PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750560

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750560

EMEA Industrial Machinery Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

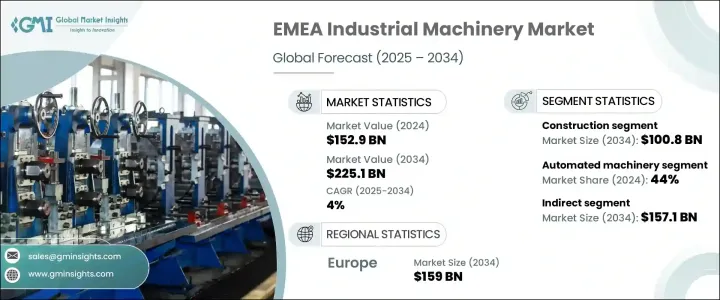

EMEA Industrial Machinery Market was valued at USD 152.9 billion in 2024 and is estimated to grow at a CAGR of 4% to reach USD 225.1 billion by 2034, driven by the increasing demand for mechanized equipment across sectors such as agriculture, construction, and packaging. Advancements in technology, paired with rising automation trends, are enhancing productivity and minimizing operational costs for businesses. In farming, population growth has intensified the pressure to produce more food, pushing farmers to adopt efficient tools like precision systems and automated machinery. Simultaneously, governments and private sectors channel capital into infrastructure development, contributing to the steady expansion of industrial equipment deployment across EMEA.

Rapid urban expansion is spurring demand for heavy machinery, especially in developing nations within the Middle East and Africa. The growing push toward digitalized and connected equipment reinforces the transition toward smart construction machinery outfitted with AI, GPS, and telematics, driving efficiencies across job sites. Automated solutions now dominate nearly half the market, offering accuracy, speed, and safety unmatched by manual systems. These tools are seeing increased demand from aerospace and automotive sectors, where production consistency and adaptive performance are non-negotiable.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $152.9 Billion |

| Forecast Value | $225.1 Billion |

| CAGR | 4% |

The automated machinery segment accounted for 44% share in 2024 as industries shift toward intelligent, efficient systems. With automation enhancing operational accuracy, reducing downtime, and lowering long-term costs, manufacturers are embracing these systems to remain competitive and meet evolving production demands. Integration of AI, IoT, and robotics into industrial equipment is also driving adoption, especially in sectors that require high precision and scalability.

The construction segment generated USD 66.2 billion in 2024 and is forecasted to hit USD 100.8 billion by 2034, fueled by rapid infrastructure expansion and the widespread rollout of energy-efficient, urban development projects across EMEA. Smart construction technologies, including GPS-enabled machinery, telematics systems, and AI-powered safety solutions, reshape how projects are managed. These advancements not only boost site productivity but also significantly enhance labor safety standards and operational transparency.

Europe EMEA Industrial Machinery Market generated USD 106.3 billion in 2024. Countries across the continent are intensifying their focus on high-tech manufacturing and automation. Germany's well-established industrial ecosystem plays a central role in regional growth, particularly due to its global leadership in precision manufacturing. The emphasis on next-gen technologies and smart production systems reinforces Europe's status as a leading exporter of industrial machinery.

Key market participants include Hitachi Construction Machinery, GEA Group, Terex Corporation, Brandt Industries Ltd., Mitsubishi Electric Corporation, ShawCor Ltd., Volvo Construction Equipment, Honeywell International Inc., Komatsu Ltd., Atlas Copco AB, Illinois Tool Works Inc., Sandvik AB, ALFA LAVAL, Deere & Company, AGCO Corporation, GE, CNH Industrial, Caterpillar Inc., Ingersoll Rand, and ESCO Corp. Leading companies are strengthening their market position through advanced manufacturing technologies, strategic mergers, regional expansion, and continuous innovation. Emphasis is placed on automation, energy efficiency, and digital integration. Businesses are aligning with Industry 4.0 standards and investing in local production capabilities to support customer proximity and minimize supply chain disruptions.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.3 Pricing analysis

- 3.4 Technology & innovation landscape

- 3.5 Key news & initiatives

- 3.6 Regulatory landscape

- 3.7 Manufacturers

- 3.8 Distributors

- 3.9 Impact on forces

- 3.9.1 Growth drivers

- 3.9.1.1 Increasing mechanization of farming operations

- 3.9.1.2 Escalating infrastructure spending

- 3.9.1.3 Rising Adoption of smart packaging solutions

- 3.9.1.4 Growth of the manufacturing sector

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 Market saturation and intense competition

- 3.9.2.2 Lack of skilled labor and technicians

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Technology overview

- 3.12 Porter's analysis

- 3.13 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By End Use, 2021-2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Agriculture

- 5.3 Construction

- 5.4 Packaging

- 5.5 Food processing

- 5.6 Mining

- 5.7 Semiconductor manufacturing

- 5.8 Others

Chapter 6 Market Estimates & Forecast, By Operations, 2021-2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Automated machinery

- 6.3 Semi-automated machinery

- 6.4 Manual machinery

- 6.5 Robotic machinery

Chapter 7 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Direct

- 7.3 Indirect

Chapter 8 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Europe

- 8.2.1 Germany

- 8.2.2 UK

- 8.2.3 France

- 8.2.4 Spain

- 8.2.5 Italy

- 8.2.6 Russia

- 8.2.7 Switzerland

- 8.2.8 Ukraine

- 8.2.9 Belgium

- 8.2.10 Sweden

- 8.3 Middle East

- 8.3.1 Saudi Arabia

- 8.3.2 UAE

- 8.3.3 Kuwait

- 8.3.4 Oman

- 8.3.5 Qatar

- 8.3.6 Yemen

- 8.4 Africa

- 8.4.1 South Africa

- 8.4.2 Tunisia

- 8.4.3 Algeria

- 8.4.4 Nigeria

Chapter 9 Company Profiles

- 9.1 AGCO Corporation

- 9.2 ALFA LAVAL

- 9.3 Atlas Copco AB

- 9.4 Brandt Industries Ltd.

- 9.5 Caterpillar Inc.

- 9.6 CNH Industrial N

- 9.7 Deere & Company

- 9.8 ESCO Corp.

- 9.9 Hitachi Construction Machinery Co., Ltd.

- 9.10 Honeywell International Inc.

- 9.11 Komatsu Ltd.

- 9.12 Mitsubishi Electric Corporation

- 9.13 Sandvik AB

- 9.14 Terex Corporation

- 9.15 Volvo Construction Equipment