PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750572

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750572

Contrast Media Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

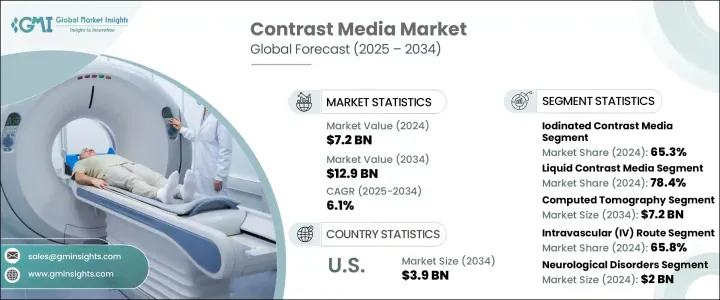

The Global Contrast Media Market was valued at USD 7.2 billion in 2024 and is estimated to grow at a CAGR of 6.1% to reach USD 12.9 billion by 2034, driven by the increased reliance on medical imaging to diagnose and manage a wide range of chronic health conditions. As the need for accurate and early diagnosis continues to rise, so do imaging techniques such as MRI, CT, X-ray, and ultrasound-all of which depend heavily on contrast agents to improve clarity and detail. Hospitals and diagnostic centers are performing more radiological procedures than ever, with inpatient and outpatient volumes increasing due to a growing population and the higher incidence of chronic illness.

Contrast-enhanced imaging is useful in identifying subtle abnormalities in tissues, blood vessels, and organs. This is especially critical in early detection leads to more effective treatment plans. The development of advanced imaging platforms and the integration of artificial intelligence are also shaping the landscape. Modern AI-driven radiology platforms enable precise dosage management and optimized workflow, supporting better diagnostic outcomes while maintaining patient safety.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.2 Billion |

| Forecast Value | $12.9 Billion |

| CAGR | 6.1% |

In 2024, iodinated contrast agents led the market with a 65.3% share. Their strong uptake is supported by widespread application in CT and X-ray procedures. Their versatility allows use across several diagnostic methods, including angiography and urography. The density of iodine enhances contrast and definition, crucial for clear and precise imaging results. This improved visibility allows for more confident diagnosis and treatment planning. The properties of iodine-based agents align well with the energy levels used in standard diagnostic imaging, making them the preferred choice across clinical settings.

The liquid contrast media segment held 78.4% share in 2024. Their widespread use is largely attributed to the practical advantages they offer-simple administration methods, rapid absorption, and effective visualization of internal structures. These agents are routinely used in high-demand diagnostic procedures like CT scans, where speed, precision, and image clarity are paramount. Their compatibility with various imaging systems and ability to quickly circulate through the bloodstream make them a go-to option for clinicians needing immediate and accurate diagnostic data. In both emergency and outpatient settings, the reliability and efficiency of liquid contrast media have solidified their position as the preferred medium in modern diagnostic workflows.

United States Contrast Media Market reached USD 2.3 billion in 2024 and is forecasted to reach USD 3.9 billion by 2034. This upward trajectory is propelled by a rise in chronic disease incidence, particularly within the aging population, where conditions like cancer, cardiovascular disease, and neurodegenerative disorders demand regular, high-precision imaging. Increasing use of MRI and CT technologies for both screening and monitoring drives steady demand for contrast-enhanced imaging agents. Additionally, innovation in imaging technologies, including AI-driven imaging platforms, makes contrast agents more effective, ensuring optimal dosing and better image acquisition.

Prominent companies in the market include TAEJOON Pharmaceutical, GE HealthCare Technologies, Livealth Biopharma, Bracco, Unijules Life Sciences, Guerbet, Trivitron Healthcare, nanoPET Pharma, Senochemia Pharmazeutika, Bayer, Jodas Expoim, J.B. Chemicals & Pharmaceuticals, Fresenius, Lantheus, and iMAX Diagnostic Imaging. To strengthen their market presence, key players are investing in R&D for next-gen contrast agents with improved safety profiles. They are also forming strategic alliances with imaging equipment manufacturers and expanding their global distribution networks. Several companies are exploring AI-integrated platforms to support precision imaging and reduce contrast dosage. Moreover, targeted marketing, regulatory approvals, and expansion in emerging markets help them secure a competitive advantage and boost revenue growth across geographies.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing regulatory approvals of contrast media

- 3.2.1.2 Growth in radiological examinations

- 3.2.1.3 Surging incidence of chronic diseases

- 3.2.1.4 Increase in minimally invasive procedures

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Presence of stringent regulations and frequent product recalls

- 3.2.2.2 Allergic reactions and side-effects associated with contrast media

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Trump administration tariffs

- 3.5.1 Impact on trade

- 3.5.1.1 Trade volume disruptions

- 3.5.1.2 Country-wise response

- 3.5.2 Impact on the Industry

- 3.5.2.1 Supply-side impact (cost of manufacturing)

- 3.5.2.1.1.1 Price volatility in key materials

- 3.5.2.1.1.2 Supply chain restructuring

- 3.5.2.1.1.3 Production cost implications

- 3.5.2.2 Demand-side impact (cost to consumers)

- 3.5.2.2.1.1 Price transmission to end markets

- 3.5.2.2.1.2 Market share dynamics

- 3.5.2.2.1.3 Consumer response patterns

- 3.5.2.1 Supply-side impact (cost of manufacturing)

- 3.5.3 Key companies impacted

- 3.5.4 Strategic industry responses

- 3.5.4.1 Supply chain reconfiguration

- 3.5.4.2 Pricing and product strategies

- 3.5.4.3 Policy engagement

- 3.5.5 Outlook and future considerations

- 3.5.1 Impact on trade

- 3.6 Technological landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Iodinated contrast media

- 5.3 Gadolinium-based contrast media

- 5.4 Microbubble contrast media

- 5.5 Barium-based contrast media

Chapter 6 Market Estimates and Forecast, By Form, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Liquid

- 6.3 Powder

- 6.4 Other forms

Chapter 7 Market Estimates and Forecast, By Modality, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 X-ray

- 7.3 Computed tomography (CT)

- 7.4 Magnetic resonance imaging (MRI)

- 7.5 Ultrasound

Chapter 8 Market Estimates and Forecast, By Route of Administration, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Intravascular route

- 8.3 Oral route

- 8.4 Rectal route

- 8.5 Other routes of administration

Chapter 9 Market Estimates and Forecast, By Indication, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Neurological disorders

- 9.3 Cancer

- 9.4 Cardiovascular disease

- 9.5 Gastrointestinal disorders

- 9.6 Musculoskeletal disorders

- 9.7 Nephrological disorders

Chapter 10 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 10.1 Key trends

- 10.2 Radiology

- 10.3 Interventional radiology

- 10.4 Interventional cardiology

Chapter 11 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 11.1 Key trends

- 11.2 Hospitals, clinics, and ASCs

- 11.3 Diagnostic imaging centers

Chapter 12 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 12.1 Key trends

- 12.2 North America

- 12.2.1 U.S.

- 12.2.2 Canada

- 12.3 Europe

- 12.3.1 Germany

- 12.3.2 UK

- 12.3.3 France

- 12.3.4 Spain

- 12.3.5 Italy

- 12.3.6 Netherlands

- 12.4 Asia Pacific

- 12.4.1 China

- 12.4.2 India

- 12.4.3 Japan

- 12.4.4 Australia

- 12.4.5 South Korea

- 12.5 Latin America

- 12.5.1 Brazil

- 12.5.2 Mexico

- 12.5.3 Argentina

- 12.6 Middle East and Africa

- 12.6.1 Saudi Arabia

- 12.6.2 South Africa

- 12.6.3 UAE

Chapter 13 Company Profiles

- 13.1 Bayer

- 13.2 Bracco

- 13.3 GE HealthCare Technologies

- 13.4 Guerbet

- 13.5 Fresenius

- 13.6 iMAX Diagnostic Imaging

- 13.7 J.B. Chemicals & Pharmaceuticals

- 13.8 Jodas Expoim

- 13.9 Lantheus

- 13.10 Livealth Biopharma

- 13.11 nanoPET Pharma

- 13.12 Senochemia Pharmazeutika

- 13.13 TAEJOON Pharmaceutical

- 13.14 Trivitron Healthcare

- 13.15 Unijules Life Sciences