PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750561

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750561

Veterinary CT Imaging Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

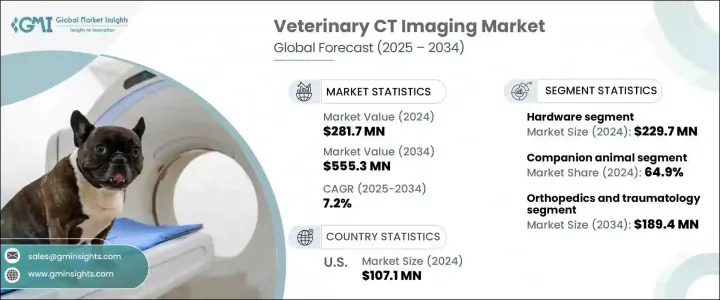

The Global Veterinary CT Imaging Market was valued at USD 281.7 million in 2024 and is estimated to grow at a CAGR of 7.2% to reach USD 555.3 million by 2034, driven by factors such as an increasing global animal population, the rising popularity of pets, greater access to veterinary services, and a higher focus on pet care. As more pets and livestock are diagnosed with chronic and complex health conditions, the demand for advanced diagnostic technologies, including veterinary CT imaging, continues to rise. This technology has revolutionized the way veterinarians assess animal health by offering clear, detailed, and three-dimensional images of animal anatomy, allowing for precise diagnostics and timely interventions.

In addition to its ability to provide high-resolution images of complex anatomical structures, CT imaging is particularly beneficial for emergency cases. Innovations like higher resolution scanners and faster imaging techniques have further enhanced its diagnostic capabilities, making it an invaluable tool in the veterinary field. Furthermore, the growth in veterinary hospitals, clinics, and the increasing availability of pet insurance are boosting market expansion. As pets and livestock face a growing number of health issues, such as tumors, orthopedic injuries, and organ abnormalities, the demand for diagnostic imaging tools like CT scanners will continue to increase.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $281.7 Million |

| Forecast Value | $555.3 Million |

| CAGR | 7.2% |

The companion animal segment held the largest share with 64.9% in 2024, driven by the growing adoption of pets such as dogs and cats, which are increasingly prone to diseases that require advanced diagnostic tools. The increasing awareness of animal health and the availability of specialized treatments are expected to continue driving the demand for veterinary CT imaging, particularly for companion animals. The rising disposable income in emerging economies and the launch of more sophisticated diagnostic devices will further propel this market.

The hardware segment within the veterinary CT imaging market accounted for USD 229.7 million in 2024. This segment includes essential components such as CT scanners, gantries, and detectors, all of which are crucial for obtaining the detailed cross-sectional images that enable accurate diagnoses. As veterinary clinics and hospitals increasingly recognize the importance of advanced diagnostic technologies, the demand for these hardware solutions is expected to grow steadily. These components are critical for producing high-resolution images, allowing veterinarians to identify and address a wide range of conditions in animals. The continued investment in sophisticated diagnostic equipment by veterinary facilities will drive further growth in the hardware segment, enhancing the overall capabilities of veterinary medicine.

United States Veterinary CT Imaging Market was valued at USD 107.1 million in 2024, driven by high rates of pet ownership in the country, along with increasing access to advanced veterinary care. With the growing focus on pet health, owners are more inclined to seek out cutting-edge diagnostic tools for their animals, leading to greater adoption of veterinary CT imaging systems. Additionally, the rise in pet insurance coverage has facilitated the affordability of these advanced diagnostic services, further contributing to market growth. The U.S. also benefits from a well-established infrastructure and ongoing innovations in imaging technology, ensuring that the market remains strong and poised for continued development.

Companies in the Global Veterinary CT Imaging Industry employ strategies such as innovation in imaging technology, expanding product portfolios, and increasing market reach through partnerships and collaborations. Companies like Canon Medical Systems Corporation and Siemens Healthineers focus on developing advanced CT scanners with higher resolution and faster imaging capabilities to meet the growing demand for precise diagnostics. Others, like GE Healthcare and Hallmarq Veterinary Imaging, are investing in expanding their product offerings and increasing their presence in emerging markets. By improving the accessibility and affordability of veterinary imaging solutions, these companies aim to strengthen their market position and cater to the increasing demand for advanced diagnostic tools in veterinary medicine.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increased pet ownership and animal health expenditure

- 3.2.1.2 Rising prevalence of animal diseases and injuries

- 3.2.1.3 Technological advancements in imaging modalities

- 3.2.1.4 Rising number of veterinary practitioners in developed economies

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of CT scanners

- 3.2.2.2 Low animal health awareness in emerging markets

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Trump administration tariffs

- 3.5.1 Impact on trade

- 3.5.1.1 Trade volume disruptions

- 3.5.1.2 Retaliatory measures

- 3.5.2 Impact on the Industry

- 3.5.2.1 Supply-side impact

- 3.5.2.1.1 Price volatility in key materials

- 3.5.2.1.2 Supply chain restructuring

- 3.5.2.1.3 Production cost implications

- 3.5.2.2 Demand-side impact (selling price)

- 3.5.2.2.1 Price transmission to end markets

- 3.5.2.2.2 Market share dynamics

- 3.5.2.2.3 Consumer response patterns

- 3.5.2.1 Supply-side impact

- 3.5.3 Key companies impacted

- 3.5.4 Strategic industry responses

- 3.5.4.1 Supply chain reconfiguration

- 3.5.4.2 Pricing and product strategies

- 3.5.4.3 Policy engagement

- 3.5.5 Outlook and future considerations

- 3.5.1 Impact on trade

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Hardware

- 5.2.1 Stationary multi-slice CT scanner

- 5.2.1.1 Mid end

- 5.2.1.2 High end

- 5.2.1.3 Low end

- 5.2.2 Portable CT scanner

- 5.2.1 Stationary multi-slice CT scanner

- 5.3 Consumables

- 5.4 Software

Chapter 6 Market Estimates and Forecast, By Animal Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Companion animal

- 6.3 Livestock animal

- 6.4 Other animal types

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Orthopedics and traumatology

- 7.3 Oncology

- 7.4 Dental

- 7.5 Neurology

- 7.6 Other applications

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Veterinary hospitals and clinics

- 8.3 Diagnostic imaging centers

- 8.4 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Carestream Health

- 10.2 Canon Medical Systems Corporation

- 10.3 Epica International

- 10.4 GNI ApS

- 10.5 GE Healthcare

- 10.6 Hallmarq Veterinary Imaging

- 10.7 Hitachi

- 10.8 Isabelle Vets

- 10.9 Neurologica corporation

- 10.10 Koninklijke Philips N.V.

- 10.11 Siemens Healthineers

- 10.12 Sound

- 10.13 Shenzhen Anke High-Tech

- 10.14 Xoran Technologies