PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750556

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750556

Europe AC Electric Vehicle Charging Station Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

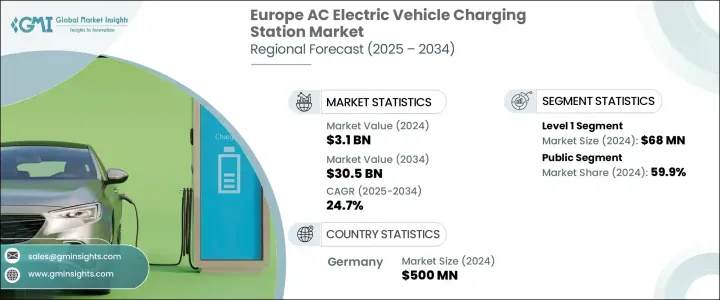

Europe AC Electric Vehicle Charging Station Market was valued at USD 3.1 billion in 2024 and is estimated to grow at a CAGR of 24.7% to reach USD 30.5 billion by 2034 driven by the growing emphasis on reducing carbon emissions has led European governments to enforce strict regulations that push automakers to prioritize electric vehicle production. To support this transition, public-private partnerships are heavily investing in charging infrastructure, and various incentives such as subsidies, grants, and tax breaks are reducing installation costs. Additionally, financial support is being provided for businesses and municipalities to install chargers in public spaces and workplaces, further fostering private sector investment in EV infrastructure.

The increasing sales of electric cars drive demand for reliable and efficient charging stations. Consumers seek fast, accessible charging points, especially near residential areas and highways. The growing commitment from automakers to phase out fossil-fuel vehicles by 2035 has underscored the need for an extensive and dependable AC charging network. Manufacturers are innovating by introducing faster, more compact AC chargers that optimize space and reduce costs. Integration with renewable energy sources and energy storage systems is becoming a key selling point, appealing to environmentally conscious consumers and businesses.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.1 Billion |

| Forecast Value | $30.5 Billion |

| CAGR | 24.7% |

The Europe AC electric vehicle (EV) charging station market is segmented into Level 1 and Level 2, each catering to different user needs and charging requirements. The Level 1 segment, valued at USD 68 million in 2024, offers slower charging speeds than other types, using regular household outlets. Typically, it provides about 2-3 kW of power per hour, making it suitable for users with limited daily driving needs. While affordable and simple to install, Level 1 charging stations are more commonly found in residential settings, less prevalent in commercial or high-traffic locations due to the slower charging speed. However, for individuals who do not require fast charging, it remains an economical and convenient option.

On the other hand, the public charging station segment dominates the market, with a significant share of 59.9% in 2024. Governments and businesses across Europe are heavily investing in public charging networks to ensure convenient, round-the-clock access to charging stations. This growth is driven by the increasing number of electric vehicles on the road and the need to establish a robust infrastructure to support their widespread adoption. The rise of smart cities and eco-friendly initiatives further supports the demand for more public charging points, contributing to the rapid expansion of this segment.

Germany AC Electric Vehicle Charging Station Market reached USD 500 million in 2024, attributed to government incentives that encourage the adoption of electric vehicles, as well as the increasing demand for cleaner transportation solutions. The government has been playing a significant role by providing subsidies and policy support to expand the charging network, facilitating the shift towards more sustainable mobility options. As electric vehicle sales rise, the need for accessible charging infrastructure is becoming more critical, further boosting the development of charging stations across Germany and other European countries.

Leading players in the Europe AC Electric Vehicle Charging Station Market include companies such as ABB, Bosch, Schneider Electric, Siemens, and Delta Electronics. These companies compete in the fast-growing industry by providing efficient, affordable, and sustainable charging solutions. Based on strategies, companies in the Europe AC electric vehicle charging station market focus on innovation, particularly in developing faster, more compact charging technologies that integrate with renewable energy systems. They are also expanding their networks through partnerships with local businesses and governments to improve accessibility. In addition, companies are investing in R&D to develop more efficient and cost-effective charging solutions.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data source

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Industry Insights

- 2.1 Industry ecosystem analysis

- 2.2 Trump administration tariffs analysis

- 2.2.1 Impact on trade

- 2.2.1.1 Trade volume disruptions

- 2.2.1.2 Retaliatory measures

- 2.2.2 Impact on the industry

- 2.2.2.1 Supply-side impact (raw materials)

- 2.2.2.1.1 Price volatility in key materials

- 2.2.2.1.2 Supply chain restructuring

- 2.2.2.1.3 Production cost implications

- 2.2.2.2 Demand-side impact (selling price)

- 2.2.2.2.1 Price transmission to end markets

- 2.2.2.2.2 Market share dynamics

- 2.2.2.2.3 Consumer response patterns

- 2.2.2.1 Supply-side impact (raw materials)

- 2.2.3 Key companies impacted

- 2.2.4 Strategic industry responses

- 2.2.4.1 Supply chain reconfiguration

- 2.2.4.2 Pricing and product strategies

- 2.2.4.3 Policy engagement

- 2.2.1 Impact on trade

- 2.3 Outlook and future considerations

- 2.4 Industry impact forces

- 2.4.1 Growth drivers

- 2.4.2 Industry pitfalls & challenges

- 2.5 Growth potential analysis

- 2.6 Porter's analysis

- 2.6.1 Bargaining power of suppliers

- 2.6.2 Bargaining power of buyers

- 2.6.3 Threat of new entrants

- 2.6.4 Threat of substitutes

- 2.7 PESTEL analysis

Chapter 3 Competitive landscape, 2024

- 3.1 Introduction

- 3.2 Strategic dashboard

- 3.3 Strategic initiative

- 3.4 Competitive benchmarking

- 3.5 Innovation & sustainability landscape

Chapter 4 Market Size and Forecast, By Type, 2021 - 2034 (Units, USD Billion)

- 4.1 Key trends

- 4.2 Level 1

- 4.3 Level 2

Chapter 5 Market Size and Forecast, By Charging Site, 2021 - 2034 (Units, USD Billion)

- 5.1 Key trends

- 5.2 Public

- 5.3 Private

Chapter 6 Market Size and Forecast, By Country, 2021 - 2034 (Units, USD Billion)

- 6.1 Key trends

- 6.2 Norway

- 6.3 Germany

- 6.4 France

- 6.5 Netherlands

- 6.6 UK

- 6.7 Sweden

Chapter 7 Company Profiles

- 7.1 ABB

- 7.2 Bosch

- 7.3 Blink Charging Co.

- 7.4 ChargePoint, Inc.

- 7.5 Eaton

- 7.6 Delta Electronics

- 7.7 EVBox

- 7.8 Elli

- 7.9 Enphase Energy

- 7.10 Leviton Industries

- 7.11 SIGNET EV

- 7.12 Schneider Electric

- 7.13 Siemens

- 7.14 Volta Industries Inc.

- 7.15 Vinfast

- 7.16 Zunder