredients Market held a 30% share in 2024, driven by its proactive stance on sustainability and innovation in green technologies. Regulatory frameworks across the region, such as those supporting carbon-neutral practices and plant-based product development, have created a fertile environment for adopting algae-based ingredients. Governments and private stakeholders are investing heavily in bioeconomy initiatives, encouraging the exploration of algae as a viable alternative to synthetic and animal-derived compounds. In the food and beverage sector, manufacturers are turning to algae to meet rising consumer demand for vegan, allergen-free, and nutrient-dense ingredients.

Key market participants include Corbion, Aliga Microalgae, Bioriginal Food and Science Corp, Cargill Inc, and Marine Hydrocolloids. These companies are pursuing aggressive strategies to strengthen their market position. They are focusing on sustainable production practices and developing eco-friendly, scalable cultivation systems. Several firms are investing in R&D to enhance the bioavailability and functionality of algae-based compounds. Strategic partnerships with food and cosmetic brands are being formed to expand product reach. Additionally, players are exploring clean-label formulations and launching innovative products such as algae protein powders, fortified oils, and skincare actives to appeal to a broader consumer base.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Key manufacturers

- 3.1.2 Distributors

- 3.1.3 Profit margins across the industry

- 3.1.4 Supply chain and distribution analysis

- 3.1.4.1 Raw material sourcing

- 3.1.4.2 Production and manufacturing

- 3.1.4.3 Cold chain infrastructure

- 3.1.4.4 Distribution channels

- 3.1.4.5 Supply chain challenges and optimization

- 3.1.4.6 Sustainable practices

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Trade statistics (HS code)

- 3.3.1 Major exporting countries, 2021-2024 (Kilo Tons)

- 3.3.2 Major exporting countries, 2021-2024 (Kilo Tons)

- 3.4 Impact forces

- 3.4.1 Growth drivers

- 3.4.1.1 Government initiatives to boost algae products production

- 3.4.1.2 Increasing utilization and growing demand from nutraceutical industry

- 3.4.1.3 Technological advancements in freezing techniques

- 3.4.1.4 Rising consumer awareness and acceptance of algae-based product

- 3.4.2 Industry pitfalls & challenges

- 3.4.2.1 Cold chain infrastructure challenges

- 3.4.2.2 Environmental impact on algae cultivation

- 3.4.3 Market opportunity

- 3.4.1 Growth drivers

- 3.5 Raw material landscape

- 3.5.1 Manufacturing trends

- 3.5.2 Technology evolution

- 3.6 Pricing analysis and cost structure

- 3.6.1 Pricing trends (USD/Ton)

- 3.6.1.1 North America

- 3.6.1.2 Europe

- 3.6.1.3 Asia Pacific

- 3.6.1.4 Latin America

- 3.6.1.5 Middle East Africa

- 3.6.2 Pricing factors (raw materials, energy, labor)

- 3.6.3 Regional price variations

- 3.6.4 Cost structure breakdown

- 3.6.5 Profitability analysis

- 3.6.1 Pricing trends (USD/Ton)

- 3.7 Regulatory framework and standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis, 2024

- 4.3 Company heat map analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

- 4.7 Recent developments & impact analysis by key players

- 4.7.1 Company categorization

- 4.7.2 Participant’s overview

- 4.7.3 Financial performance

- 4.8 Product benchmarking

Chapter 5 Market Estimates & Forecast, By Source, 2021 - 2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Microalgae

- 5.2.1 Spirulina (arthrospira)

- 5.2.2 Chlorella

- 5.2.3 Dunaliella

- 5.2.4 Haematococcus

- 5.2.5 Schizochytrium

- 5.2.6 Nannochloropsis

- 5.2.7 Other microalgae

- 5.3 Macroalgae (seaweed)

- 5.3.1 Red seaweed (rhodophyta)

- 5.3.2 Brown seaweed (phaeophyceae)

- 5.3.3 Green seaweed (chlorophyta)

- 5.3.4 Other macroalgae

- 5.4 Cyanobacteria (blue-green algae)

- 5.4.1 Aphanizomenon flos-aquae

- 5.4.2 Other cyanobacteria

Chapter 6 Market Estimates & Forecast, By Ingredient Type, 2021 - 2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Proteins & amino acids

- 6.3 Whole algae protein

- 6.3.1 Protein concentrates

- 6.3.2 Protein isolates

- 6.3.3 Peptides & amino acids

- 6.4 Lipids & fatty acids

- 6.4.1 Omega-3 fatty acids (DHA/EPA)

- 6.4.2 Polar lipids

- 6.4.3 Other lipids

- 6.5 Carbohydrates & fibers

- 6.5.1 Alginates

- 6.5.2 Carrageenan

- 6.5.3 Agar

- 6.5.4 Fucoidan

- 6.5.5 Other carbohydrates & fibers

- 6.6 Pigments & antioxidants

- 6.6.1 Chlorophyll

- 6.6.2 Phycocyanin

- 6.6.3 Astaxanthin

- 6.6.4 Fucoxanthin

- 6.6.5 Other pigments & antioxidants

- 6.7 Vitamins & minerals

- 6.8 Whole algae ingredients

- 6.9 Other ingredient types

Chapter 7 Market Estimates & Forecast, By Form, 2021 - 2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Powder

- 7.3 Liquid

- 7.4 Gel

- 7.5 Flakes

- 7.6 Tablets & capsules

- 7.7 Other forms

Chapter 8 Market Estimates & Forecast, By Production Method, 2021 - 2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Open pond systems

- 8.3 Closed systems

- 8.4 Photobioreactors

- 8.5 Fermenters

- 8.6 Other closed systems

- 8.7 Hybrid systems

- 8.8 Wild harvesting (for macroalgae)

- 8.9 Other production methods

Chapter 9 Market Estimates & Forecast, By Application, 2021 - 2034 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 Food & beverage

- 9.2.1 Bakery & confectionery

- 9.2.2 Dairy & dairy alternatives

- 9.2.3 Meat & seafood alternatives

- 9.2.4 Beverages

- 9.2.5 Snacks & convenience foods

- 9.2.6 Sauces, dressings & condiments

- 9.2.7 Other food applications

- 9.3 Dietary supplements

- 9.3.1 Protein supplements

- 9.3.2 Omega-3 supplements

- 9.3.3 Antioxidant supplements

- 9.3.4 General health supplements

- 9.3.5 Other supplement types

- 9.4 Animal feed

- 9.4.1 Aquaculture feed

- 9.4.2 Poultry feed

- 9.4.3 Swine feed

- 9.4.4 Pet food

- 9.4.5 Other animal feed

- 9.5 Cosmetics & personal care

- 9.5.1 Skincare

- 9.5.2 Haircare

- 9.5.3 Other cosmetic applications

- 9.6 Pharmaceuticals

- 9.7 Biofuels & bioenergy

- 9.8 Other applications

Chapter 10 Market Estimates & Forecast, By End Use Industry, 2021 - 2034 (USD Billion) (Kilo Tons)

- 10.1 Key trends

- 10.2 Food & Beverage Industry

- 10.3 Nutraceutical Industry

- 10.4 Animal Feed Industry

- 10.5 Cosmetics & Personal Care Industry

- 10.6 Pharmaceutical Industry

- 10.7 Energy Industry

- 10.8 Other End Use Industries

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Billion) (Kilo Tons)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Spain

- 11.3.5 Italy

- 11.3.6 Rest of Europe

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.4.6 Rest of Asia Pacific

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.5.4 Rest of Latin America

- 11.6 MEA

- 11.6.1 Saudi Arabia

- 11.6.2 South Africa

- 11.6.3 UAE

- 11.6.4 Rest of Middle East and Africa

Chapter 12 Company Profiles

- 12.1 AEP Colloids

- 12.2 AgarGel

- 12.3 Aliga Microalgae

- 12.4 Bioriginal Food & Science Corp

- 12.5 Cargill Inc.

- 12.6 Corbion

- 12.7 CP Kelco U.S. Inc

- 12.8 Gino Biotech

- 12.9 Hispanagar SA

- 12.10 KIMICA

- 12.11 Marine Hydrocolloids

- 12.12 Taiwan Chlorella Manufacturing Company

- 12.13 Triton