PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750562

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750562

In-Vehicle Apps Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

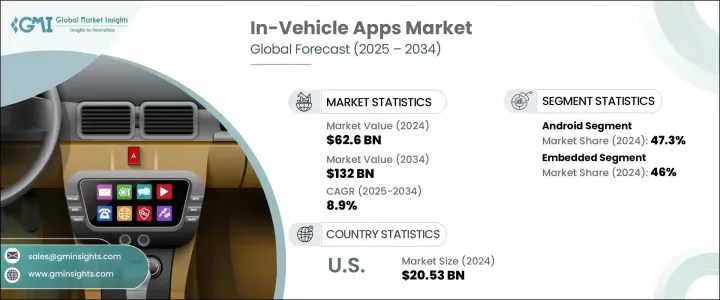

The Global In-Vehicle Apps Market was valued at USD 62.6 billion in 2024 and is estimated to grow at a CAGR of 8.9% to reach USD 132 billion by 2034, driven by the rapid advancements in automotive technology, coupled with the rising adoption of electric and autonomous vehicles. These next-gen vehicles are increasingly reliant on software ecosystems to manage navigation, energy efficiency, driver assistance, and more. As a result, in-vehicle applications are becoming indispensable for automakers looking to enhance user experience, improve functionality, and offer continuous connectivity. The growing emphasis on smart mobility solutions and the integration of real-time services into vehicles is transforming how drivers interact with their cars, promoting app-centric experiences that prioritize convenience, safety, and personalization.

Automakers are investing in smarter infotainment platforms that support HD touchscreens, AI-powered voice controls, and high-speed connectivity to elevate in-car interactions. With enhanced operating systems and seamless synchronization across devices, these platforms are powering feature-rich apps that offer navigation, media access, diagnostics, and vehicle control within a user-friendly interface. The demand for these solutions is increasing as consumers expect the same fluid digital experience inside their cars that they get from their smartphones and tablets.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $62.6 Billion |

| Forecast Value | $132 Billion |

| CAGR | 8.9% |

The Android-based in-vehicle platforms segment held a 47.3% share in 2024, and this segment is expected to grow at a CAGR of 9.5% through 2034. The appeal lies in Android's open-source flexibility, which allows car manufacturers to build customizable and scalable infotainment ecosystems. This approach supports integration with a broad range of third-party services and applications, enabling drivers to access navigation, music, voice assistants, and real-time vehicle data across various price segments and models. Automakers are increasingly leaning toward Android to craft immersive, personalized experiences that match evolving consumer demands.

When categorized by connectivity technology, the embedded systems segment held a 46% share in 2024. These built-in applications function independently of external smartphones or mobile devices, which makes them highly reliable in all driving conditions. By integrating directly with the vehicle's hardware and internal network, embedded apps offer consistent access to core features like safety alerts, route guidance, and system diagnostics-even in areas with limited or no internet connectivity.

United States In-Vehicle Apps Market held 85.6% share and generated USD 20.53 billion in 2024 as the country's mature auto industry, high-tech infrastructure, and demand for connected vehicle features continue to propel innovation and adoption. The strong presence of leading automotive OEMs, tech companies, and software developers fosters a collaborative environment for rapid product development and deployment. The U.S. market benefits from high consumer expectations for advanced infotainment, seamless smartphone integration, and real-time digital services in vehicles.

Leading players in the Global In-Vehicle Apps Market, including Hyundai Motor Company, Apple, Microsoft, Harman International Industries, Nvidia, Garmin, Toyota Motor, NXP Semiconductors, General Motors, and Google, are focused on several key strategies to reinforce their market foothold. These include partnerships with OEMs, integration of AI and cloud services, and development of proprietary operating systems to enhance user experience. Companies are also expanding their app ecosystems, investing in user interface design, and collaborating with mobility startups to stay ahead of trends and offer differentiated, scalable solutions in a highly competitive environment.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 App developers

- 3.2.2 Platform providers

- 3.2.3 Connectivity providers

- 3.2.4 Technology providers

- 3.2.5 Media and content providers

- 3.2.6 End use

- 3.3 Impact of Trump administration tariffs

- 3.3.1 Trade impact

- 3.3.1.1 Trade volume disruptions

- 3.3.1.2 Retaliatory measures

- 3.3.2 Impact on industry

- 3.3.2.1 Supply-side impact (raw materials)

- 3.3.2.1.1 Price volatility in key materials

- 3.3.2.1.2 Supply chain restructuring

- 3.3.2.1.3 Production cost implications

- 3.3.2.2 Demand-side impact (Cost to customers)

- 3.3.2.2.1 Price transmission to end markets

- 3.3.2.2.2 Market share dynamics

- 3.3.2.2.3 Consumer response patterns

- 3.3.2.1 Supply-side impact (raw materials)

- 3.3.3 Key companies impacted

- 3.3.4 Strategic industry responses

- 3.3.4.1 Supply chain reconfiguration

- 3.3.4.2 Pricing and product strategies

- 3.3.4.3 Policy engagement

- 3.3.5 Outlook & future considerations

- 3.3.1 Trade impact

- 3.4 Profit margin analysis

- 3.5 Technology & innovation landscape

- 3.6 Patent analysis

- 3.7 Key news & initiatives

- 3.8 Vehicle apps statistics

- 3.8.1 Vehicle penetration statistics

- 3.8.2 Application usage statistics

- 3.8.3 User behavior engagement

- 3.8.4 Connectivity and data usage

- 3.9 Regulatory landscape

- 3.10 Impact on forces

- 3.10.1 Growth drivers

- 3.10.1.1 Rise of electric and autonomous vehicles

- 3.10.1.2 Technological advancements in infotainment systems

- 3.10.1.3 Growing consumer demand for connectivity

- 3.10.1.4 Increasing need for vehicle safety and driver assistance

- 3.10.2 Industry pitfalls & challenges

- 3.10.2.1 Driver distractions and safety concerns

- 3.10.2.2 Data privacy and security

- 3.10.1 Growth drivers

- 3.11 Growth potential analysis

- 3.12 Porter's analysis

- 3.13 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Mn)

- 5.1 Key trends

- 5.2 Passenger cars

- 5.2.1 Sedans

- 5.2.2 Hatchbacks

- 5.2.3 SUV

- 5.3 Commercial vehicles

- 5.3.1 Light duty

- 5.3.2 Medium duty

- 5.3.3 Heavy duty

Chapter 6 Market Estimates & Forecast, By Operating System, 2021 - 2034 ($Mn)

- 6.1 Key trends

- 6.2 iOS

- 6.3 Android

- 6.4 Windows

- 6.5 Others

Chapter 7 Market Estimates & Forecast, By Connectivity Technology, 2021 - 2034 ($Mn)

- 7.1 Key trends

- 7.2 Embedded

- 7.3 Tethered

- 7.4 Integrated

Chapter 8 Market Estimates & Forecast, By App, 2021 - 2034 ($Mn)

- 8.1 Key trends

- 8.2 Infotainment apps

- 8.3 Navigation apps

- 8.4 Telematics apps

- 8.5 Safety apps

- 8.6 Communication apps

- 8.7 Vehicle control apps

- 8.8 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 Saudi Arabia

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 Alcatel-Lucent

- 10.2 Apple

- 10.3 Audi

- 10.4 Continental

- 10.5 Elektrobit Automotive

- 10.6 Ford Motor Company

- 10.7 Garmin

- 10.8 General Motors

- 10.9 Google

- 10.10 Harman International Industries

- 10.11 Hyundai Motor Company

- 10.12 Microsoft

- 10.13 Nvidia

- 10.14 NXP Semiconductors

- 10.15 Renesas Electronics

- 10.16 Robert Bosch

- 10.17 Siemens

- 10.18 Tesla

- 10.19 TomTom

- 10.20 Toyota Motor