PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750553

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750553

Western Europe Ready-to-Eat Meat Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

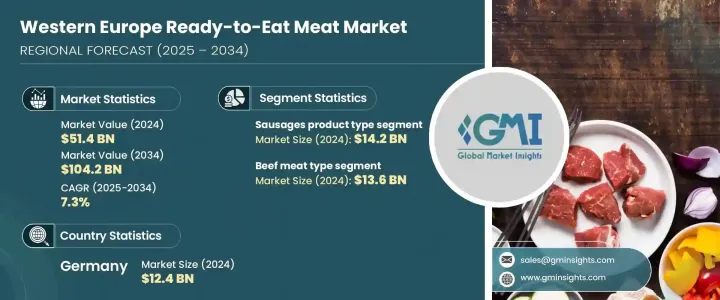

Western Europe Ready-to-Eat Meat Market was valued at USD 51.4 billion in 2024 and is estimated to grow at a CAGR of 7.3% to reach USD 104.2 billion by 2034, driven by evolving consumer lifestyles, particularly the demand for convenient, protein-rich meal options. The rise of dual-income households and busy schedules has led to a preference for ready-to-eat meat products, such as sausages, deli meats, and meat snacks, which offer quick and easy meal solutions. Additionally, advancements in packaging technologies, including vacuum-sealed and portable packaging, have enhanced product shelf life and convenience, further fueling market growth.

Consumer awareness of nutritional needs, especially the importance of protein intake, has also contributed to the market's expansion. The increasing popularity of meat-based snacks and ready-to-eat meals aligns with this trend, as consumers seek convenient ways to meet their dietary requirements. Moreover, the growing interest in innovative meat product formats and packaging solutions has spurred investment and development in the sector, leading to a diverse range of offerings that cater to various consumer preferences.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $51.4 Billion |

| Forecast Value | $104.2 Billion |

| CAGR | 7.3% |

In 2024, the sausages segment was valued at USD 14.2 billion, with an anticipated growth rate of 6.7% CAGR through 2034. Sausages, encompassing wet and dry varieties, are deeply embedded in regional culinary traditions and continue to be a staple in many households. Their versatility, ease of preparation, and alignment with consumer preferences for convenient protein sources contribute to their sustained popularity. Additionally, introducing reduced-fat and preservative-free options caters to the growing health-conscious consumer base, further bolstering demand.

The beef segment, valued at USD 13.6 billion in 2024, holds a 26.4% share and is projected to grow at a 7.2% CAGR through 2034. Beef products, including pre-cooked cuts, jerky, and ready-to-eat entrees, are favored for their rich taste and cultural significance. The increasing consumer inclination towards organic and ethically sourced beef, such as grass-fed options, reflects a broader trend towards health and sustainability. Innovations in packaging technologies have also played a crucial role in extending the shelf life and enhancing the convenience of beef products, meeting the demands of modern consumers.

Germany Ready-To-Eat Meat Market was valued at USD 12.4 billion in 2024, with expectations of a 5.9% CAGR from 2025 to 2034. The country's strong consumer appetite for convenient packaged meat products, coupled with advancements in refrigeration and packaging technologies, has driven significant growth in the sector. Moreover, the increasing export of German meat products to other European countries, as well as regions like Asia and North America, has opened new markets and opportunities for expansion.

Key players in the Western European ready-to-eat meat market include Smithfield Foods, Tyson Foods, Cargill, JBS S.A., and Tonnies Group. These companies are adopting various strategies to strengthen their market presence. For instance, they are investing in product diversification by introducing new meat formats and innovative packaging solutions to meet changing consumer preferences. Additionally, strategic mergers and acquisitions are being pursued to expand market reach and capabilities. Emphasis on sustainability practices, such as reducing carbon emissions and improving animal welfare standards, aligns with the growing consumer demand for ethically produced meat products. Furthermore, enhancing e-commerce platforms and direct-to-consumer sales channels enables companies to reach a broader customer base, catering to the increasing trend of online grocery shopping. Through these initiatives, companies aim to solidify their positions in the competitive ready-to-eat meat market in Western Europe.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research methodology

- 1.1.1 Objective and scope

- 1.1.2 Information procurement

- 1.1.3 Primary research

- 1.1.4 Secondary research

- 1.1.5 Data analysis and triangulation

- 1.2 Market definition and segmentation

- 1.3 Forecast methodology

- 1.4 Research assumptions and limitations

- 1.5 List of data sources

Chapter 2 Executive Summary

- 2.1 Market snapshot

- 2.2 Segment highlights

- 2.3 Competitive landscape snapshot

- 2.4 Country market outlook

- 2.5 Key market trends

- 2.6 Future market outlook

Chapter 3 Industry Insights

- 3.1 Market introduction

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Demand-side impact (selling price)

- 3.2.3.1 Price transmission to end markets

- 3.2.3.2 Market share dynamics

- 3.2.3.3 Consumer response patterns

- 3.2.4 Key companies impacted

- 3.2.5 Strategic industry responses

- 3.2.5.1 Supply chain reconfiguration

- 3.2.5.2 Pricing and product strategies

- 3.2.5.3 Policy engagement

- 3.2.6 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Trade statistics (HS code)

- 3.3.1 Major exporting countries, 2021-2024 (kilo tons)

- 3.3.2 Major importing countries, 2021-2024 (kilo tons)

- 3.4 Supplier landscape

- 3.5 Profit margin analysis

- 3.6 Key news & initiatives

- 3.7 Regulatory landscape

- 3.7.1 EU food safety regulations

- 3.7.2 Labeling requirements

- 3.7.3 Additives & preservatives regulations

- 3.7.4 Protected designation of origin (PDO) & protected geographical indication (PGI)

- 3.7.5 Post-Brexit UK regulations

- 3.7.6 Animal welfare standards

- 3.8 Impact forces

- 3.8.1 Growth drivers

- 3.8.1.1 Rising demand for convenience and on-the-go food options

- 3.8.1.2 Increased consumer preference for high-protein diets

- 3.8.1.3 Expansion of retail and e-commerce food distribution channels

- 3.8.1.4 Innovation in packaging and extended shelf-life technologies

- 3.8.2 Industry pitfalls & challenges

- 3.8.2.1 Growing health concerns over processed and high-sodium meat products

- 3.8.2.2 Stringent regulations and compliance requirements across the region

- 3.8.1 Growth drivers

- 3.9 Consumer behavior analysis

- 3.9.1 Consumer demographics

- 3.9.2 Purchase patterns

- 3.9.3 Preference factors

- 3.9.4 Willingness to pay premium

- 3.9.5 Consumer perception of organic products

- 3.10 Manufacturing process analysis

- 3.10.1 Raw material selection & preparation

- 3.10.2 Curing & fermentation processes

- 3.10.3 Cooking & smoking techniques

- 3.10.4 Slicing & portioning

- 3.10.5 Packaging technologies

- 3.10.6 Quality control procedures

- 3.11 Raw material analysis & procurement strategies

- 3.12 Pricing analysis

- 3.13 Sustainability & environmental impact assessment

- 3.14 Pestle analysis

- 3.15 Porter's five forces analysis

- 3.16 Growth potential analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Market share analysis

- 4.2 Strategic framework

- 4.2.1 Mergers & acquisitions

- 4.2.2 Joint ventures & collaborations

- 4.2.3 New product developments

- 4.2.4 Expansion strategies

- 4.3 Competitive benchmarking

- 4.4 Vendor landscape

- 4.5 Competitive positioning matrix

- 4.6 Strategic dashboard

- 4.7 Brand positioning & consumer perception analysis

- 4.8 Market entry strategies for new players

- 4.9 Private label analysis & strategies

Chapter 5 Market Estimates & Forecast, By Product Type, 2021 - 2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Deli meats & cold cuts

- 5.2.1 Ham

- 5.2.2 Salami

- 5.2.3 Prosciutto

- 5.2.4 Chorizo

- 5.2.5 Mortadella

- 5.2.6 Other deli meats

- 5.3 Sausages

- 5.3.1 Frankfurters & hot dogs

- 5.3.2 Bratwurst

- 5.3.3 Chorizo

- 5.3.4 Other sausage types

- 5.4 Bacon & breakfast meats

- 5.5 Pâtes & meat spreads

- 5.6 Meat snacks

- 5.6.1 Jerky

- 5.6.2 Meat sticks

- 5.6.3 Biltong

- 5.6.4 Other meat snacks

- 5.7 Pre-cooked meat entrees

- 5.8 Canned meat products

- 5.9 Other product types

Chapter 6 Market Estimates & Forecast, By Meat Type, 2021 - 2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Pork

- 6.3 Beef

- 6.4 Poultry

- 6.4.1 Chicken

- 6.4.2 Turkey

- 6.4.3 Other poultry

- 6.5 Mixed meat

- 6.6 Game meat

- 6.7 Other meat types

Chapter 7 Market Estimates & Forecast, By Processing Method, 2021 - 2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Cured

- 7.2.1 Dry-cured

- 7.2.2 Wet-cured

- 7.3 Smoked

- 7.4 Cooked

- 7.5 Fermented

- 7.6 Dried

- 7.7 Other processing methods

Chapter 8 Market Estimates & Forecast, By Packaging Type, 2021 - 2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Vacuum packaging

- 8.3 Modified atmosphere packaging (MAP)

- 8.4 Shrink wrapping

- 8.5 Trays & clamshells

- 8.6 Cans & jars

- 8.7 Flexible packaging

- 8.8 Other packaging types

Chapter 9 Market Estimates & Forecast, By Price Segment, 2021 - 2034 (USD Billion) (Kilo Tons)

- 9.1 Premium

- 9.2 Mainstream

- 9.3 Economy

Chapter 10 Market Estimates & Forecast, By Consumer Demographic, 2021 - 2034 (USD Billion) (Kilo Tons)

- 10.1 Key trends

- 10.2 By age group

- 10.2.1. 18-34 years

- 10.2.2. 35-54 years

- 10.2.3. 55+ years

- 10.3 By household size

- 10.3.1 Single-person households

- 10.3.2 Two-person households

- 10.3.3 Families with children

- 10.3.4 Other household types

- 10.4 By income level

- 10.5 By lifestyle & dietary preferences

Chapter 11 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 (USD Billion) (Kilo Tons)

- 11.1 Key trends

- 11.2 Supermarkets & hypermarkets

- 11.3 Convenience stores

- 11.4 Specialty food stores & delicatessens

- 11.5 Online retail

- 11.6 Foodservice

- 11.6.1 Hotels & restaurants

- 11.6.2 Cafes & bakeries

- 11.6.3 Institutional catering

- 11.6.4 Other foodservice channels

- 11.7 Other distribution channels

Chapter 12 Market Estimates & Forecast, By Country, 2021 - 2034 (USD Billion) (Kilo Tons)

- 12.1 Key trends

- 12.2 Germany

- 12.3 France

- 12.4 United Kingdom

- 12.5 Italy

- 12.6 Spain

- 12.7 Netherlands

- 12.8 Belgium

- 12.9 Switzerland

- 12.10 Austria

- 12.11 Sweden

- 12.12 Denmark

- 12.13 Norway

- 12.14 Finland

- 12.15 Ireland

- 12.16 Portugal

- 12.17 Rest of Western Europe

Chapter 13 Company Profiles

- 13.1 Aoste (Campofrio Food Group)

- 13.2 Atria Plc

- 13.3 Bell Food Group

- 13.4 Bernard Matthews Ltd

- 13.5 BRF S.A.

- 13.6 Campofrio Food Group (Sigma Alimentos)

- 13.7 Cargill, Incorporated

- 13.8 Cranswick plc

- 13.9 Danish Crown A/S

- 13.10 Ferrarini S.p.A.

- 13.11 Fiorucci Foods (Campofrio Food Group)

- 13.12 Fleury Michon

- 13.13 Groupe Bigard

- 13.14 Herta (Casa Tarradellas)

- 13.15 Hormel Foods Corporation

- 13.16 JBS S.A.

- 13.17 Kerry Group plc

- 13.18 Nestle S.A.

- 13.19 Noel Alimentaria S.A.U.

- 13.20 Oscar Mayer (The Kraft Heinz Company)

- 13.21 Pini Group

- 13.22 Smithfield Foods (WH Group Limited)

- 13.23 The Kraft Heinz Company

- 13.24 Tonnies Group

- 13.25 Tulip Ltd (Pilgrim's Pride Corporation)

- 13.26 Tyson Foods, Inc.

- 13.27 Vion Food Group

- 13.28 Wiesenhof (PHW Group)

- 13.29 Zwanenberg Food Group

- 13.30 Zur Muhlen Gruppe (Zur Muhlen Group)