PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750544

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750544

Water Tube Chemical Boiler Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

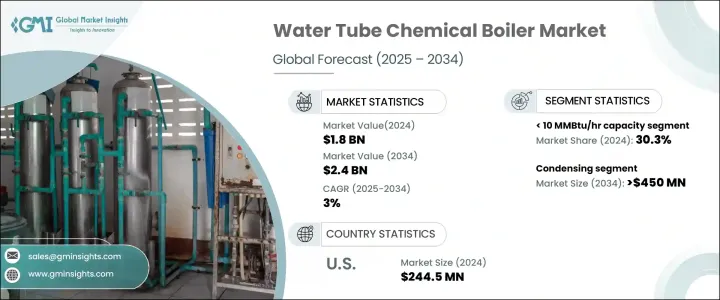

The Global Water Tube Chemical Boiler Market was valued at USD 1.8 billion in 2024 and is estimated to grow at a CAGR of 3% to reach USD 2.4 billion by 2034, bolstered by the increasing adoption of cleaner energy units and significant advancements in boiler systems aimed at reducing emissions and enhancing efficiency. Key regions witnessing rapid urbanization and industrial growth, coupled with rising investments in energy infrastructure, will further support the industry's positive outlook.

Water tube chemical boilers, tailored for the chemical industry, employ water-tube technology. In this setup, water circulates through tubes heated externally by fuel combustion. Heightened environmental regulations, emphasizing energy efficiency, and upgrades to existing boiler units, are set to drive market growth. There's a pronounced emphasis on efficient heating technologies and integrating smart solutions in these boilers is expected to boost product adoption. Manufacturers embedded connectivity and automation features to support predictive maintenance and operational reliability. With industries placing greater emphasis on both sustainability and smart technology, water tube chemical boilers are expected to remain essential to future-ready infrastructure.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.8 Billion |

| Forecast Value | $2.4 Billion |

| CAGR | 3% |

The 10 - 25 MMBTU/hr boiler segment is expected to grow at a CAGR of 3% through 2034, driven largely by its scalability and ability to deliver consistent performance in demanding industrial settings. Increasing investments in energy-efficient technologies, combined with a strong push toward digital integration, are reinforcing the market's expansion. Integrating intelligent control systems has redefined boiler operations, making them more adaptable to real-time needs while reducing energy wastage. The focus is on sustainable and responsive heating solutions that meet modern performance benchmarks.

The non-condensing segment in the water tube chemical boiler market is expected to grow at a CAGR of 2.5% through 2034, due to their reduced GHG emissions and superior energy efficiency. The industry's trajectory is positively influenced by the rising adoption of digitalization and automation in industrial processes, especially with the integration of advanced control systems. Furthermore, the ongoing development and expansion of small and medium-sized enterprises in the chemical sector, coupled with a pronounced emphasis on cost efficiency, are set to amplify product penetration.

United States Water Tube Chemical Boiler Market was valued at USD 244.5 million in 2024, driven by technological innovation, evolving industry needs, and energy efficiency goals. Rising demand for cleaner energy solutions, alongside an increased focus on reducing carbon footprints, is encouraging the shift toward high-efficiency water tube boilers. These systems are gaining traction as industries seek to modernize their operations while adhering to stricter emission regulations. Continued upgrades in industrial infrastructure and the push toward decarbonization across sectors have opened up new avenues for adoption.

To maintain a strong position in the market, leading manufacturers such as Cleaver-Brooks, Miura America, Thermodyne Boilers, Rentech Boiler Systems, Bosch Industriekessel, Babcock and Wilcox, Forbes Marshall, Alfa Laval, Cochran, Bryan Steam, Viessmann, Clayton Industries, Ariston Holding, BM GreenTech, Hurst Boiler & Welding, Victory Energy Operations, Babcock Wanson, and Thermax are leveraging multiple strategies. These include expanding R&D capabilities to develop high-efficiency boiler systems, forming strategic collaborations, and investing in smart control technologies. Many firms are also focusing on sustainability by adopting cleaner combustion technologies and offering customized solutions to meet the specific requirements of end-users.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Regulatory landscape

- 3.4 Industry impact forces

- 3.4.1 Growth drivers

- 3.4.2 Industry pitfalls & challenges

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Strategic dashboard

- 4.3 Strategic initiatives

- 4.4 Company market share analysis, 2024

- 4.5 Competitive benchmarking

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Capacity, 2021 - 2034 (USD Million, MMBTU/hr & Units)

- 5.1 Key trends

- 5.2 < 10 MMBTU/hr

- 5.3 10 - 25 MMBTU/hr

- 5.4 25 - 50 MMBTU/hr

- 5.5 50 - 75 MMBTU/hr

- 5.6 75 - 100 MMBTU/hr

- 5.7 100 - 175 MMBTU/hr

- 5.8 175 - 250 MMBTU/hr

- 5.9 > 250 MMBTU/hr

Chapter 6 Market Size and Forecast, By Technology, 2021 - 2034 (USD Million, MMBTU/hr & Units)

- 6.1 Key trends

- 6.2 Condensing

- 6.3 Non-condensing

Chapter 7 Market Size and Forecast, By Fuel, 2021 - 2034 (USD Million, MMBTU/hr & Units)

- 7.1 Key trends

- 7.2 Natural gas

- 7.3 Oil

- 7.4 Coal

- 7.5 Others

Chapter 8 Market Size and Forecast, By Region, 2021 - 2034 (USD Million, MMBTU/hr & Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.2.3 Mexico

- 8.3 Europe

- 8.3.1 France

- 8.3.2 UK

- 8.3.3 Poland

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Austria

- 8.3.7 Germany

- 8.3.8 Sweden

- 8.3.9 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Philippines

- 8.4.4 Japan

- 8.4.5 South Korea

- 8.4.6 Australia

- 8.4.7 Indonesia

- 8.5 Middle East & Africa

- 8.5.1 Saudi Arabia

- 8.5.2 Iran

- 8.5.3 UAE

- 8.5.4 Nigeria

- 8.5.5 South Africa

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Chile

- 8.6.3 Argentina

Chapter 9 Company Profiles

- 9.1 Alfa Laval

- 9.2 Ariston Holding

- 9.3 Babcock and Wilcox

- 9.4 Babcock Wanson

- 9.5 BM GreenTech

- 9.6 Bosch Industriekessel

- 9.7 Bryan Steam

- 9.8 Clayton Industries

- 9.9 Cleaver-Brooks

- 9.10 Cochran

- 9.11 Forbes Marshall

- 9.12 Hurst Boiler & Welding

- 9.13 Miura America

- 9.14 Rentech Boiler Systems

- 9.15 Thermax

- 9.16 Thermodyne Boilers

- 9.17 Victory Energy Operations

- 9.18 Viessmann